By Jonathan Chevreau

Financial Independence Hub

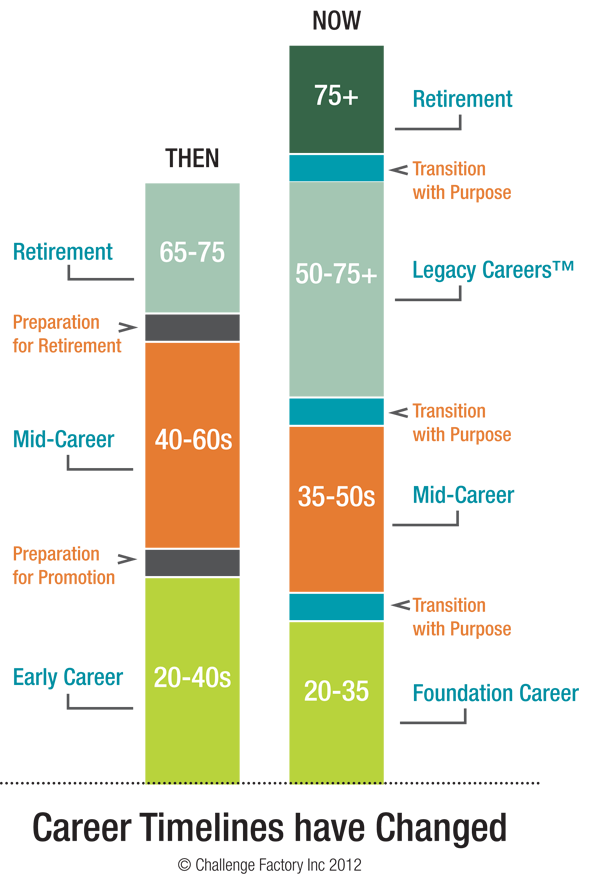

On Wednesday, the Financial Post ran an online column of mine it titled Life After Retirement: Your Working Career Probably Isn’t Over Yet — Welcome to the Encore Act.

Regular Hub readers will know that if I had my druthers, the headline would read more like “Why Work won’t end after your Findependence Day.” (that is, the day you achieve Financial Independence).

I don’t view the terms Retirement and Financial Independence as interchangeable. By definition, Retirement (or at any rate, traditional full-stop Retirement funded with a generous Defined Benefit pension) means no longer working for money. Financial Independence (aka Findependence), on the other hand, can occur years and even decades before traditional Retirement and so seldom means the end of productive work.

This very web site — which just passed six months in existence — is dedicated to clarifying this distinction. And of course the site also constitutes a big element of my own personal Encore Act: next Tuesday will be the one-year anniversary of my own Findependence Day. In my case, I define that as no longer working as an employee of a giant corporation or government entity, and having the financial resources to work if I choose to, and not if I don’t.

How to find your Encore Career