By Mark and Joe

By Mark and Joe

Special to the Financial Independence Hub

Hello readers of the Financial Independence Hub! We are the founders of CashflowsandPortfolios.com, a free resource dedicated to helping DIY investors in getting started with their portfolio right up to planning efficient withdrawal strategies during retirement.

We are honoured to have been invited by Jon Chevreau to contribute a piece on a new income product for retirees: the Purpose Investments Longevity Fund.

If you are close to retiring or already a retiree, you’ve likely thought a lot about the following questions:

- Did I save enough for retirement?

- How will I generate sufficient income for my retirement?

- How long will my money last?

If you are lucky enough to have worked for a Government entity for 25-30 years, then you are probably not too worried about funding your retirement. However, for the rest (most) of us, we need to save and invest on our own over the long-term. If that’s not enough, we then need to figure out ways to decumulate our savings as efficiently as possible.

For DIY investors, there is not much in the form of “forever” payments until death, except of course Canada Pension Plan (CPP) and Old Age Security (OAS). We consider these as one of the three pillars of retirement income for Canadians.

Another common source of “forever” income that acts like a government defined benefit (DB) pension are annuities: which are guaranteed by insurance companies. With annuities, investors are trading their capital for a steady income stream, which is essentially a DB pension.

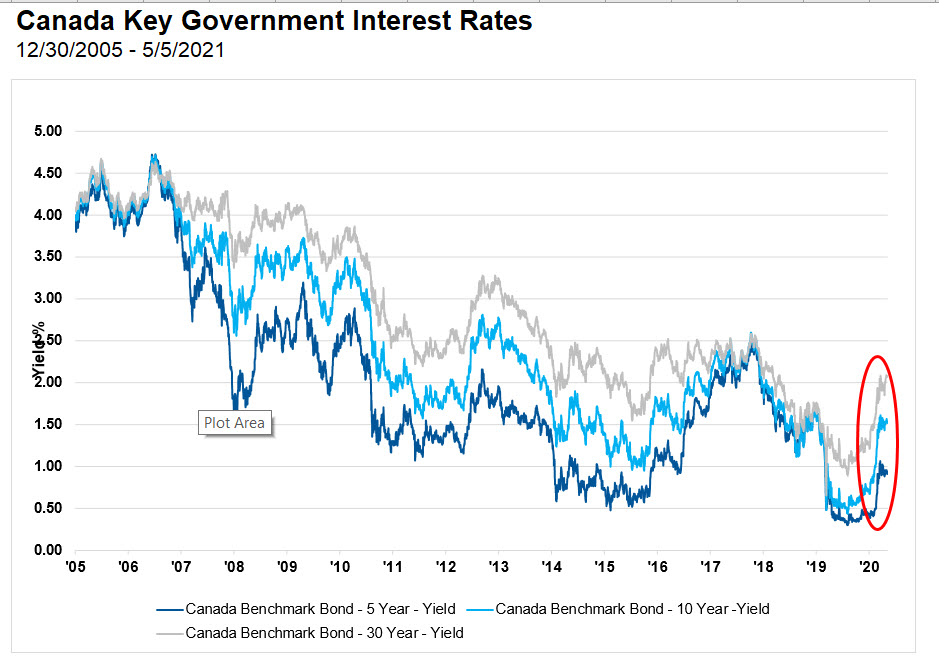

Why aren’t annuities more popular? For DIY investors, it’s likely because of the fact that you are giving up your capital for a yield (currently around 4-5%) that can be obtained by your own DIY portfolio (see below for an example).

So what if there was a product out there that would provide:

- Income for life

- A yield higher than annuities

- An option to “sell” the product to regain some of your invested capital if needed?

That’s the opportunity and challenge that Purpose Investments has taken on with the creation of their latest mutual fund: The Longevity Pension Fund.

There has been a lot of buzz about the Purpose Investments Longevity Pension Fund and for good reason: it solves a number of big problems that retirees face.

What is the Longevity Pension Fund and what are the pros and cons of owning such a fund?

Pros and Cons of the Longevity Pension Fund

At a high level, the Longevity Pension Fund is a cross between a balanced index mutual fund (47% equities/38% fixed income/15% alternatives), an annuity, and a defined benefit pension. While the fund does offer income for investors, a solid yield, and an option to “sell” the product if needed, these potential benefits must be considered with some drawbacks. As always with financial products, the devil is in the details.

With the basics out of the way, what are the PROS and CONS of the fund?

PRO – Reduces longevity risk (i.e., outliving your money) by offering income for life, but without the guarantees

As mentioned, the Longevity Purpose Fund is a mutual fund that any investor will be able to buy. Once purchased, and the investor is 65 or older, the fund will pay a distribution for life (at least that is the plan). Purpose Investments has stated that the 6.15% yield may sound high, but to maintain that yield they would only need to achieve an annual return of 3.5% net, which is well below historical returns for a common 60/40 stock/bond balanced portfolio.

Combined with mortality credits (investors who die sooner than expected, leaving their money invested in the fund for other investors), Purpose Investments has stated that 6.15% is conservative and can possibly go higher in the future.

PRO – You can get some of your investment back

With annuities and defined benefit pensions, you don’t typically get your contributions back. With this Longevity Fund, if you sell the fund you will get your initial investment minus any income payments. For example, if you have invested $100k into the fund, and have been paid out $10k, then you get back $90k if you sell. At a yield of 6.15%, essentially you can get some capital back up to 16 years of being invested in the fund. After that point, co

nsider yourself invested for life.

PRO – The taxation of the distributions will be tax efficient

While the fund is available for all kinds of accounts — including tax-free savings accounts (TFSAs) and registered retirement income funds (RRIFs) — potentially the best home for this fund could be in a taxable account. That is because monthly income distributions in the first year are expected to be roughly half a return of capital (RoC) with the remainder from capital gains, dividends and interest. This means that in a taxable investment account, the distributions will be tax-efficient (much more so than a defined benefit pension payment).

PRO – No Binding Contract

A key feature of this Longevity Pension Fund is a script from the annuity playbook: mortality credits. Similar to an annuity, you are participating in a pool of credits: those that die. When you die, your estate gets your initial contribution minus the total amount of income payments. The investment gains generated by your investments over the years stay in the fund and are used to top up monthly payments for everyone else.

Unlike an annuity though, you can get out of the fund: it’s not a one-way binding contract.

From Purpose:

“Unlike many traditional annuities or other lifetime income products, the Longevity Pension Fund is not meant to feel like a binding contract. You can change your mind and access the lesser of your unpaid capital** (i.e., your invested capital less the distributions you’ve received) or current NAV. Your beneficiaries are entitled to the same amount if you pass away. Once your cumulative distributions surpass your invested capital, there will no longer be any redeemable value left. Please speak to your advisor or see the prospectus for further details.”

The fund is also designed similar to many pension plan funds or funds of funds: a balanced mix of stocks, bonds and other investments that should* meet their income obligations to unitholders.

*Target income is just that. This fund does not offer an income guarantee.

CONS – The fund does not pass onto heirs

As mentioned above, the mortality credits are how this fund will sustain its yield into the future, which also means that the fund and its payout do not pass onto your spouse/heirs. For investors with a spouse/heirs, this is one of the largest drawbacks of the Longevity Pension Fund.

CONS – The distributions are not guaranteed

The monthly payments seem juicy right now but the Longevity Pension Fund is not like an annuity whereby income is guaranteed for life; the 6% or more income target is just that: a target. Continue Reading…