Special to the Financial Independence Hub

Republished with permission of Vanguard Canada

Late last year we launched a new all-in-one ETF solution, VRIF, to complement our existing line up of popular asset allocation ETFs.

VRIF, or the Vanguard Retirement Income ETF Portfolio, provides steady and predictable income to help investors meet their monthly expenses. It is made up of eight underlying Canadian Vanguard ETFs and will make an annual payout (currently 4% of the portfolio) split across equal payments each month.

The product has generated interest from investors and advisors along with several industry observers helping it become one of our top selling ETFs over the past few months and generating $150 million in assets (as of February 8, 2021).

It has also led to some questions on how it works and what it hopes to achieve. I wanted to collect some of those common questions and provide a few answers about VRIF.

1) What makes VRIF different from other similar monthly income funds and ETFs?

VRIF is unique in a few different ways. It incorporates a total return approach, meaning the portfolio is constructed to ensure it can help meet the daily living expenses of investors. There is an annual payout (currently 4% of the portfolio) split across equal payments each month. This is appropriate for investors and retirees looking for regular income as well as helping RRIF account withdrawals. For example, if you hold $30,000 in VRIF at the start of the year, that equates to $100 a month, for $1,200 over the year.

You also get a fully diversified portfolio with a mix of stocks and bonds, global diversification and a low-cost management fee of 0.29%*, which is currently about one-third of other similar retirement income products across the industry.

Another advantage to VRIF is that investors can rely on Vanguard’s global investment experts to monitor and assess the portfolio to meet the return target, along with providing regular rebalancing to help simplify the monthly income component. It really is a single ticket solution for investors to access monthly income.

* The management fee is equal to the fee paid by the ETF to Vanguard Investments Canada Inc. and does not include applicable taxes or other fees and expenses of the ETF.

2) How can VRIF help retirees and investors looking for income?

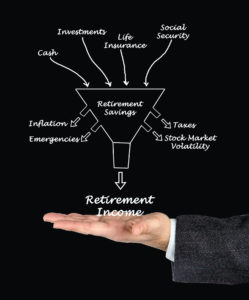

Managing income in retirement is not an easy task. There are a lot of ETFs and mutual funds for building up your retirement savings but not many for people who are looking to use those savings for their retirement spending.

With 30% of Canada’s population being 55 or older, the need for income has never been greater among investors. VRIF gives you a regular consistent payout each month (currently 4% of the total portfolio) and readjusts it once per year. Each year we set a dollar amount and it’s the same for every month in that year. The outcome is a simple and low-cost investment option that can help people enjoy their retirement.

3) How does VRIF expect to achieve the annual payout for investors given the current low-yield environment and where does that payout come from?

Within VRIF, we use a well-diversified total return approach to achieve a tax-friendly annual payout, (currently 4% of the portfolio) split across equal payments each month, that includes income from the portfolio and capital appreciation. Continue Reading…