By Bob Lai, Tawcan

Special to Financial Independence Hub

Recently I wrote about what we’re doing in this bear market condition. Since we’re still in our accumulation phase, we’re following our investment strategy by continuing buying dividend stocks and index ETFs regularly and building up our dividend portfolio.

But what if you’re closer toward retirement or already retired? How do you protect yourself from the bear market so make sure you can sustain your expenses in retirement? What is the ideal retirement portfolio for Canadian? Should someone simply try to aim to build a dividend portfolio and live off the dividends? To answer this complicated question, I thought it’d be best to ask an expert. So I decided to reach out to Dale Roberts to talk about the retirement portfolio for Canadians.

For those who don’t know Dale, he is a former investment advisor and trainer with Tangerine. He now runs Cut The Crap Investing and is a regular contributor to MoneySense.

Please take it away Dale!

Thanks Bob.

The typical retirement is likely a thing of the past. Yours will not be your Mom and Dad’s retirement and it certainly won’t look much like Grandpa’s either. The traditional model of a workplace pension plus Canada CPP (Canada Pension Plan) and Old Age Security payments plus home equity won’t likely get the job done.

In previous generations many would work until age 65 and with life expectancy in the mid to upper 70s, the retirement was short lived, meaning that long-term inflation was not the threat it is today. And those workplace pensions were commonplace. A retiree could sit back knowing those cheques were coming in on a regular basis, and those pension amounts were often adjusted for inflation.

According to Statistics Canada the Life expectancy in Canada has improved considerably. Women’s life expectancy at birth has increased from 60.6 years in 1920–1922 to 83.0 years in 2005–2007, and men’s life expectancy from 58.8 to 78.3 years in the same period—increases of 22.4 years for women and 19.5 for men.

A Canadian male who makes it to age 65 will on average live another 20 years. It’s even longer for women. Many will live to age 90 and beyond. We all assess our own longevity prospects, but it may be prudent to plan for a retirement of 25 to 35 years. If you opt for an early retirement, your portfolio (and any pensions) might have to support you for 40 or 50 years.

A sensible retirement plan will work to make sure that you don’t outlive your money. You will also likely want to pass along wealth to children, grandchildren and charities. Estate planning and leaving a meaningful legacy will be a priority for many Canadians.

The pandemic has made Canadians rethink many areas of their lives. Our own mortality became a concern. For good reasons, during the pandemic more Canadians have sought out meaningful financial advice. They recognize the need for proper insurance, investments that can stand the test of time and a well-thought-out financial plan that ties it all together.

You don’t get a second chance

It all adds up to greater peace of mind. There is that popular expression from Benjamin Franklin:

If you fail to plan, you are planning to fail

When it comes to retirement, that plan is essential. You don’t get a second chance.

Retirement building blocks

The traditional building blocks of a secure retirement will be insurance, plus cash flow from savings and a well-diversified investment portfolio, plus government and company pensions. Income from investment properties are often in the mix.

Annuities offer the ability to pensionize more of your nest egg. Thanks to product innovation Canadians can add a pension-like component with a revolutionary new offering such as the Longevity Pension Fund from Purpose Investments.

Canadians who might have missed out on a workplace pension can fill that void. It operates like a pension fund with mortality credits. That is, it protects the risk of longevity as plan members who die sooner will top up the retirement of those who live to a very ripe old age.

- Insurance

- Cash

- Pensions, public and workplace

- Old Age Security (GIS for lower income)

- Retirement portfolio

- Annuities and investment pensions

- Real estate and other

- Part-time work

- Inheritance

The retirement portfolio

Historically, simplicity can work when it comes to building the retirement portfolio. That is to say, a simple balanced portfolio that owns stock market funds and bond market funds will do the trick.

The famous, or infamous 4% rule shows that a 60% stock and 40% bond portfolio can provide a 4% (or slightly more) spend rate that will support a retirement of 30 years or more.

