By Mark Seed, myownadvisor

By Mark Seed, myownadvisorA recent post in the Financial Post caught my eye, why some financial planners seem worried about the FIRE movement.

My reaction is, they need not worry too much about any FIRE movement. I believe some financial planners might have bigger issues to contend with. More on that in a bit.

Why is FIRE so hot?

As a refresher, FIRE stands for “Financial Independence Retire Early.”

Some FIRE investors strive to save as much of their income as possible during their working years, hoping to attain financial independence at a young age and maintain it through the rest of their life: aka retirement.

A common goal of many FIRE-seekers is to build enough capital and wealth whereby they can largely live off their portfolio value in perputuity or thereabouts. Some of them even leverage an outdated financial study to help them realize their goal: the 4% rule.

The 4% rule (a general guide for a sustained safe withdrawal rate (SWR)) used by many early retirees, was the result of using historical market performance data from 1926 to 1992 by U.S. financial planner Bill Bengen. In general terms, the “4% rule” says that you can withdraw “safely” 4% of your savings each year (and increase it every year by the rate of inflation) from the time you retire and have a very high probability you’ll never run out of money.

You can find the details of that study here.

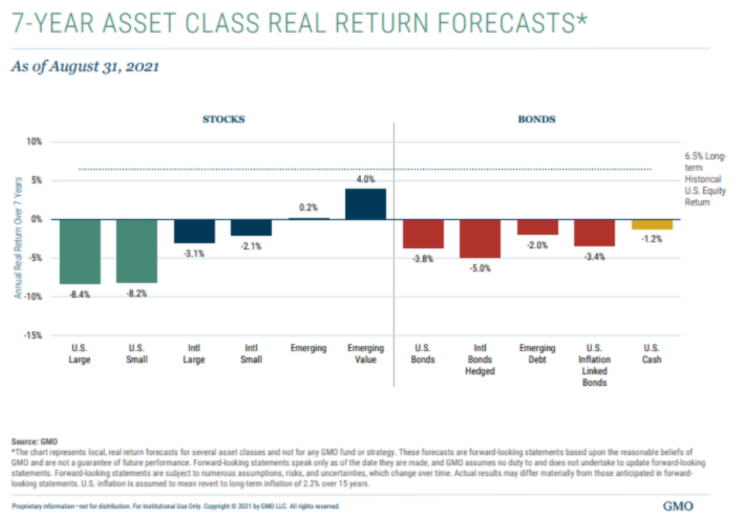

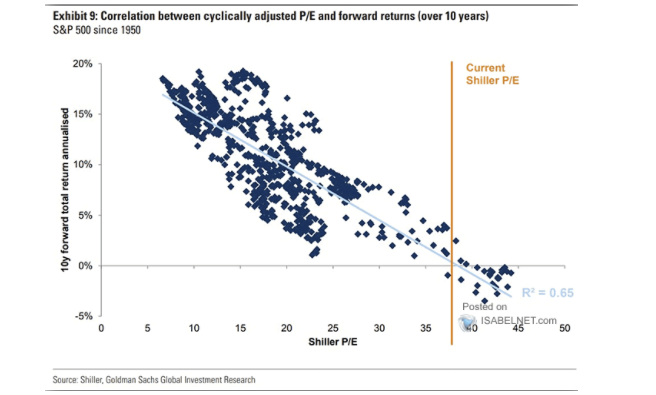

However, the first challenge of many related to this rule is that this study was published almost 30 years ago. A lot has changed since then, including real returns from bonds. There are also products on the market now that allow investors to diversify far beyond the mix of large-cap U.S. stocks and treasuries that the Bengen study was based on. In fact, the abundance of low-cost investing products should be what many financial planners should fear the most, a point I’ll come back to soon.

Certainly, in my personal finance and investing circles, I don’t know of many FIRE-seekers that live by any strict 4% rule. Thank goodness they don’t.

Even though the 4% rule remains a decent rule of thumb to start any early retirement discussion with, it’s a flawed concept for many of today’s early retirees aged 40 or less.

- The 4% rule was based on a 30-year retirement horizon. However, a FIRE investor’s retirement could last 50 years or even more. So, while spending in line with the 4% rule could give an early retiree a very good chance at not outliving their money, a 50-year “retirement” timeline could be disasterous if said early retiree was striving to live through a prolonged period of low stock market returns.

- This rule was used to demonstrate a safe withdrawal rate associated with only U.S. assets: a mix of U.S. stocks and treasuries to be more exact. There is little doubt that if an investor uses a broader, more globally diversified portfolio with U.S. and international assets leading the way, I suspect their chances of financial success would increase. In fact, Vanguard said they would.

- Finally, the 4% rule assumes a constant dollar-plus-inflation spending strategy: straight-line thinking that assumes your spending will follow a very linear path over many retirement decades. My hunch is: of course that won’t happen. Sure, maybe in the first retirement year you spend your desired 4% and at best, maybe next year you spend a bit more accounting for inflation. However, just like asset accumulation is dynamic so will your spending patterns be in retirement. This means you should strongly consider a Variable Percentage Withdrawal (VPW) approach that largely takes into account the flexibility to raise your spending “in good years” and decrease your spending in “bad years.”

Further Reading: Why you should follow a VPW drawdown strategy.

With any retirement drawdown plan, the ability to operate in a spending range will be very key to the longevity of your portfolio. I hope to follow some form of this approach myself in semi-retirement.

Which brings me back to our case study in the Financial Post.

Why financial planners shouldn’t be worried about FIRE

For Kristy Shen and Bryce Leung, a couple from Toronto who retired at 31, they gave up the dream of owning a million-dollar home in Toronto and decided to travel the world instead.

For Kristy and Bryce, their goal was always financial independence and not so much the retire early part. As Kristy explained on my site:

“The idea of retiring from our job and living off passive income seemed so weird and foreign to us, so at first we dismissed it as an idea that only tech entrepreneurs or trust fund babies could pull off. Then we woke up and realized our savings had hit half a million bucks, and we were like “Hey, why not us?””

Why not indeed.

And so, by living off about $40,000 per year (you can see one of their income reports here), travelling and writing (likely earning some money from their blog and book), they’ve realized their goal of financial independence and then some. Six years past their “retirement date” their portfolio is now worth a cool $1.8 million thanks to a major market bull run in recent years.

However, there are some financial planners in that post that argue there is no magic in personal finance.

“People make money off putting out something that seems magical … like the latte factor. I’ll just skip a cup of coffee every day, and you get rich. But the math doesn’t work — unless you’re having 17 lattes a day.”

While true, citing longevity risk from these planners as yet another major risk for Kristy and Bryce to contend with is definitely reaching here. To argue that our millennial millionaire couple has to worry about spending $40,000 or so per year from a $1.8 million portfolio is a “problem” many Canadians would love to have.

The FIRE movement has been great for many reasons, and people have been doing it for decades before it became an internet thing. FIRE-seekers have: Continue Reading…

These articles are click baits. They are there to get the average Joes and Janes to click on them, read, and feel more miserable about their lives.

These articles are click baits. They are there to get the average Joes and Janes to click on them, read, and feel more miserable about their lives.