By John De Goey, CFP, CIM

Special to the Financial Independence Hub

The fed won. I admit defeat. My point is that what just transpired was merely the most recent bout. Circumstances were extenuating. I demand a rematch. As soon as things begin to normalize, I absolutely believe I will win. To provide a bit of context for how I feel now, here’s a groovy little two-minute ditty from the Bobby Fuller Four to help channel the vibe…

https://www.youtube.com/watch?v=OgtQj8O92eI

One of the oldest adages in finance is “Don’t fight the fed.” In Canada, that translates into “Don’t fight the Bank of Canada.” That, in a nutshell is what I did. I brought a knife to a gun fight and I lost. Here’s why I lost that figh t… and why I absolutely expect to win the next one:

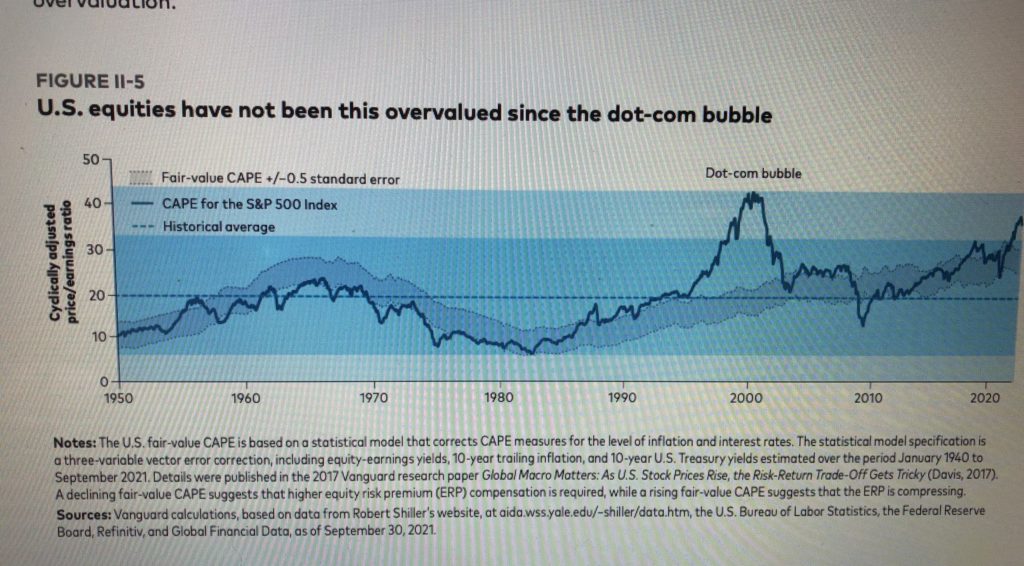

I took the position that markets (and especially the U.S. market) were expensive in early 2020. Sure enough, markets tumbled a month or two later – not because of fundamentals or valuations, but because of a global pandemic that no one saw coming. For five weeks starting in February, it looked very much like I had been vindicated. I suppose I could have taken credit for being prescient, but in fact, I was merely at the right place and the right time. By mid-March 2020, I was feeling pretty good about my call.

