By Laurie Campbell

Special to the Financial Independence Hub

These days, don’t be surprised to find a senior citizen standing behind the counter of your favourite fast food spot taking your order instead of a braces-wearing teen. What retirement looks like today has changed quite significantly from what it was even just ten years ago, and there’s no stopping this trend. More and more seniors are staying in the workforce, and for many of them, they have no choice.

Last June for Seniors Month, our agency, Credit Canada co-sponsored a seniors and money study that looked at the financial difficulties Canadian seniors are facing; the results, while shocking, were no surprise.

As a non-profit credit counselling agency, our counsellors are on the forefront of what’s happening when it comes to people and their financial hardships, and we are seeing a large number of people who should be starting to settle into their “golden years” still working, maybe even taking on an additional side job, just to pay off their debt, let alone get a time-share in Florida.

When we conducted our study in June 2018, it revealed that one-in-five Canadians are still working past age 60, including six per cent of those 80 and older. And while one third do so simply because they want to — which is fantastic, kudos to you — 60 per cent are still working because of some form of financial hardship, whether it’s too much debt, not enough savings, or other financial responsibilities, like supporting adult children.

The truth is the golden years have been tarnished, and I don’t know if we’ll ever get them back.

Half of 60-plus carrying some form of debt

Many of today’s retirees are living on fixed incomes, making them vulnerable to unpaid debt. In fact, our study revealed more than half of Canadians age 60 and older are carrying at least one form of debt, with a quarter carrying two or more types of debt. What’s even more alarming is that 35 per cent of seniors age 80 and older have debt, including credit-card debt and even car loans.

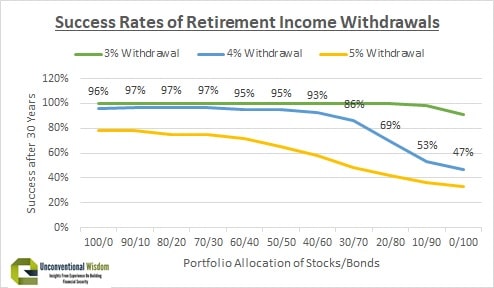

Staring at the problem isn’t going to help, nor is hiding from it. The best thing we can all do is to face the facts head-on and devise a plan of action that we know will work, whether it’s getting rid of any debt while building up savings, taking on a side job, delaying retirement by a few years, or all of the above.

Sizing up Government support

Before delving into the numbers it’s important to understand what income you can expect to have during your retirement. A few numbers have been compiled here as an example, but if you wanted to get more detailed information you can visit the Government of Canada website and click on the Canada Pension Plan (CPP) or Old Age Security (OAS) pages.

So, let’s get started by taking a look at 2017. Continue Reading…