I’ve always enjoyed interviewing the managers of the Templeton Growth Fund (TGF), one of the most famous global mutual funds in the world and the basis for the famous “Mountain Chart” (shown below.)

TGF also happens to be one of a handful of mutual funds our family still owns, along with numerous ETFs and individual stocks, so when Franklin Templeton brings in its fund managers for its annual media lunch in June or July, I’m always happy to take advantage of the access.

On Wednesday, I taped an interview with the new portfolio manager of Templeton Growth, British-born James Harper, normally based in Nassua and a veteran of 22 years in the business, the last eight with Franklin Templeton. He took over the fund on April 21st of this year. Like his predecessors, Lisa Myers and George Morgan, Harper has a refreshing take on the valuations of stocks around the world.

Fund underweight U.S. stocks: “becoming fully valued”

He started by saying the fund is 18% overweight Europe, 15% underweight the United States, and later in the interview revealed the fund no longer has any exposure to Canada, even though as a global equity fund, you might expect it to own perhaps a 3% index weighting.

“As of today, the fund (TGF) has no holdings in Canada, zero,” he told me, “That’s not an anti-Canada statement. It’s simply the fact this is a market that’s relatively overweight financial companies and we see more value in European financials, especially recently because they fell so much in the first quarter.”

Like the managers before him, Harper says he’s “geographically agnostic.” By that, he means that the fund does not start with a top-down geographic perspective but from a bottom-up stock-by-stock process based on valuations. The geographic mix that results is purely a byproduct of that discipline, which is why it’s always interesting to hear their views on relative valuations around the world.

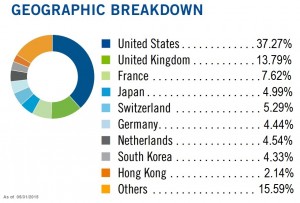

So while you might expect a global index fund to be half in the U.S., TGF was only 37% in the U.S. as of May 31st. “The U.S. is becoming a bit of a fully valued market. Earnings are at all time highs, which is testimony to the fact QE actually worked and companies have been very aggressive on their margins. They’re well above the 2007 peak in earnings and valuations are starting to reflect that.”

So US stocks are trading at a 10% premium to their long-term values. “That’s not to say there’s not some value in the U.S. Our largest holding is Microsoft, which has done very well recently. There’s just more value in Europe.” As of April, a Templeton fact sheet shows that other top ten US holdings include Citigroup Inc., Comcast Corp., CVS Health Corp. and biotech firms Amgen Inc. and Gilead Sciences.

Europe is the opposite: trading at a 10% discount to their longer term values. In Europe, “earnings of companies are still way below their 2007 peak, partly because they were very slow on QE but now we’re seeing a bit of that. Touch wood that Greece will be resolved very soon.”

The obvious question is how the ongoing volatility over Greece affects its view on European stocks in general. The fund has no direct exposure to Greek equities and very few holdings in Portugal, Italy or Span.

But you’d think European financial stocks with exposure to Greece would be at risk, I ask.

Greece situation was more serious a few years ago

“Greece is very interesting,” Harper replied, “If you’d asked the same question three years ago I’d have been concerned because we have exposure to European financials. A number of those companies have exposure to the Greek financial system but over the last two or three years they rebuilt their tier-one capital ratios and companies like ING reduced their exposure to Greek lending. I cover the reinsurance industry and know that back in 2012-2013, Munich Re had $4 or $5 billion exposure to Greek bonds but that’s now in the hundreds of millions. They’re reduced their exposure so if there is to be an event, the impact would be relatively small. I don’t think it’s a big issue.”

Opportunity in European energy stocks

Another macro trend that came up is energy. After the price of oil dropped from $100 to $50, some European oil stocks dropped between 20 and 40%, Harper said. “Our analysts did a great job looking at the long-term marginal cost of oil production and concluded this was a supply-side shock, not a demand-driven shock. Demand is still rob oust. We concluded the cost of getting oil out of the ground is $80, so at $50 there is a chance of recovery and we found a number of companies really discounting $50 oil prices in perpetuity.”

Initially, the fund has been buying oil services companies because when oil lurches down, the service firms react the quickest and most severely. So the fund scooped up Baker Hughes and Halliburton in the U.S., Petrofac in the UK and Subsea 7 in Norway. It doesn’t currently own the big national oil firms like Chevron or Exxon, although it has in the past. “Within the oil sector, again we have a bias to Europe: BP, for example, and Statoil.”

Overweight Emerging Markets, underweight Japan

Currently the fund is slightly overweight Emerging Markets, in part because some of its Chinese and Hong Kong holdings have done well recently. But it’s underweight Japan. Its auto holdings there, including Toyota and Nissan, have done well because its exporters have been benefiting from currency, but Harper is seeing more value in South Korea. “We’re rotating from names that have done well in Japan and into names in Korea that have done poorly and we think look extremely cheap.” Examples are Samsung and Hyundai.

Harper sees selective value in Emerging Asia but is cautious about volatile currency swings and, in China, “sometimes we run into companies that are not really being run for shareholders.”