By Bob Lai, Tawcan

Special to the Financial Independence Hub

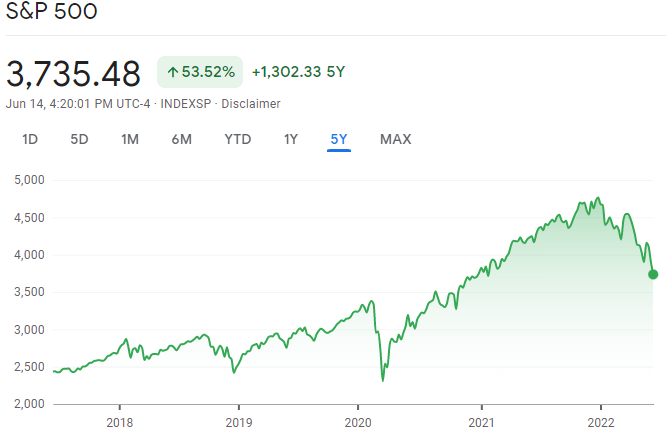

Unless you’ve been living under a rock, you probably have heard that the stock market is crashing. Year-to-date, the S&P 500 is down by 23.55% and the NASDAQ is down by 32.76%, and the Russell 2000 is down by 27.4%. The TSX YTD performance of -10.51% actually doesn’t seem too bad when we compare it to its US counterparts.

Battling high inflation rate

Because interest rates were very low throughout 2020 and 2021, as pandemic restrictions started to lift and pent-up consumer demands for travel, cars, electronics, food, fuel, etc increased, this caused the inflation rate to rise quickly. The Russian invasion of Ukraine caused the price of oil and some commodities to soar further, which drove the CPI even higher.

Inflation rose 8.6% in May in the US, the highest since 1981 – more than four decades!. Here in Canada, we saw an inflation rate of around 6.7% in the same period. This is causing a lot of fear and angst. Both the Federal Reserve and the Bank of Canada are hiking interest rates quickly in an attempt to try to tame the high inflation rate.

I don’t believe we’ll see hyperinflation like post-WWI in Germany and I think there’s no appetite to see inflation rates in the teens like in the early 80s. The central banks will simply not allow that to happen under their watch. But I have my doubts that the inflation rate will start to go down quickly.

I believe interest rates are still way too low and both the Fed and the BoC should be raising interest rates more aggressively (the Fed did hike interest rates by the biggest amount (0.75%) since 1994 recently). Can we agree that the central banks were too slow in reacting to the pandemic recovery and the pent-up consumer demands? Interest rates probably should have gone up last year but didn’t because there were still a lot of pandemic-related uncertainties.

One thing to keep in mind is that the Fed and the BoC are being very careful about hiking interest rates too quickly. Since many people purchased properties during the past couple of years in a heightened housing price period, some of them do not have additional cash each month to pay for higher mortgage interests. If the Fed and the BoC start to raise interest rates too quickly, this can cause people to default on their mortgages, creating a housing crash, similar to what we saw in the US during the financial crisis. (Apparently nearly 1 in 4 Canadian homeowners ay they’d have to sell their home if interest rates rise more, according to a survey)

Interest rates also impact the unemployment rate. As interest rates rise, companies may decide to freeze hires and lay off people to reduce operational costs and company debt levels. As people lose their jobs, they won’t spend as much money buying things and may have issues paying off mortgages and consumer debt. High unemployment rates also hurt the country’s GDP.

As you can see, interest rates can create a lot of cascade effects and this is why monetary policy can be a very interesting topic.

So what’s my guess when it comes to the high inflation rate? My guess is that the high inflation rate will peak and flatten out later in 2022 or early 2023 before it starts to trend down to the inflation target rates in late 2023.

That’s just a pure guess on my part. As we all know, it is nearly impossible to predict the future.

How do interest rates affect the stock market?

Well, as interest rates go up, the yield for new bonds also goes up. Since bonds are safer than stocks, once bond yields reach a certain rate, bonds become more attractive to some investors and money starts to shift from the stock market to bonds. As people sell their stocks and buy more bonds, this puts pressure on the stock market (remember, stock prices are determined by demand and supply).