Note: a 4% spend rate suggests that 4% of the total portfolio value can be spent each year, with an increase at the rate of inflation. The 4% rule is more of a rule of thumb to help you figure out how much you need to save and invest to hit your magic retirement number. This video demonstrates why no one really uses the 4% rule.

You’ll find examples of these core balanced portfolios on my ETF portfolio page. You might look to the Balanced Portfolio with More Bonds and the Balanced Growth Portfolio as potential candidates for a core retirement portfolio. There are also the all-in-one asset allocation ETFs.

I would suggest that the traditional balanced portfolio can be improved with a cash allocation and dedication inflation protection. You might consider the Purpose Diversified Real Asset ETF, ticker PRA on the TSX. The cash will help during periods of extended bear markets. In 2022 saw how stocks and bonds can fall together in a rising rate environment.

Given that you might consider for a simple balanced model:

- 50% stocks

- 30% bonds

- 10% cash

- 10% PRA

But Canadians love their dividends

While a core ETF portfolio might do the trick, most self-directed investors love their dividend stocks and ETFs. That’s more than fine by me.

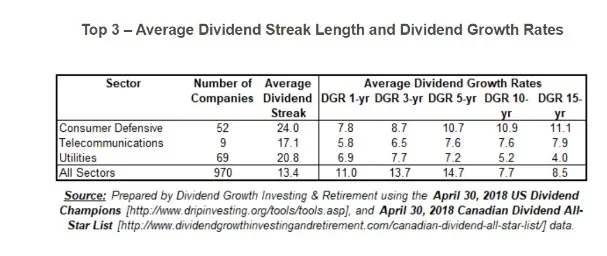

In fact, building around a core Canadian stock portfolio is likely a superior approach for retirement funding. Thanks to wide moats (lack of competition) and oligopolies, Canada is home to the most generous and retirement-friendly dividends on the planet.

That said, don’t sell yourself short by only living off the Canadian dividends. Total return matters and dividend investors should always consider selling some shares to supplement their dividend income and for tax efficiency purposes.

Tawcan: Can’t agree with you more Dale! Selling some shares later on during your retirement will help with estate planning as well. I’d say living off dividends and not touch your principal early on during your retirement may provide some margin of safety.

Dale: My Canadian core stock portfolio provides a generous and growing (though not guaranteed) income stream and a defensive stance. I call it the Canadian Wide Moat 7. Bob always has listed some top Canadian dividend stocks to consider as well.

To boost the yield you might also consider some Canadian Utilities as bond proxies (i.e. replacements). And certainly, thanks to the defensive telcos, utilities and other defensives, you might go much lighter on any bond allocation.

I recently posted on building the defensive big dividend portfolio for retirement.

I prefer dividend growth stocks for the U.S. allocation. In the post below you’ll find our (for my wife and me) personal stock portfolio, and how the Canadian stocks work with the Canucks. The portfolio offers generous market-beating returns with a more total portfolio defensive stance.

To generate modestly better retirement funding (compared to core balanced index portfolios) we can boost the dividend stream, and hold a greater concentration in defensive stocks.

We’ll find that defensive nature in telcos, pipelines, utilities, healthcare and consumer staples. U.S stocks help fill in those Canadian portfolio holes as we find wonderful healthcare and staples stocks south of the border. The U.S. offers ‘the best companies on the planet’ – my sentiment. And many of those companies are in the technology and tech sectors. It’s a great idea to add growth in retirement, but we do want to make sure that we are defense first.

Tawcan: Yup, since the Canadian market is very financial and energy heavy, investing in U.S. stocks will help with sector diversification.

Dale: On the defensive front, I’d throw in Canadian financials as well – they will offer up those generous, and mostly reliable dividends. And yes, you might also consider international, non North American ETFs. I prefer to mostly get my international diversification by way of the U.S. multinationals.

While not advice, my personal portfolio shows how easy it is to build a simple retirement stock portfolio. As you can see from that above post, we also hold other assets in moderation – including cash, bonds, gold and other commodities plus oil and gas stocks. Continue Reading…