By Jonathan Chevreau

My latest MoneySense blog has been posted, titled Maybe you just think you want to retire?

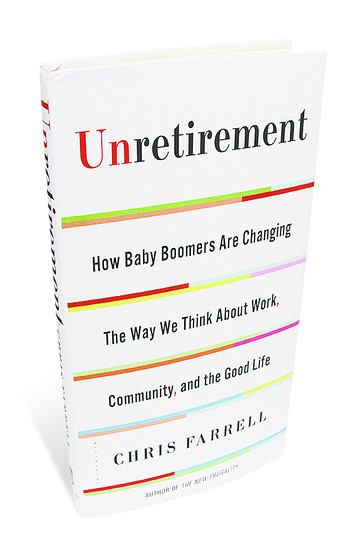

The word “think” needs to be emphasized, since the point is that I’m not so sure baby boomers really want to retire anymore, at least not in their 50s or early 60s. I actually had written this particular blog before reading and reviewing some books about Encore Careers and Second Acts, such as last week’s review of Unretirement.

Of course, this entire website is dedicated to the proposition that there is a difference between traditional “full-stop” retirement and Financial Independence, or “Findependence.” To us, Findependence sets the stage for one’s true calling in life, which is why the six blog sections here at the Hub now include one called Encore Acts. From where I sit, it’s a lot easier to launch an Encore Act once you have a modicum of Financial Independence established.

For the full blog, click the red link above.

For archival purposes and the convenience of one-stop shopping, the piece is also included below: Continue Reading…