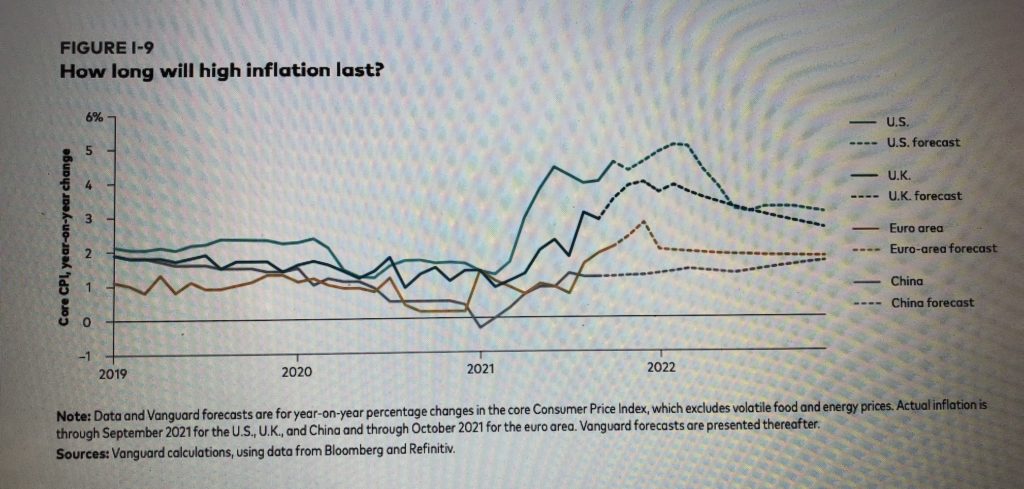

Then it happened. Central banks mercifully came riding to the rescue. It was the right thing to do when viewed through many lenses, including public health, economic stability, and small business viability. They did so with such fury and determination that no one had ever seen anything like it before. Interest rates were slashed to effectively zero. Governments of all political stripes around the western world took advantage of their newfound monetary cover and started sending cheques to what seemed like anyone who could fog a mirror. Before the end of March, markets hit a bottom and began an upward march. A massive bull market was unleashed.

I don’t honestly think anyone could have foreseen what ensued. There was certainly no precedent for markets dropping violently and then recovering equally quickly. To have expected that outcome would be to have expected something that had no antecedent in all of history anywhere on earth.

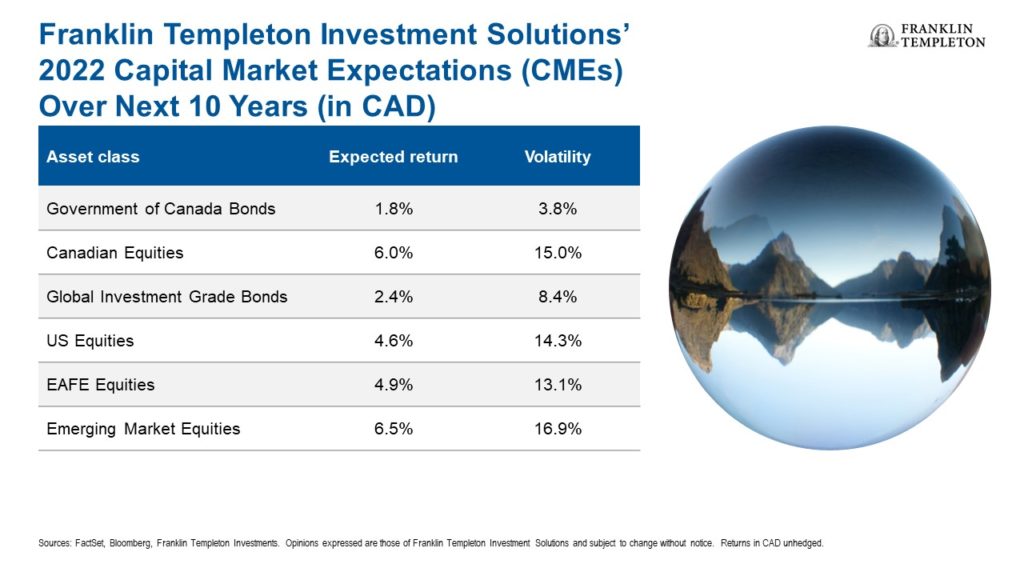

For nearly 23 months now, interest rates have remained at effectively zero. Pretty much everyone expects that to change in March. If lowering rates is like giving Popeye can of spinach, raising them is like giving Superman a bag full of kryptonite. Forgive many the pop culture references in this post, but I find it helps to make things accessible and vivid. Basically, the artificial party that has gone on for nearly two years and has given almost everyone a false sense of confidence is going to end. Soon. Badly. I’ll eat my hat if I’m wrong. Continue Reading…