By Kevin Flanagan, WisdomTree Investments

Special to the Financial Independence Hub

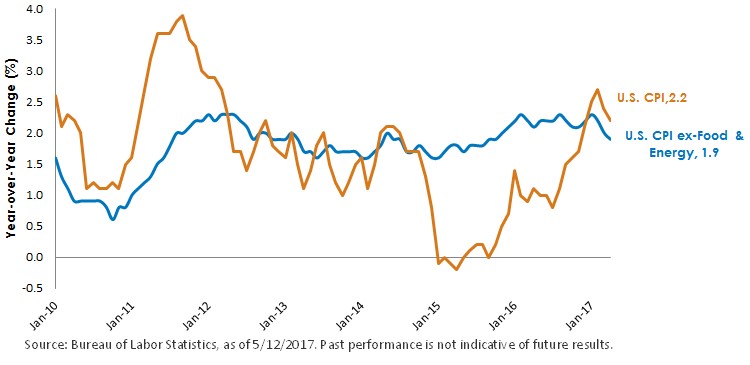

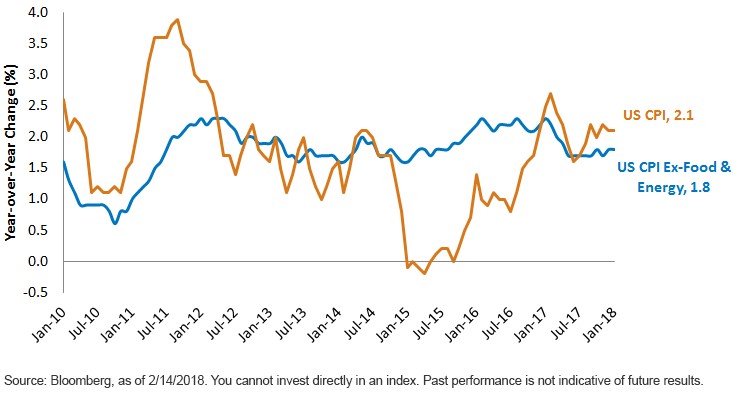

There is no doubt that inflation fear has reared its ugly head early in 2018, impacting the money and bond markets in rather noteworthy fashion. Some key headline-grabbing measures, such as wages and the Consumer Price Index (CPI), have come in above consensus forecasts to start the year, fueling a case of high anxiety for the fixed income arena. Naturally, the million (or should it be billion?) dollar question is: Are these heightened inflation fears warranted?

As we entered the new year, consensus forecasts for inflation were that readings at both the overall and core (ex-food and energy) levels would essentially remain unchanged. Interestingly, economists’ projections have been revised upward of late and now post slightly elevated readings. Indeed, the CPI is now expected to come in at a year-over-year rate of +2.3%, or 0.2 percentage points (pp) higher than the prior projection. The alternate measure, the personal consumption expenditures (PCE) price index, has been changed to a +1.9% increase (also up 0.2 pp), with the core PCE gauge being lifted 0.1 pp to +1.8%. The bottom line is that these revised estimates now all look for some modest increase from 2017 levels.

What about the Federal Reserve (Fed)? For now, all investors have to go by is the policy makers’ December projections. The March FOMC meeting, scheduled for March 21st, will be the Fed’s next chance to make any potential adjustments to their prior forecasts.. The preferred measure is the PCE price index, and the policy makers provide projections for both the overall and core PCE gauges. The Fed’s central tendency estimate is similar to the revised market consensus, with a range of +1.7% to +1.9% for each index. It should be noted that both the economists’ and the Fed’s current PCE projections still fall below the +2.0% target laid out by the policy makers.

Let’s take another look

So, let’s take another look at the aforementioned wages and CPI numbers. Continue Reading…