Special to the Financial Independence Hub

The other day I had a lovely exchange with some friends on Twitter about advisor behaviour considering current market valuations. Every time I write about this, I need to begin with the caveat: this is NOT about forecasting or market timing. I can’t do it. You can’t. No one can do that if reliability is properly considered. What follows is not about predictions.

It is about what, if anything, can be done – either proactively or reactively – considering high market levels and what that might mean for investors. To be clear, I will admit that “what that might mean” is my code for “if markets take a really big tumble.”

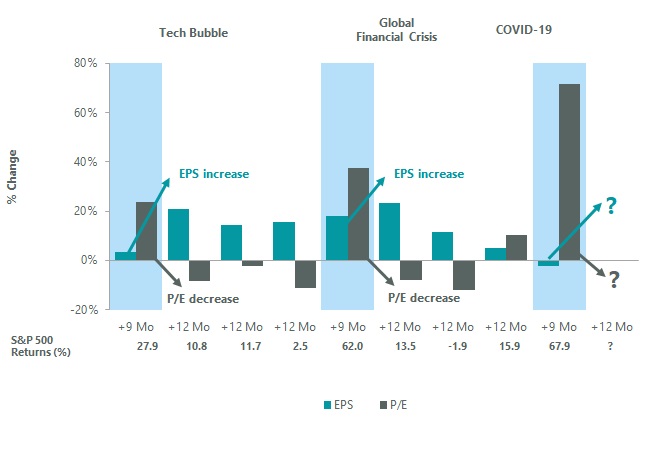

By now, you’ll know that I have been concerned about the frothy levels of market valuation south of the border for over a year. The fact is that the Shiller CAPE for the S&P 500 has been above 30 for about four years now. In early February, it hit 35 for the first time since the dot.com bubble at the turn of the millennium. Based on valuation alone, markets are much higher today than they were at the start of the GFC [Great Financial Crisis], for instance. I think we should be worried, but most of my colleagues don’t seem to be.

At these levels, returns next decade could be poor

The thing about CAPE is that although it is a poor tool for short term market timing (i.e., it is essentially useless in picking ‘tops’), it has, over the years, proven to be a highly reliable predictor of returns over the next decade or so. When valuations are this high, the ensuing decade is pretty much always ugly.

Despite this, all I ever seem to hear about is how the good times are rolling and it would be folly to ‘fight the fed’, that ‘the trend is your friend’ and that investors seem to be more confident than ever before. Like they say in the movies… “it’s pretty quiet out there … a little TOO quiet.”

People like Jeremy Grantham at GMO have taken to suggesting the coming returns for North American stocks and bonds are likely to be negative (!) over the next seven years at least. Who has THAT in their financial plans? Perhaps more to the point, what if there’s not a single, monumental point where markets fall off a cliff? If markets drop by 1% or 2% every year for the better part of the coming decade, how will people react … and who will be genuinely prepared?

A Thought Exercise

Here’s a thought exercise. Continue Reading…

Share this:

- Click to share on X (Opens in new window) X

- Click to share on LinkedIn (Opens in new window) LinkedIn

- Click to share on Facebook (Opens in new window) Facebook

- Click to share on Reddit (Opens in new window) Reddit

- Click to email a link to a friend (Opens in new window) Email

- Click to print (Opens in new window) Print