By Dr. Bryan Taylor, Chief Economist, Global Financial Data

By Dr. Bryan Taylor, Chief Economist, Global Financial Data

Special to the Financial Independence Hub

Global Financial Data has collected extensive data on stocks from the United States and the United Kingdom covering over 400 years. With this, GFD has generated indices that cover the history of the stock market from the incorporation of the Dutch East India Company in 1602 to the current market in 2018-2019.

One question that the creation of size indices creates is how many components should be in the large-cap, mid-cap and small-cap indices. Where should large-cap, mid-cap and small-cap begin and end? Currently, each index company treats large-cap, mid-cap and small-cap indices differently. Let’s look at how different index companies treat market capitalization.

Standard and Poor’s has three size indices for the United States with 500 shares in the large cap index, 400 in the mid-cap and 600 in the small-cap. The 500-share index was introduced in 1957, the 400-share Midcap was introduced in 1981, and the Small Cap Index was introduced in 1994. The proper weights for the three size indices was not calculated when the indices were introduced, so the S&P 500 Composite represents 90% of total market capitalization, the Midcap 400 7% and the Small Cap 3%.

The idea for a small-cap index was introduced by Russell in 1987 and the data was extended back to 1978. Russell has 1000 stocks in their large cap index and 2000 in their small-cap index. However, this creates an even greater imbalance for the large cap stocks since the Russell 1000 represents about 92% of the total market cap in the United States and the Russell 2000 represents about 8%.

Morningstar and MSCI have more balanced approaches to the size categories. Morningstar refers to the top 70% of stocks as large-cap stocks, the next 20% as mid-caps and the bottom 10% as small-caps. MSCI divides the US stock market into 300 Large Cap stocks, 450 Midcap Stocks, 1750 Small Cap Stocks and the remaining stocks (around 1000) as Micro-cap stocks. By our calculations, this would give about 70% to the Large Cap 300, 16% to the Midcap 450, 13% to the Small Cap 1750 and 1% to the Micro-Cap 1000.

Taylor’s Golden Rule

The problem with creating long-term indices is that the number of stocks that listed on the exchanges and over-the-counter grew dramatically over time and the number of stocks in the large-cap, mid-cap and small-cap groups vary accordingly. During most of the 1800s, there weren’t even 500 stocks listed on all of the exchanges in the United States. So how do you determine how to allocate stocks to the large cap, midcap and small cap categories if the number of stocks in existence is constantly changing?

The best solution is to determine a ratio of the number of stocks in each category. Our research has shown that a golden rule possibly exists for the different groups by size. Our rule is the 10-20-30-40 rule. The top 10% of the stocks by number are Blue Chips, the next 20% are large caps, the next 30% are midcaps and the bottom 40% are small caps. A stock index that included 1000 stocks would include 100 Blue Chips, 200 Large Caps, 300 Midcaps and 400 Small Cap Stocks. The Blue Chips and Large Caps can be combined to create a single Large Cap group.

To test our theory, we calculated the market caps that would result from this combination for historical indices for the United States and the United Kingdom. For the United States, we chose 1000 stocks from 1894 to 2016, 500 stocks from 1875 to 1893 and 200 stocks from 1830 to 1874. For the United Kingdom we chose 250 stocks from 1864 to 1985.

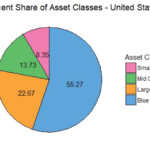

After we summed the market cap for each group, we divided the market cap of each group by the market cap of all the stocks in the population to determine what the ratios of the different groups were. The results of our analysis are provided in the pie chart at the top of this blog. What is interesting is how closely the percentages for the Large cap, Midcap and Small cap compare over the 300 years of data that is used from the United States and the United Kingdom.

The result is five size indices which can provide useful information to investors. The Blue Chip stocks provide about 60% of the total market cap, the Large Caps 20%, the Midcaps 12% and the Small Caps 8%. As the number of stocks changes over time, or the number of stocks varies from one exchange to the other, these ratios can be used to create useful indices that provide contrasting behavior between the different size indices. GFD’s size indices will be based upon Taylor’s Golden Rule, and we recommend that other index creators begin using this rule as well.

Bryan Taylor is President and Chief Economist for California-based Global Financial Data. He received his Ph.D. from Claremont Graduate University in Economics writing about the economics of the arts. He has taught both economics and finance at numerous universities in southern California and in Switzerland. He began putting together the Global Financial Database in 1990, collecting and transcribing financial and economic data from historical archives around the world. Dr. Taylor has published numerous articles and blogs based upon the Global Financial Database, the US Stocks and the GFD Indices. Dr. Taylor’s research has uncovered previously unknown aspects of financial history. He has written two books on financial history.

Bryan Taylor is President and Chief Economist for California-based Global Financial Data. He received his Ph.D. from Claremont Graduate University in Economics writing about the economics of the arts. He has taught both economics and finance at numerous universities in southern California and in Switzerland. He began putting together the Global Financial Database in 1990, collecting and transcribing financial and economic data from historical archives around the world. Dr. Taylor has published numerous articles and blogs based upon the Global Financial Database, the US Stocks and the GFD Indices. Dr. Taylor’s research has uncovered previously unknown aspects of financial history. He has written two books on financial history.