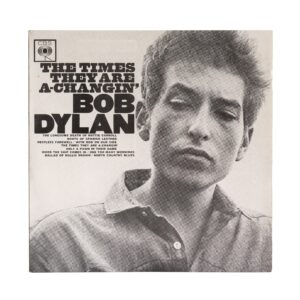

Come gather ’round people

Wherever you roam

And admit that the waters

Around you have grown

And accept it that soon

You’ll be drenched to the bone

If your time to you is worth savin’

And you better start swimmin’

Or you’ll sink like a stone

For the times they are a-changin’

- Bob Dylan © Sony/ATV Music Publishing LLC

By Noah Solomon

Special to Financial Independence Hub

In this month’s commentary, I will discuss both how and why the environment going forward will differ markedly from the one to which investors have grown accustomed. Importantly, I will explain the repercussions of this shift and the related implications for investment portfolios.

The Rear View Mirror: Where we’ve been

After being appointed Fed Chairman in 1979, Paul Volcker embarked on a vicious campaign to break the back of inflation, raising rates as high as 20%. His steely resolve ushered in a prolonged era of low inflation, declining rates, and the favourable investment environment that prevailed over the next four decades.

Importantly, there have been other forces at work that abetted this disinflationary, ultra-low-rate backdrop. In particular, the influence of China’s rapid industrialization and growth cannot be underestimated. Specifically, the integration of hundreds of millions of participants into the global pool of labour represents a colossally positive supply side shock that served to keep inflation at previously unthinkably well-tamed levels in the face of record low rates.

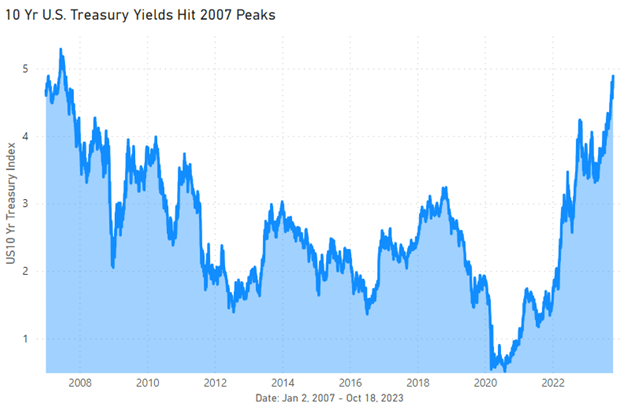

It’s all about Rates

The long-term effects of low inflation and declining rates on asset prices cannot be understated. According to Buffett:

“Interest rates power everything in the economic universe. They are like gravity in valuations. If interest rates are nothing, values can be almost infinite. If interest rates are extremely high, that’s a huge gravitational pull on values.”

On the earnings front, low rates make it easier for consumers to borrow money for purchases, thereby increasing companies’ sales volumes and revenues. They also enhance companies’ profitability by lowering their cost of capital and making it easier for them to invest in facilities, equipment, and inventory. Lastly, higher asset prices create a virtuous cycle: they cause a wealth effect where people feel richer and more willing to spend, thereby further spurring company profits and even higher asset prices.

Declining rates also exert a huge influence on valuations. The fair value of a company can be determined by calculating the present value of its future cash flows. As such, lower rates result in higher multiples, from elevated P/E ratios on stocks to higher multiples on operating income from real estate assets, etc.

The effects of the one-two punch of higher earnings and higher valuations unleashed by decades of falling rates cannot be overestimated. Stocks had an incredible four decade run, with the S&P 500 Index rising from a low of 102 in August 1982 to 4,796 by the beginning of 2022, producing a compound annual return of 10.3%. For private equity and other levered strategies, the macroeconomic backdrop has been particularly hospitable, resulting in windfall profits.

From Good to Great: The Special Case of Long-Duration Growth Assets

While low inflation and rates have been favourable for asset prices generally, they have provided rocket fuel for long-duration growth assets.

The anticipated future profits of growth stocks dwarf their current earnings. As such, investors in these companies must wait longer to receive future cash flows than those who purchase value stocks, whose profits are not nearly as back-end loaded.

All else being equal, growth companies become more attractive relative to value stocks when rates are low because the opportunity cost of not having capital parked in safe assets such as cash or high-quality bonds is low. Conversely, growth companies become less enticing vs. value stocks in higher rate regimes.

