By Michael J. Wiener

Special to Financial Independence Hub

I’ve heard a few times over the years that one of the disadvantages of making an extra payment against your mortgage, or any other debt, is that saving this way only earns simple interest rather than compound interest. This is nonsense, as I’ll show with an example.

Flawed Reasoning

The reasoning behind the claim that paying down a mortgage only earns simple interest goes as follows. Each month, your payment pays all of the interest plus some of the principal. Therefore, there is no interest accruing on previous interest, so there is no compounding.

This is a tidy little story, but the reasoning doesn’t hold up.

An Example

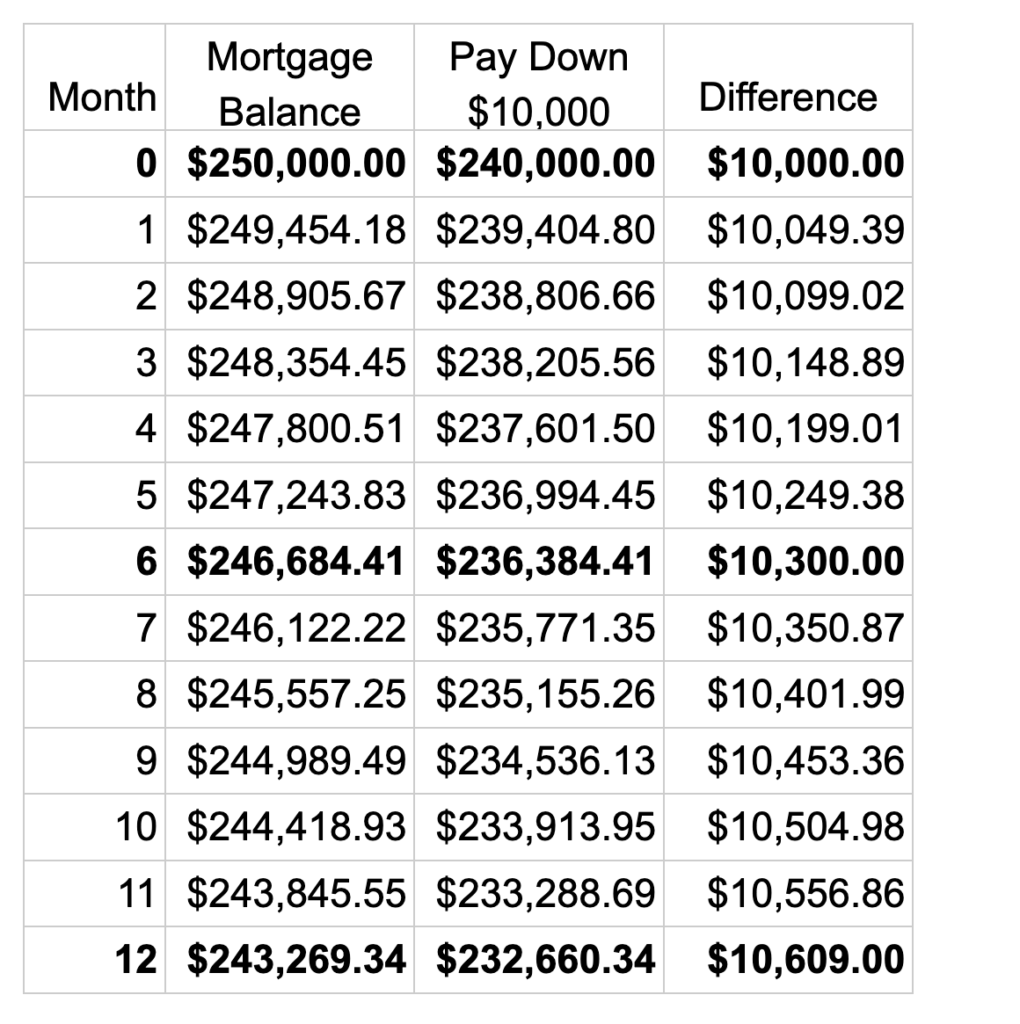

Suppose you have 20 years left on your 6% mortgage (in Canada where most mortgages use semi-annual compounding). This makes your monthly payment $1780.47. The second column of the table below shows how your mortgage balance would decline over the coming year.

Suppose you decide to pay $10,000 down on your mortgage, but you leave the payments the same. The third column shows your declining mortgage balance for this scenario. The last column shows the difference between these scenarios. This difference shows your returns from your investment in paying down your mortgage.

If your investment earned only simple interest at 6% per year, then the difference would be $10,600 after a year, but it is $10,609. The extra $9 comes from the semi-annual compounding. This isn’t much after one year, but after ten years, simple interest gives $16,000, but the real figure if we continued this table is $18,061. The compounding effect is significant.

Where Does the Flawed Reasoning Go Wrong?

To get the correct answer to questions such as whether paying down your mortgage earns compound interest, we have to treat money as fungible. Consider what happens when your debt accrues new interest. Think of the interest blending evenly with the former debt amount. Then when your payment gets applied, it wipes out proportional amounts of the original debt and the new interest. This leaves some interest with your debt that will accrue compound interest later.

Giving the Flawed Reasoning Another Chance

Let’s consider a simpler example. You borrow $10,000 at 12% (compounded monthly), pay off just the $100 interest each month for a year, and then pay back the $10,000. So, you paid a total of $1200 in interest. Continue Reading…