Furthermore, rising interest rates mean it is increasingly expensive for businesses to take out loans. So rising interest rates typically have a negative impact on companies that require a lot of new capital to grow. Tech companies usually are considered in this bucket, hence we’re seeing the likes of Amazon, Google, Tesla, Apple, and other major tech companies’ stock prices dropping like stones in the water.

Warren Buffett has repeatedly compared interest rates to gravity, as they represent the risk-free rate of return available to investors. This in turn affects the relative value of other assets. Since high interest rates make borrowing money more expensive, leveraged bets are therefore discouraged.

“The most important item over time in valuation is obviously interest rates,” Buffett said last year. “If interest rates are destined to be at low levels. … It makes any stream of earnings from investments worth more money. The bogey is always what government bonds yield.”

At first glance, high interest rates generally would lead to bad market performance. But if rates were kept high, companies and investors adjust to the new norm and the market would adjust accordingly as well. So as we’ve seen in the past, just because the interest rates are high, it doesn’t mean the market can’t have high returns.

Our portfolio is taking a beating

As you’d expect, our investment portfolio is taking a beating, HARD!!!

Since late March, our dividend portfolio is down around $200k. If we include all of our investments like kids’ RESP, my work’s RRSP, and our growth portfolio (i.e. more speculative stocks, it’s less than 5% of our overall portfolio), we are down over $250k, possibly more.

I hope by sharing our portfolio loss will put your losses in perspective. However, remember, these are all ‘unrealized’ losses as nothing has been sold. It’s all on paper. They only become ‘real’ – of course – if you sell and realize the losses.

And we ain’t planning to sell any stocks any time soon.

If I look at our dividend stock purchases so far in 2022, we are down by about $8,600 or about 10.3% at the time of writing.

| Ticker | Gain/Loss $ | Gain/Loss % |

| SRU.UN | -$1,156.67 | -17.76% |

| GRT.UN | -$1,734.36 | -26.21% |

| ENB.TO | $559.4 | 3.41% |

| AQN.TO | -$315.9 | -4.61% |

| BEPC.TO | $89.43 | 8.51% |

| AAPL | -$695.51 | -25.05% |

| CM.TO | -$561.49 | -21.60% |

| BCE.TO | -$520.77 | -12.75% |

| POW.TO | -$884.48 | -14.58% |

| BMO.TO | -$1,254.39 | -14.01% |

| AAPL | -$258.41 | -22.11% |

| SBUX | -$168.05 | -19.15% |

| BMO.TO | -$320.7 | -14.48% |

| BMO.TO | -$194.7 | -12.30% |

| BNS.TO | -$51.29 | -2.52% |

| BCE.TO | -$228.95 | -11.75% |

| BCE.TO | -$256.53 | -11.23% |

| COST | $35.77 | 4.12% |

| CM.TO | -$314.07 | -8.10% |

| AAPL | -$224.84 | -13.58% |

| XAW | -$162.06 | -4.84% |

Am I worried that most of our 2022 purchases are in the red right now? Not really. Since all of these stocks that we purchased are solid and highly profitable companies and aren’t going bankrupt anytime soon, I continue to believe the stock prices will eventually recover and roar higher.

Let’s not forget this is exactly what we saw in 2020. Many of the stocks that we bought back then were down significantly for many months after our purchases. But eventually, these stocks recovered as you can see below.

| Ticker | Purchase Price | Current Price | Gain/Loss $ | Gain/Loss % |

| BMO | $77.63 | $126.39 | $2,779.43 | 62.81% |

| BNS | $53.26 | $79.39 | $2,665.73 | 49.07% |

| CM | $37.81 | $63.73 | $6,013.59 | 68.56% |

| CNR | $118.29 | $140.03 | $260.84 | 18.38% |

| CU | $32.40 | $37.10 | $201.98 | 14.50% |

| ENB | $38.72 | $52.98 | $5,334.48 | 36.84% |

| GRT | $67.11 | $76.40 | $250.85 | 13.84% |

| NA | $65.54 | $85.61 | $1,003.50 | 30.62% |

| PEP | $135.94 | $157.03 | $421.86 | 15.52% |

| RY | $84.60 | $124.77 | $1,044.32 | 47.48% |

| SU | $30.63 | $47.66 | $2,009.57 | 55.60% |

| TD | $63.11 | $86.17 | $7,379.43 | 36.54% |

Above is just a small selection of the winning stocks we’ve bought in 2022. I can tell you that not every stock we purchased back in 2020 was a winner. We certainly bought some losers like Inter Pipeline, Algonquin Power & Utilities, and Brookfield Renewable Corp, to name a few. But the important thing is that overall we are up by over 22% if we look at our $115k purchases in 2020.

