By Mark Seed, myownadvisor

Special to Financial Independence Hub

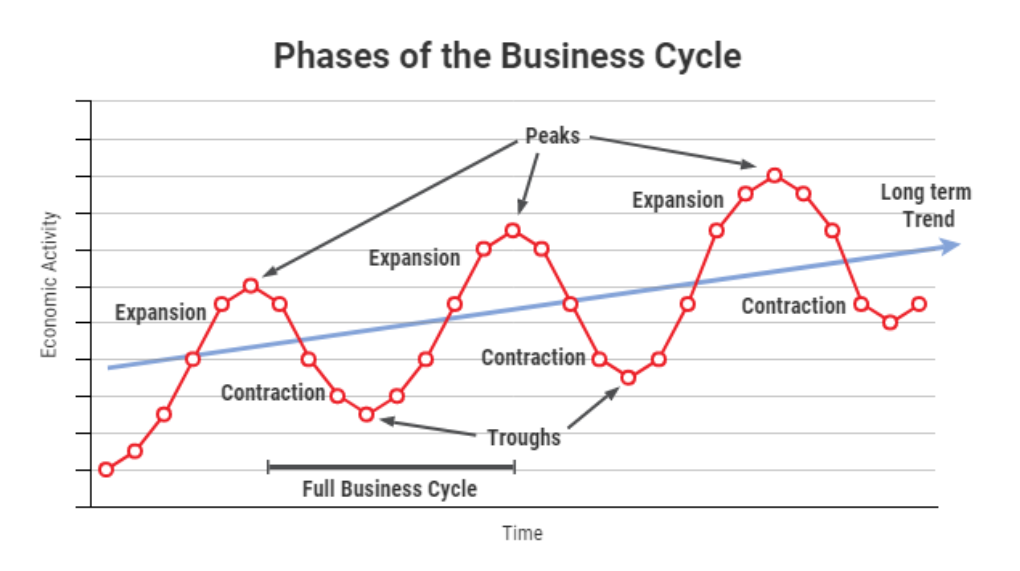

According to the largest asset manager firm in the world (BlackRock), policymakers will no longer be able to support markets as much as they did during past recessions – so we have been warned – a team of BlackRock strategists led by vice chairman Philipp Hildebrand wrote in a report titled 2023 Global Outlook.

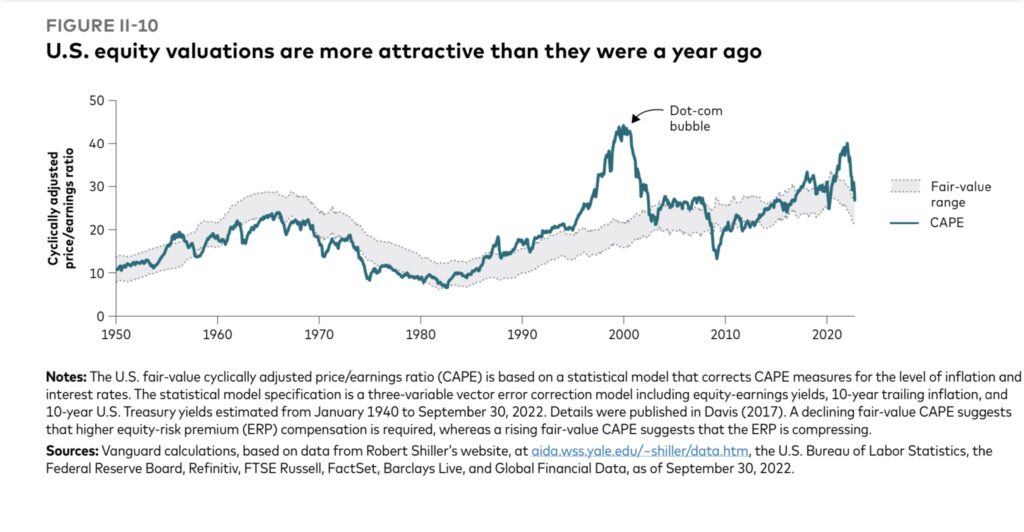

“Recession is foretold as central banks race to try to tame inflation. It’s the opposite of past recessions,” they said. “Central bankers won’t ride to the rescue when growth slows in this new regime, contrary to what investors have come to expect. Equity valuations don’t yet reflect the damage ahead.”

The report went on to say “The old playbook of simply ‘buying the dip’ doesn’t apply in this regime of sharper trade-offs and greater macro volatility. We don’t see a return to conditions that will sustain a joint bull market in stocks and bonds of the kind we experienced in the prior decade.”

I reflected on this report recently. How is an investor to cope?