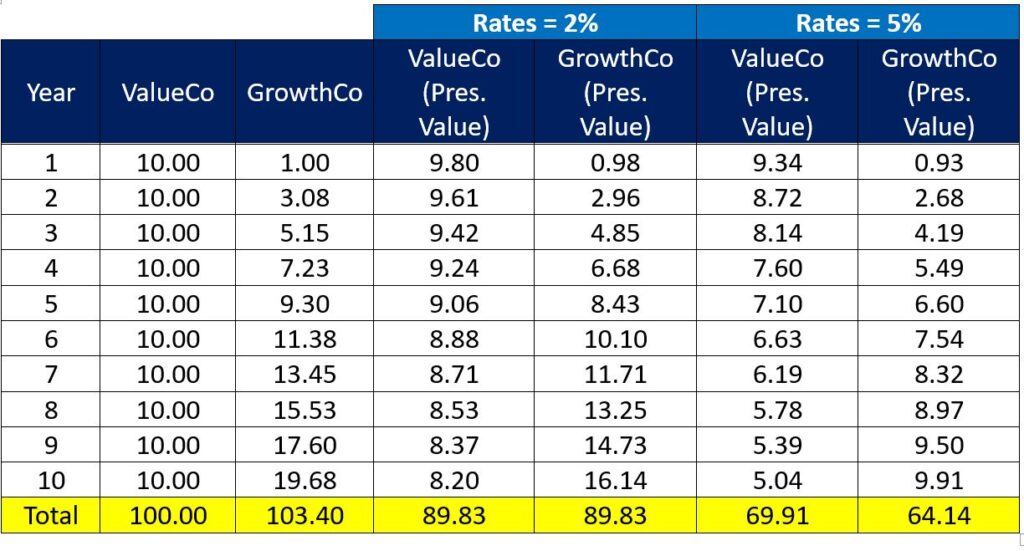

Example: The Effect of Higher Interest Rates on Value vs. Growth Companies

The earnings of the value company are the same every year. In contrast, those of the growth company are smaller at first and then increase over time.

- With rates at 2%, the present value of both companies’ earnings over the next 10 years is identical at $89.83.

- With rates at 5%, the present value of the value company’s earnings decreases to $69.91 while those of the growth company declines to $64.14.

- With no change in the earnings of either company, an increase in rates from 2% to 5% causes the present value of the value company’s earnings to exceed that of its growth counterpart by 9%.

Losing an Illusion makes you Wiser than Finding a Truth

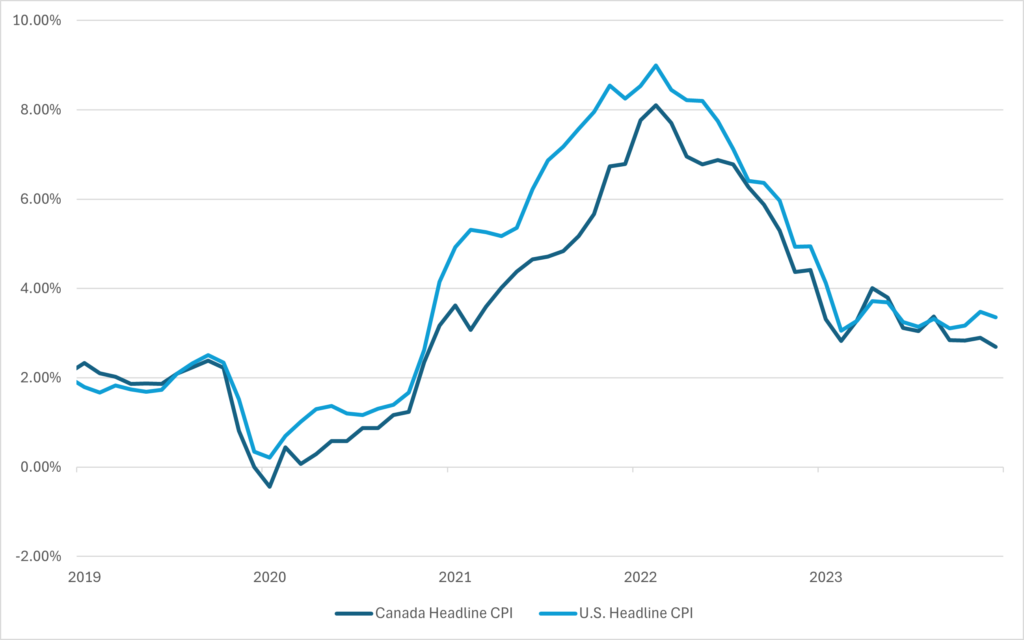

There are several features of the global landscape that will make it challenging for inflation to be as well-behaved as it has been in decades past. Rather, there are several reasons to suspect that inflation may normalize in the 3%-4% range and remain there for several years.

- In response to rising geopolitical tensions and protectionism, many companies are investing in reshoring and nearshoring. This will exert upward pressure on costs, or at least stymie the forces that were central to the disinflationary trend of the past several decades.

- The unfolding transition to more sustainable sources of energy has and will continue to stoke increased demand for green metals such as copper and other commodities.

- ESG investing and the dearth of commodities-related capital expenditures over the past several years will constrain supply growth for the foreseeable future. The resulting supply crunch meets demand boom is likely to cause an acute shortage of natural resources, thereby exerting upward pressure on prices and inflation.

- The world’s population has increased by approximately one billion since the global financial crisis. In India, there are roughly one billion people who do not have air conditioning. Roughly the same number of people in China do not have a car. As these countries continue to develop, their changing consumption patterns will stoke demand for natural resources, thereby exerting upward pressure on prices.

- Labour unrest and strikes are on the rise. This trend will further contribute to upward pressure on wages and prices.

A Word about Debt

The U.S. government is amassing debt at an unsustainable rate, with spending up 10% on a year-over-year basis and a deficit running near $2 trillion. Following years of unsustainable debt growth (with no clear end in sight), the U.S. is either near or at the point where there are only four ways out of its debt trap:

- Raise taxes

- Cut spending/entitlements

- Default

- Stealth default (see below) Continue Reading…