By Shiraz Ahmed, Raymond James Ltd.

Special to the Financial Independence Hub

Until recently young investors were not terribly concerned with inflation. Why should they have been? It was so low for such a long time that we could predict with pretty good accuracy what was around the corner, at least, in terms of the cost of living. But those days are long gone.

Simply speaking, inflation can be defined as the general increase in prices for those staple ingredients of daily life. Food. Gas. Housing. What have you. And as those prices rise the value of a purchasing dollar falls. When these things are rising at 1% a year, or even less, investors can plan and strategize accordingly. But when inflation is rising quickly, and with no end in sight, that is very different and this is where we find ourselves today.

Someone with hundreds of thousands of dollars to invest, but who must wrestle with mortgage payments that suddenly double, is into an entirely new area. It happened back in the early 1980s when mortgage rates went as high as 21%. Many people lost their homes. But even rates like that pale in comparison to historical examples of hyperinflation.

In the 1920s, the decade known as The Roaring Twenties, the stock market rose to heights never seen before and for investors it was seen as a gravy train with no end in sight. But that was not the case in Germany where a fledgling government – the Weimer Republic – was desperately trying to bring the country out of its disastrous defeat in World War I. Inflation in Weimer Germany rose so quickly that the price of your dinner could increase in the time it took to eat it!

Consider that a loaf of bread in Berlin that cost 160 German marks at the end of 1922 cost 200 million marks one year later. By the end of 1923 one U.S. dollar was worth more than four trillion German marks. The end result was that prices spiralled out of control and anyone with savings or fixed incomes lost everything they had. That in no small way paved the way for Adolf Hitler and the Nazis. Let us also not forget that the gravy train of the Roaring Twenties eventually culminated in the stock market crash of 1929 which led to the Great Depression.

Inflation can both hurt you and help you. Let’s first look at how it can hurt. Assuming that you’re on salary, it means lower buying power and less extra money on hand for saving since necessities now cost more. Thus, any ‘cash’ savings you might have on hand are now worth less. But those on a fixed income, like pensioners, suffer the most. And then we have young people who take on debt to go to school or who buy their first home and now face higher rates of borrowing. Inflation hurts them all.

How can inflation help you? Generally, wages go up although maybe not as much as the rate of inflation. Likewise, inflation-adjusted fixed income, again for things like pensions, may rise as well but probably not as much as you want. Inflation also means that debts at a fixed rate are now worth less so that would be a good thing, especially if you just locked into a mortgage last year at 2.5% and that will look even better should inflation reach 10%.

As with the aforementioned example of Weimer Germany, periods of high runaway inflation can lead to dramatic social change. Indeed, as mentioned, hyperinflation was one reason why the Nazis came to power. But we can go back further than that. In China, in the year 1900, there was the Boxer Rebellion which was a peasant revolt that got started, at least in part, by rising food prices. It was enough to bring down the Qing Dynasty. And we can even go all the way back to the Roman Empire when rising inflation, once again for things like food, helped bring everything down.

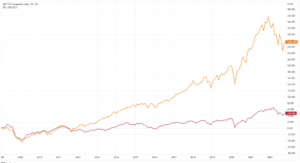

When it comes to investing the overall goal should be slow and steady, reliable growth of your portfolio. Generally speaking, major swings – either way – are deemed to be bad for markets and economic stability. And this brings us to today’s reality. Most young people have known only low interest rates, coupled with high economic growth, in their lives. In fact, this is all we have known since 2008 when we went through the great financial crisis. The chart below shows the growth of the S&P 500 (orange) and TSX (red). The last decade has been among the best performing time frames in recent history.

Source: Tradingview.com

Changing economic factors is why you need to have a financial plan that is constantly updated so you can make adjustments. Think of a coach who must make changes during a game to offset what the opponent is doing, not to mention the natural elements. If we’re talking about a World Cup soccer match and it suddenly starts to rain or the wind picks up, those speedy strikers on one team may not be as speedy anymore. So things can, and will, change. You can count on it.

Who could have predicted the war in Ukraine at this time last year and how that would impact the geo-political world? Four years ago who could have predicted Covid and how that would impact supply chains? Well, I know that Bill Gates said we should expect a pandemic and looking back now we probably should have listened to him, but then people tend to get complacent when things are going well. It’s human nature.

Hindsight is everything. But when it comes to money and your financial health, I can’t stress enough the importance of having solid steps in place to help you get to where you want to go. Here then are a few specific tips you can take away from this article and implement on your own.

- Aggressively pay down your debts. I know investing for the future is always a good idea, however, from a financial planning perspective you may be better served during periods of high inflation by reducing debt as the real return (return after inflation) on risk-free investments is currently negative, let alone deeply negative for higher-risk investments.

- Clamp down on unnecessary expenditures. I know it’s the “Buckley’s” style medicine (tastes awful but it works). Lowering your monthly and annual expenses can help you absorb the shocks of rising rates, namely in the form of increased housing and energy costs many Canadians are facing.

- Make more money! I know its easier said than done, but this is a good opportunity to negotiate for that raise, start a side hustle, or consider upskilling so you can move upwards in your chosen career path.

Shiraz Ahmed is a Financial Advisor & Portfolio Manager with Sartorial Wealth of Raymond James Ltd.

Shiraz Ahmed is a Financial Advisor & Portfolio Manager with Sartorial Wealth of Raymond James Ltd.

Information in this article is from sources believed to be reliable; however, we cannot represent that it is accurate or complete, and it should not be considered personal taxation advice. We are not tax advisors, and we recommend that clients seek independent advice from a professional advisor on tax-related matters. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Shiraz Ahmed, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor's circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member Canadian Investor Protection Fund. Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Therefore, a response to a request for information may be delayed. Please note that not all of the investments and services mentioned are available in every state. Investors outside of the United States are subject to securities and tax regulations within their applicable jurisdictions.