Well, I think the “old playbook” is actually something I’ve already started to think about for the “new playbook” and maybe you have as well …

- Directionally, i.e., longer-term than one year or so, stay with equities. Lots of them. In fact, to be specific, consider infrastructure stocks in particular. BlackRock: “We see some opportunities in infrastructure. From roads to airports and energy infrastructure, these assets are essential to industry and households alike. Infrastructure has the potential to benefit from increased demand for capital over the long term, powered by structural trends such as the energy crunch and digitalization.”

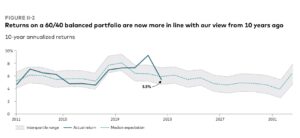

- Tactically, i.e., within the next year, if you need that money balance, consider bonds. Yes, consider fixed income again. According to BlackRock: “In fixed income, the return of income and carry has boosted the allure of certain bonds, especially short term. We don’t think leaning into broad indexes or asset allocation blocks is the correct approach. We stay underweight long-term nominal bonds as we see term premium returning due to persistent inflation, high debt loads and thinning market liquidity.” Meaning, if you are going to own some bonds, stay short and own short-duration bonds.

I come back to Ben Carlson’s thesis (that I agree with) after reading this recent BlackRock global outlook report when it comes to bonds. There are absolutely good reasons to own bonds, but it’s more for the near-term variety:

- Bonds can help your investing behaviour – helping you ride out stock market volatility – including being strategic to buy more stocks soon.

- Bonds can be used to rebalance your portfolio – helping you keep your portfolio aligned to your investing risk tolerance and therefore asset allocation (mix of stocks and bonds).

- Bonds can be used for spending purposes – where some fixed income is “king” for major, upcoming, near-term spending.

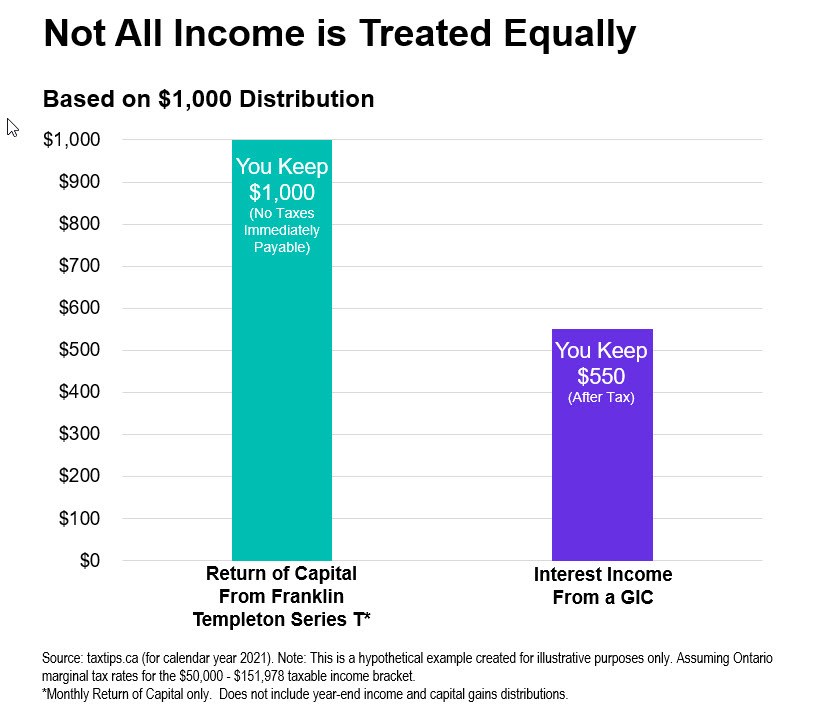

The main reason I would keep any bonds (and I still don’t have any right now) is if I was saving for a major purchase in a few years (e.g., secondary residence?). Then, I would like rely on some form of fixed income between now and then to help secure that purchase. Otherwise, an interest savings account in the short-term will do that and/or some 1 or 2-year GICs are a great consideration as well as part of any bucket strategy.

Personally, I believe the main role of fixed income in your portfolio is essentially safety – not the investment returns and not the cash flow needs. In other words, if all else fails per se, if/when stocks crash, then bonds should historically speaking offer a flight to safety for preserving principal.

So, they are there for diversification purposes.

As Andrew Hallam, a Millionaire Teacher has so kindly put it over the years: when stocks fall hard, bonds act like parachutes for your portfolio. Bonds might not always rise when the equity markets drop. But broad bond market indexes don’t crash like stocks do.

Is that enough to own bonds in your portfolio? Maybe.

For now, I’m going to continue living with stocks: a mix of dividend-paying stocks (including infrastructure stocks that BlackRock likes for the year or so ahead) AND owning low-cost equity ETFs for growth.

I will also grow my cash wedge to my desired safety net by the end of 2023 too. That’s one year’s worth of spending/expenses held in cash that will form Bucket 1 below. That first bucket is an insulator from my dividend and growth equities.

Your mileage may vary. Continue Reading…