By Billy and Akaisha Kaderli, RetireEarlyLifestyle.com

Special to the Financial Independence Hub

We know many of our readers are not “average.” However, if average Joe can support his retirement on as little as US$200,000 savings, imagine what you can do with the amount you have!

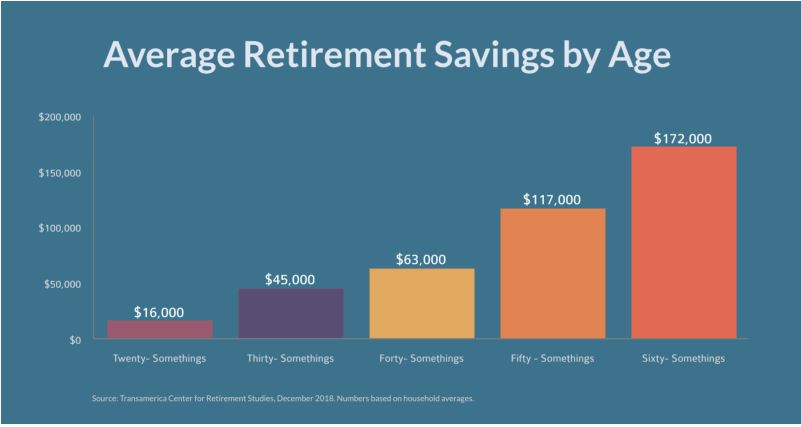

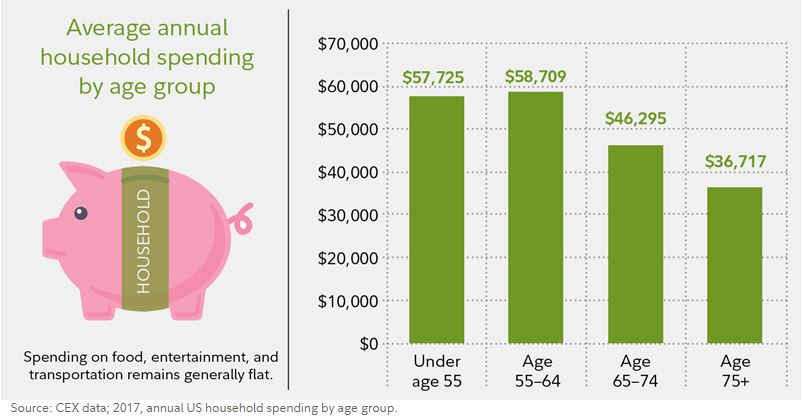

By reading the chart below, you can see that the average spending for retirement households age 65 – 74 is US$46,000.

It is tough to make that $46k amount with only Joe’s savings, so what should he do?

Social Security

The average recipient today (in the United States) collects US$1,461 a month, or US$17,532 a year. Joe’s SS check is average and he has a wife who also collects the average Social Security amount.

$17,532 times 2 (people) = US$35,000 per year.

Not quite the $46,000 that they need but getting closer.

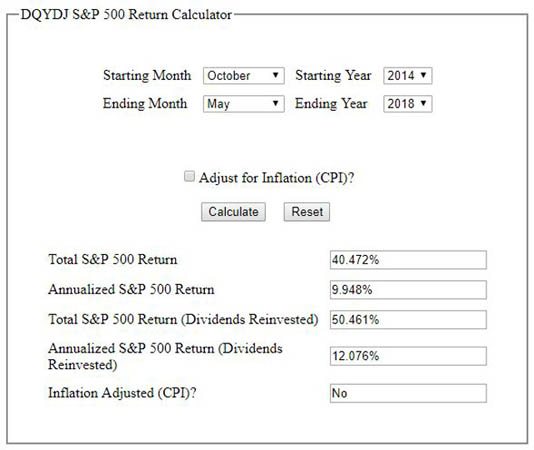

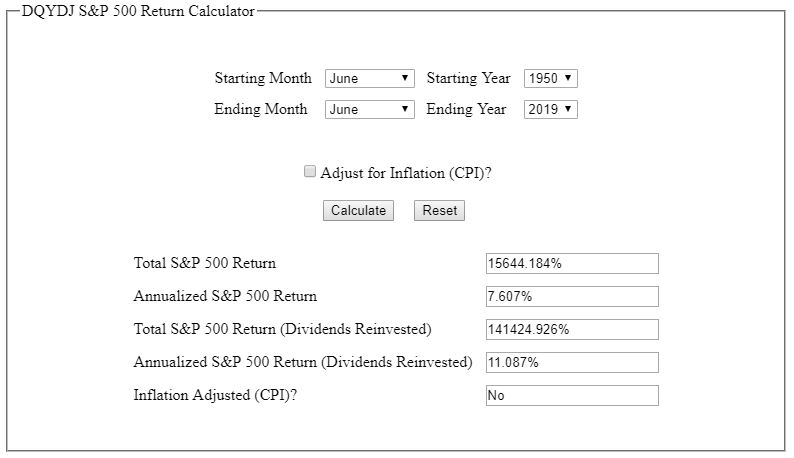

Hopefully, Joe has his retirement money invested in VTI (Vanguard Total Stock Market) or SPY (S&P 500 Index) and is making market gains equaling around 10% annually.

Here you can see that since the 1950’s — about when Joe was born — the S&P 500 has had an annualized return of over 11%, dividends reinvested, but let’s use 10% as a more conservative projection.

Remember, Joe has to make up $11,000 to match his average spending ($46,000). But let’s give Joe an extra one thousand dollars per year so he can pamper Mrs. Joe with occasional gifts and dinners out.

So, he needs $12,000 out of the $200,000 in savings per year to make up the difference in spending. That’s an extra $1.000 per month.

Invested in the S&P 500 — based on 69 years of returns and using 10% as the annual return — after his first year he would have $220,000 minus $12,000 withdrawal = $208,000.

Now Joe has $47,000 in annual income: $35,000 from Social Security and $12,000 from investments.

Plus, his $200,000 has grown to $208,000, a 4% gain outpacing inflation at the current rate of less than 2% per year.

Their Social Security payment is also indexed to inflation so as inflation rises, so will their Social Security. Continue Reading…