By Dale Roberts

Special to the Financial Independence Hub

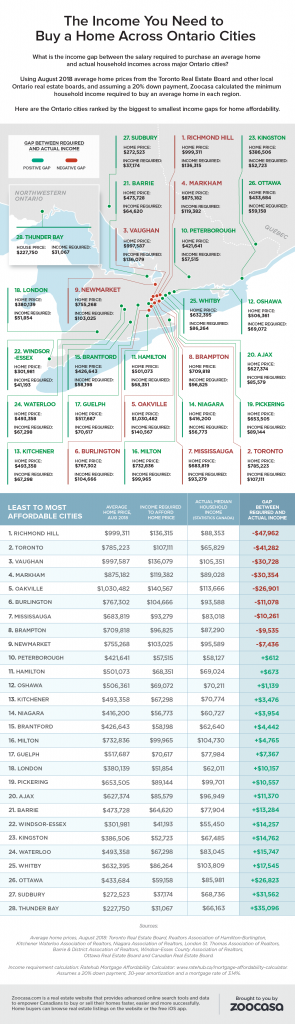

It’s a tough question, especially if you live in one of the major cities where home prices are skyrocketing. Or let’s say the home prices have skyrocketed over the last couple of decades. For many potential homeowners it’s a race against the clock. The price of entry might keep increasing at a rate that is faster than you can amass that initial down payment.

On that front the government agencies are working hard to help first time home buyers with greater access to RRSP home buyer’s plan funds and even down payment monies from the CMHC. Please have a read of Cream and sugar and tens of thousands of dollars for first time home buyers.

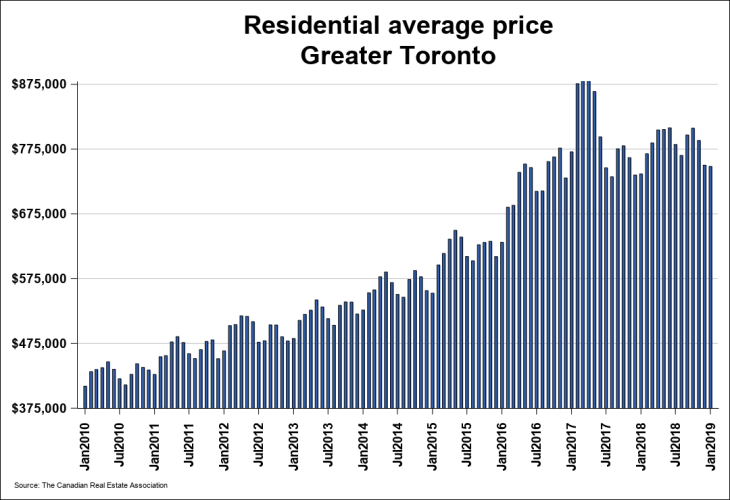

Trying to raise enough cash for that initial deposit is more than challenging, and discouraging, when you see home prices increase by several percent or more per year. We’ll use Toronto area real estate prices to demonstrate the recent history.

Over the last decade average Toronto home prices have more than doubled. Of course, in certain desirable pockets the price increases have been outrageous. And if we head out to the west coast we’ll see periods when the Vancouver area market had rates of increase over several years that is nothing short of silliness.

You don’t have to own a home or property to build wealth

While home ownership is a wonderful goal, and it can help build that more than important total net worth, it’s not the only route to finding a wonderful place to live and growing your long-term wealth. You can rent and invest the monies that would ‘normally’ go to pay that mortgage and surprising list of costs that come with home ownership.

I recently had a question from a reader on the very subject of renting vs home ownership. For an answer I turned to John Robertson the author of The Value of Simple. John also operates the blog Blessed by the potato. And on that site here is the go-to post for Rent vs Buy. On that page you can click on a rent vs buy spreadsheet.

In an email reply to the reader and me John framed the proposition quite succinctly …

In some cases it can make sense to invest your money and rent instead. Indeed, I’m a renter myself in Toronto. It’s a bit more complicated than the scenario you paint, though. Remember that keeping that house is not just about your mortgage payment, you also have to pay property tax, maintenance, insurance, and somewhere account for the transaction costs for your eventual move — expenses that a renter doesn’t face (or are implicit in the rent). So when you do the math, you’ll have to back those costs out, meaning you need less of a return from your investments to help offset the rent. And exactly what (after-tax) return you use when estimating your investment performance will matter to the decision, too.

The main takeaway from John’s opening remarks is that home ownership (or condo with fees and such) is much more expensive than one might think. Beyond the mortgage and property taxes the additional costs of home ownership is quite surprising.

Check out this home ownership mortgage calculator on ratehub.ca. There are some incredible tools on that site that will help you determine affordability and the expected costs. You’ll discover that you have to add at least several hundred dollars per month in costs above your mortgage.