Remember to look at the big picture

During volatile times it is important to remember to step back and look at the big picture. Remember that the S&P 500 is down 23.55% year to date? If we zoom out to the 5-year view, the S&P 500 actually returned +53.52% over the last five years.

Similarly, the TSX has returned 28.67% over the last five years.

Similarly, the TSX has returned 28.67% over the last five years.

If we zoom out even further, this current bear condition looks like an even smaller flip. And as you can see, since 1979, there have been a lot of these flips where the market dropped by a few percentages. As a matter of fact, the steep drop in March 2022 isn’t as scary and steep when we look at the big picture.

If you had invested in the TSX index in 1980 and held it ever since you’d be looking at more than a 540% gain!So what’s my key message to investors that are worried and are losing sleep because of the current scary market condition?If you’re investing in passive index ETFs, understand that you’re tracking the market performance minus fees and expenses. So as the market recovers, so will your portfolio. If you’re investing in dividend paying stocks or high growth stocks, invest in companies that are highly profitable, have a high return of equity, and have a wide moat. Always focus on the fundamentals. Furthermore, remember that real cash flow matters. If a company isn’t generating free cash flow that should raise warning lights, especially in a high interest rates environment.One more point… we investors need to remember to remain patient. Companies like Apple and Costco may not generate as much profits as Street’s expectation every single quarter but as long as they are growing revenues and profitability over time, shareholders will eventually get rewarded.

If you had invested in the TSX index in 1980 and held it ever since you’d be looking at more than a 540% gain!So what’s my key message to investors that are worried and are losing sleep because of the current scary market condition?If you’re investing in passive index ETFs, understand that you’re tracking the market performance minus fees and expenses. So as the market recovers, so will your portfolio. If you’re investing in dividend paying stocks or high growth stocks, invest in companies that are highly profitable, have a high return of equity, and have a wide moat. Always focus on the fundamentals. Furthermore, remember that real cash flow matters. If a company isn’t generating free cash flow that should raise warning lights, especially in a high interest rates environment.One more point… we investors need to remember to remain patient. Companies like Apple and Costco may not generate as much profits as Street’s expectation every single quarter but as long as they are growing revenues and profitability over time, shareholders will eventually get rewarded.

What we’re doing in this bear market

So what are we doing in this bear market environment?

Long time readers will remember I’m a true believer in time in the market rather than timing the market. Since we are still in the accumulation phase, we plan to continue to add new cash and buy dividend paying stock regularly. I continue to like stocks like Apple, the Canadian banks, Costco, Algonquin Power & Utilities, Brookfield Asset Management, Brookfield Renewable, Waste Connections, Fortis, Metro, Telus, and BCE, to name a few.

More importantly, we will continue to spend less than what we earn, continue with our relatively high savings rate, and have multiple income streams whenever possible. Saving money each month and having the ability to deploy that cash saving to purchase stocks is extremely powerful.

Also important is that we will continue to keep an eye on our spending trend and avoid lifestyle inflation. Before we make a big purchase, we always ask if we really need the item. Having some cash savings as a cushion will come in very handy in volatile times. Some people recommend having an emergency fund equivalent to three to six months of your expenses. But I’d argue that amount depends on whether you have any consumer debt, mortgage, your average monthly savings rate, and how secure your job is. For us, we are probably looking at around two to three months worth of saving.

Dear readers, what are you doing in this bear stock market environment? Are you doing anything different?

This blog originally appeared on the Tawcan site on June 20, 20202 and is republished on the Hub with the permission of Bob Lai. Hi there, I’m Bob from Vancouver Canada. My wife & I started dividend investing in 2011 with the dream of living off dividends in our 40’s. Today our portfolio generates over $2,700 in dividends per month.

This blog originally appeared on the Tawcan site on June 20, 20202 and is republished on the Hub with the permission of Bob Lai. Hi there, I’m Bob from Vancouver Canada. My wife & I started dividend investing in 2011 with the dream of living off dividends in our 40’s. Today our portfolio generates over $2,700 in dividends per month.