Alternative asset classes like private equity and real estate have long been in vogue with pension funds, institutional investors and some high-net-worth individual investors but the pickings have been slim for retail mutual fund investors. Now, Franklin Templeton Investments Canada has introduced the Franklin K2 Alternatives Fund.

Alternative asset classes like private equity and real estate have long been in vogue with pension funds, institutional investors and some high-net-worth individual investors but the pickings have been slim for retail mutual fund investors. Now, Franklin Templeton Investments Canada has introduced the Franklin K2 Alternatives Fund.

The company says its new mutual fund, announced on Monday, March 11, uses “a multi-strategy approach in seeking to dampen volatility and offer downside protection, while providing added diversification and low-correlation to asset classes typically held in a traditional portfolio.

Franklin Templeton Canada Duane Green pointed to the unpredictable market environment of the past year and said “investors are looking to reduce volatility and protect capital … Our alternatives fund addresses these investor needs and combines the benefits of a sophisticated solution with the liquidity, convenience and fee transparency of a mutual fund.”

In a piece this weekend in the Financial Post, which mentioned the new Templeton fund among others, investing reporter Victor Ferreira said Canadian retail investors looking for exposure to hedge-fund like strategies that can involve leverage and short-selling are being inundated with new options, following a rule change in January. At least six firms have brought so-called “liquid alternative” products (some of them ETFs and some of them mutual funds from firms like Mackenzie and C.I. Funds) to market since regulations barring them from doing so were lifted at the beginning of 2019. Prior to the regulations being altered, he said, only a few firms were able to offer such products after applying for exclusions.

As the Post pointed out, some alternative assets — notably real estate and private equity — are seldom easily liquidated if you need some cash. It cited a 2018 Scotiabank report that projects the Canadian market for these kind of products could grow to be worth $20 billion.

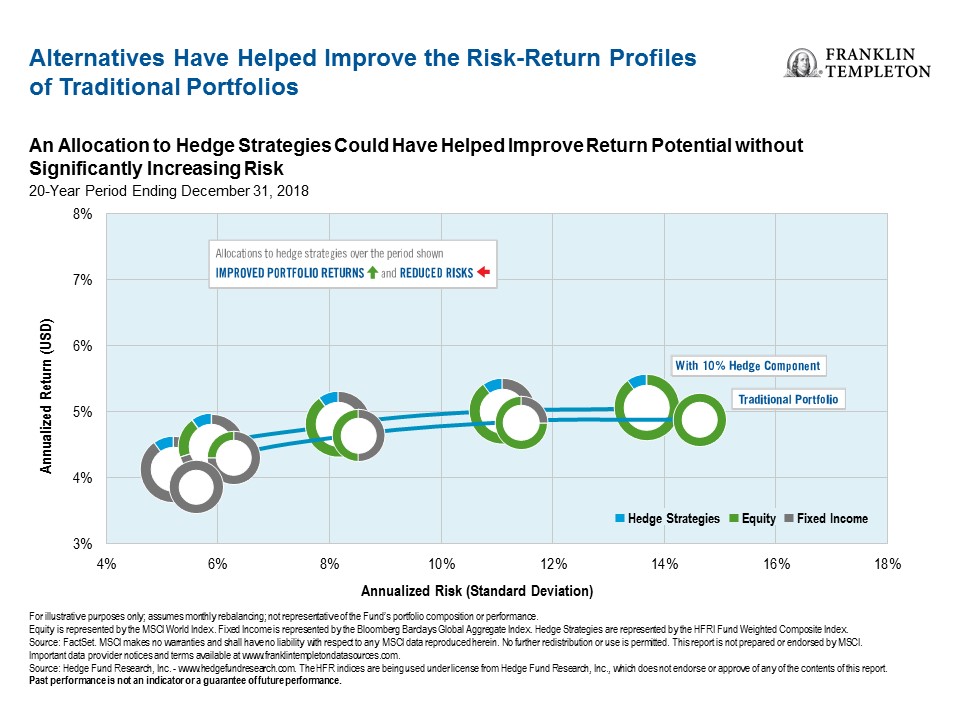

According to Franklin Templeton marketing documents, alternative asset classes or hedging products can improve return potential without significantly increasing risk. It describes three possible “buckets” investors can choose from: traditional Equity Beta or “Risk On,” traditional Bond Beta or “Risk Off” and Alpha Alternatives, or “Risk Uncertain.” It said Alternative Assets can also protect client assets during declining equity markets. In addition, Alternatives have “held up well in weak bond markets.”

Green told the Post that the new Franklin Templeton fund gives investors access to three different strategies: the fund will index 50 hedge funds and aim to replicate their returns. On the long/short side, the fund will also identify the most popular stocks that alternative asset managers are buying and take long positions in them while shorting S&P 500 or futures contracts and any individual names it deems unattractive. Thirdly, the fund will target risk premia.

Or, in the language used in the Franklin Templeton press release:

Franklin K2 Alternatives Fund provides access to multiple alternative strategies in an integrated, cost-effective solution, including:

- Hedge fund replication that seeks to replicate the returns of high conviction hedge funds.

- Equity premium alpha that seeks to capture alpha produced by skilled hedge fund managers while shorting crowded hedge fund equities.

- Risk premia that seeks to monetize behavioural and structural market anomalies using a systematic approach.

The fee on the fund is 0.9%

The company added that as market conditions warrant, its K2 Advisors – the fund’s sub-advisor – may implement a conditional risk overlay for risk mitigation, which will act as a hedge against negative market events: Franklin K2 Alternatives Fund will be co-managed by Brooks Ritchey, senior managing director and head of portfolio construction, Rob Christian, senior managing director and head of investment research, and Gordon Nicholson, senior vice president and portfolio manager, K2 Advisors. K2 Advisors provides integrated hedge fund and alternative product solutions covering multiple strategies for institutional and high net worth investors, as well as liquid alternative fund offerings for retail investors worldwide, with more than US$10 billion in assets under management as of December 31, 2018. The Stamford, Connecticut-based office has a global presence and offices in New York, London, Tokyo, Hong Kong and Sydney

I am surprised that you did not take the opportunity to mention that: 1) hedge funds, overall, have had dismal performance for quite a long time, 2) according to Winton, there is “no distinct hedge fund industry”. The “idea that hedge funds represent a clear, separate grouping has never been more dubious.” They go on say that, because of this lack of definition, the hedge fund indices could be poor yardsticks, and 3) it is a well-known fact that, by the time sophisticated strategies reach the general investing public, they are so overused, watered-down, that it is ridiculous to think that paying higher fees for these for a very small part of your portfolio will help your portfolio returns.