Vanguard Canada has released an interesting study on home country bias around the world, and makes the familiar case that most Canadian investors are woefully overweight Canadian equities and underweight the rest of the world. You can find the full report (PDF), by clicking here.

Vanguard Canada has released an interesting study on home country bias around the world, and makes the familiar case that most Canadian investors are woefully overweight Canadian equities and underweight the rest of the world. You can find the full report (PDF), by clicking here.

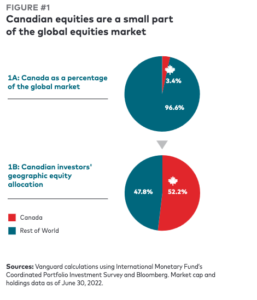

The report is written by Bilal Hasanjee, CFA®, MBA, MSc Finance, Senior Investment Strategist for Vanguard Investments Canada. He points out that Canadian stocks account for only 3.4% of the total global stock market as of June 30, 2022, but as the chart to the left shows, the average Canadian investor is more than 50% in domestic (Canadian) equities. That’s a whopping overweight position of 15 times!

“There are good reasons to have some overweight to Canada for domestic investors, including future return differentials, preference for the familiar, favourable tax considerations, the need to hedge domestic liabilities and currency risk,” writes Hasanjee, “However, Vanguard believes the optimal asset allocation for Canadian investors is 30% vs 70% allocation to Canadian versus international equities, based on our research …”

In other words, it’s okay to be overweight Canada by a factor of nine (30% versus 3.4) but most of us still need to boost our foreign content by roughly 50%: from 47.8% to 70%.

Home Country bias is hardly unique to Canada

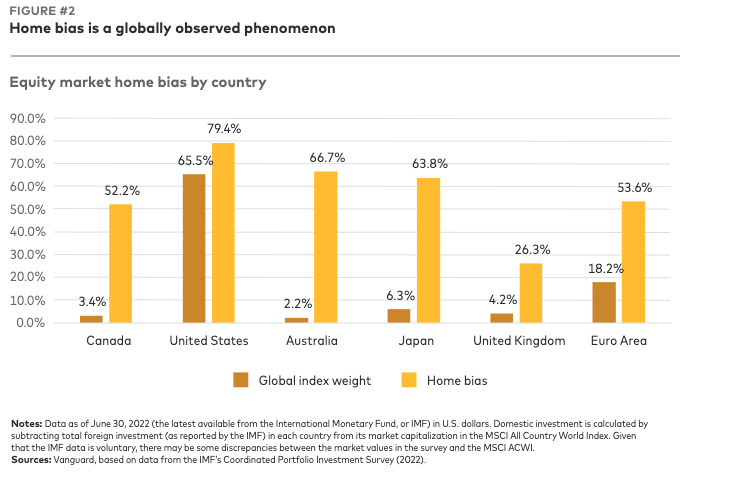

Home country bias is hardly unique to Canada, the report says: it’s certainly the case in the United States and many developed countries, as Figure 2 demonstrates:

Americans are also overweight their home market — the United States — but they can get away with it, as more than half the global market capitalization is in American stocks, plus many of those are blue-chip corporations that have the world as their market. If anything, Interestingly you can see from the above that Australia, which is similar to the Canadian stock market in being focused mostly on energy/resources and financials, suffers even more than Canada from home country bias.

Or as Hasanjee puts it: “The Canadian equity market is significantly overweight in the energy and financials sectors, with relatively smaller overweight in materials and industrials. However, this results in information technology, healthcare, consumer discretionary and consumer staples being underweight relative to the global market … Canadian investors are exposed to a considerable amount of risk that could have been diversified away.”

From this he concludes two things: “Firstly, the Canadian stock market has historically been more volatile than the global market, but without a proportionate increase in return (in fact, all individual countries have had greater risk than the global index). Secondly, in a forward-looking context, any portfolio that deviates from the global market is, by definition, inefficient.”

So how much global diversification is optimal?

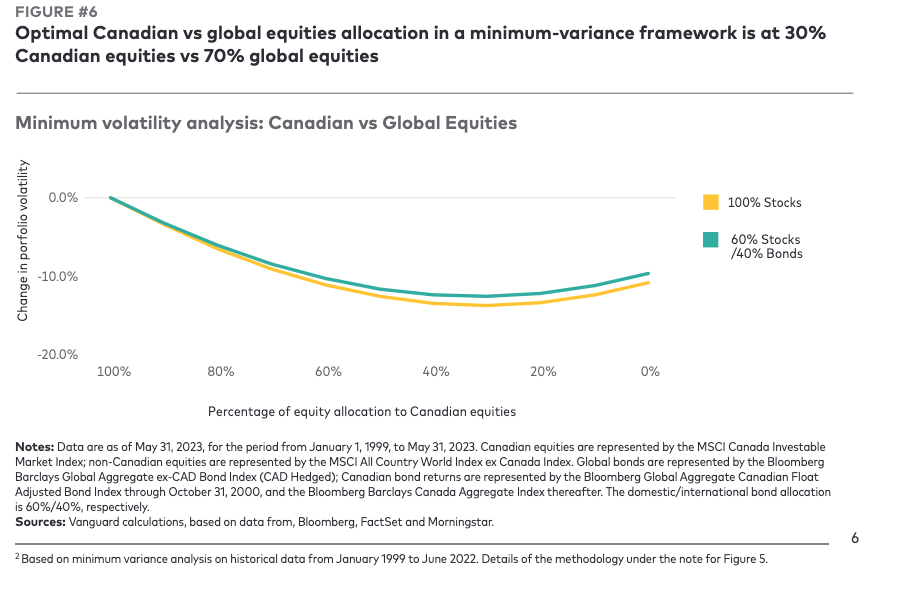

See the full paper for the analysis of how much global diversification is optimal for Canadians. Here’s what Hasanjee concludes: “The marginal benefit of international diversification declines as allocations to international equities increase … Portfolio volatility begins to rise with allocations of greater than 70% to international equities. Looking at the data, the optimal asset allocation for Canadian investors is a 30% allocation to Canadian equities and a 70% allocation to international

equities because it has shown to minimize the long-term volatility of their portfolio.”