By Bradley Komenda

(Sponsor Content)

Harvest Portfolios Group launched a global bond ETF in January 2020 to complement its equity ETF offerings.

The Harvest US Investment Grade Bond Plus ETF (HUIB:TSX) is managed by Boston-based Amundi Pioneer Asset Management, a subsidiary of Amundi Asset Management, a leading global manager based in France. In a Q&A, Bradley Komenda, the ETF’s portfolio manager, discusses how Amundi’s value investing approach helps guide its strategy. Mr. Komenda joined Amundi Pioneer in 2008 and is also Senior Vice President and Deputy Director of Investment Grade Corporates at the firm.

Financial Independence Hub: What is the demand for these bonds for the Canadian investor?

Bradley Komenda: Canadian bond market opportunities are pretty narrow and heavily weighted towards energy and financials. Because there is a lot of demand for these bonds, yields are less attractive than in the US.

This bond ETF gives you breadth. It is Canadian dollar hedged, but with access to top quality US, European and Global issuers. Expectations of further fiscal stimulus will all be supportive of the corporate bond market, so we think that this is where we want to be.

Q: What is Amundi Pioneer’s approach?

A: We are value investors. We invest in credits that we think over a one to three-year time horizon are going to generate a superior return. By value investing, I don’t mean buying the cheapest securities. It means trying to identify the securities that have the best risk adjusted return potential.

Q: How do you assess risk?

A: We look at risk in three ways. We look at nominal risk, which is how much we have invested in a single issuer. Then we look at the maturity of the bonds. We know that if we buy a one-year bond, it is a lot less risky than buying a 30-year. And then we look at duration times spread, (DTS) which is a way to measure the credit volatility of a bond.

Q: Where is the Harvest US Investment Grade Bond Plus ETF on the risk spectrum?

A: From an overall portfolio perspective, this bond ETF is rated low risk, and within the fixed income universe, I’d say it’s medium.

If you want lower risk, you can do a couple things. You can buy government bonds, but after inflation your purchasing power will be eroded even with longer duration bonds.

If you go for a short-term ETF, or cash, you’re going to struggle to get a yield similar to inflation. So, this ETF is for someone with patience, a one to three-year time horizon and a willingness to accept short-term volatility but with the expectation of attractive returns relative to risk-free or very short bonds.

Q: What about bond quality?

Q: What about bond quality?

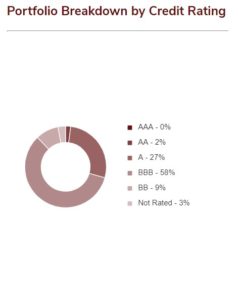

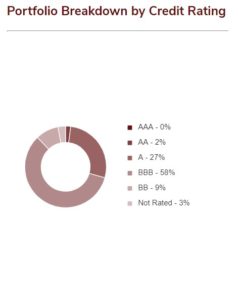

A: HUIB is concentrated in the Triple B space (BBB) or higher. The breakdown is roughly 60% BBB, 30% A or higher and 10% Non-rated.

Q: Who is the core investor for this bond ETF?

A: Anybody who wants exposure to fixed income. That’s because it has a negative correlation to stocks which means they move in different directions. If you buy a high yield fund, you’re going to get more yield, but you’re going to have a positive correlation to stock market movements.

Q: Investors worry about liquidity. How easy is this ETF to sell?

A: It’s highly liquid. We had a liquidity crisis in the corporate bond market in March of this year. The Fed stepped in and now is backstopping things by purchasing bonds as needed. It means the draw down we saw in March and early April is unlikely to occur again.

Q: What is the relative advantage of this ETF?

A: This ETF is part of our investment grade corporate bond strategy. Continue Reading…