A year after Vanguard Canada shook up the ETF industry with its ground-breaking suite of three Asset Allocation ETFs (VGRO, VBAL, VCNS) it today followed up with two new iterations, bringing the total to five.

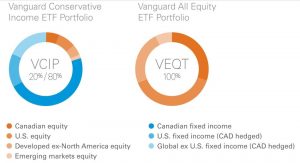

As you can see from the adjacent illustration, the two new ETFs include an all-equity ETF, VEQT; and a very conservative fund, VCIP, dubbed the Vanguard Conservative Income ETF Portfolio, which is 80% in fixed income. (The previous conservative entry, VCNS, was 60% fixed income). Both new ETFs begin trading on the TSX today.

Note that the color key above applies to BOTH funds: that is, Orange refers to four equity ETFs contained in both funds; blue refers to the three fixed-income ETFs that are present only in VCIP, since VEQT is 100% equity/orange. At least one sharp-eyed reader has noted the potential for confusion here.

In any case, the original suite of three ETFs were hailed by the financial press, including Yours Truly here and for the MoneySense ETF All-stars. The newcomers are further along the risk spectrum (100% equities) or further along the conservative income spectrum. And consumers have responded, injecting more than $1 billion into them, according to Kathy Bock, Managing Director of Vanguard Investments Canada Inc. Vanguard Canada now offers 39 ETFs, containing a total of C$17 billion in assets under management.

Here is the description of the two new ETFs contained in a press release:

Vanguard Conservative Income ETF Portfolio (TSX: VCIP) – The Vanguard Conservative Income ETF Portfolio seeks to provide a combination of income and some long-term capital growth by investing in equity and fixed income securities with a strategic allocation of 20% equities and 80% fixed income, made up of seven underlying Vanguard index ETFs.

Vanguard All-Equity ETF Portfolio (TSX: VEQT) – The Vanguard All-Equity ETF Portfolio seeks to provide long-term capital growth by investing primarily in equity securities with a strategic allocation of 100% equities, made up of four underlying Vanguard index ETFs.

Vanguard Canada head of product Tim Huver said “Canadian investors have embraced our ‘all-in-one’ asset allocation ETFs based on their sound portfolio construction, low-cost and simplicity. These ETFs have been among our most popular over the past year and we are committed to giving Canadians greater flexibility by offering two new investing options on both sides of the risk profile spectrum.”

Great stuff. So pleased to see Canadians embracing these wonderful simple portfolio solutions. Bye bye high fee Canadian mutual fund industry.

Agree: no doubt the two newcomers will be added to the 2019 MoneySense ETF All-stars, as were the original three a year ago.

Great article as usual

I have the following question regarding the taxable account:

Now that Vanguard introduced the all equity etf:VEQT I have three options: (60% stocks 40% bonds)

Option 1: VUN (30%) , VIU (25%) VEE (5%) and ZDB(40%): Bond ETF more efficient in taxable account

Option 2: VEQT (60%) ZDB (40%)

Option 3: VBAL (the bond part not as tax efficient as ZDB)

Which one do you thing would be more tax efficient in the taxable account.

Re-balancing multiple ETF’s is not an issue for me

Thanks

VEQT is the 100% stocks one, right? (which to me isn’t really Asset Allocation). I’d think all of these AA ETFs are more tax efficient in RRSPs than non-registered or even in TFSAs, to the extent they pass along lots of foreign dividends and interest income. Good question for Vanguard itself or the MoneySense ETF All-Stars panel.

Hello Jonathan,

Thanks for the quick reply.

Yes VEQT is the 100 % stock.

Due to the fact that both my TSFA and RRSP are maxed out I just wanted to have the most tax efficient way to invest new money in my taxable account.

Cheers