My latest MoneySense Retired Money looks in more detail at the National Institute of Ageing’s recent series of papers on CPP (and OAS). As the Hub reported on April 11th, few Canadians are aware that delaying CPP benefits to age 70 can more than double (2.2 times actually) eventual monthly benefits compared to taking it early at age 60. That blog reproduced a chart from the NIA that showed just how much money Canadians are leaving on the table by NOT deferring benefits as long as possible.

My latest MoneySense Retired Money looks in more detail at the National Institute of Ageing’s recent series of papers on CPP (and OAS). As the Hub reported on April 11th, few Canadians are aware that delaying CPP benefits to age 70 can more than double (2.2 times actually) eventual monthly benefits compared to taking it early at age 60. That blog reproduced a chart from the NIA that showed just how much money Canadians are leaving on the table by NOT deferring benefits as long as possible.

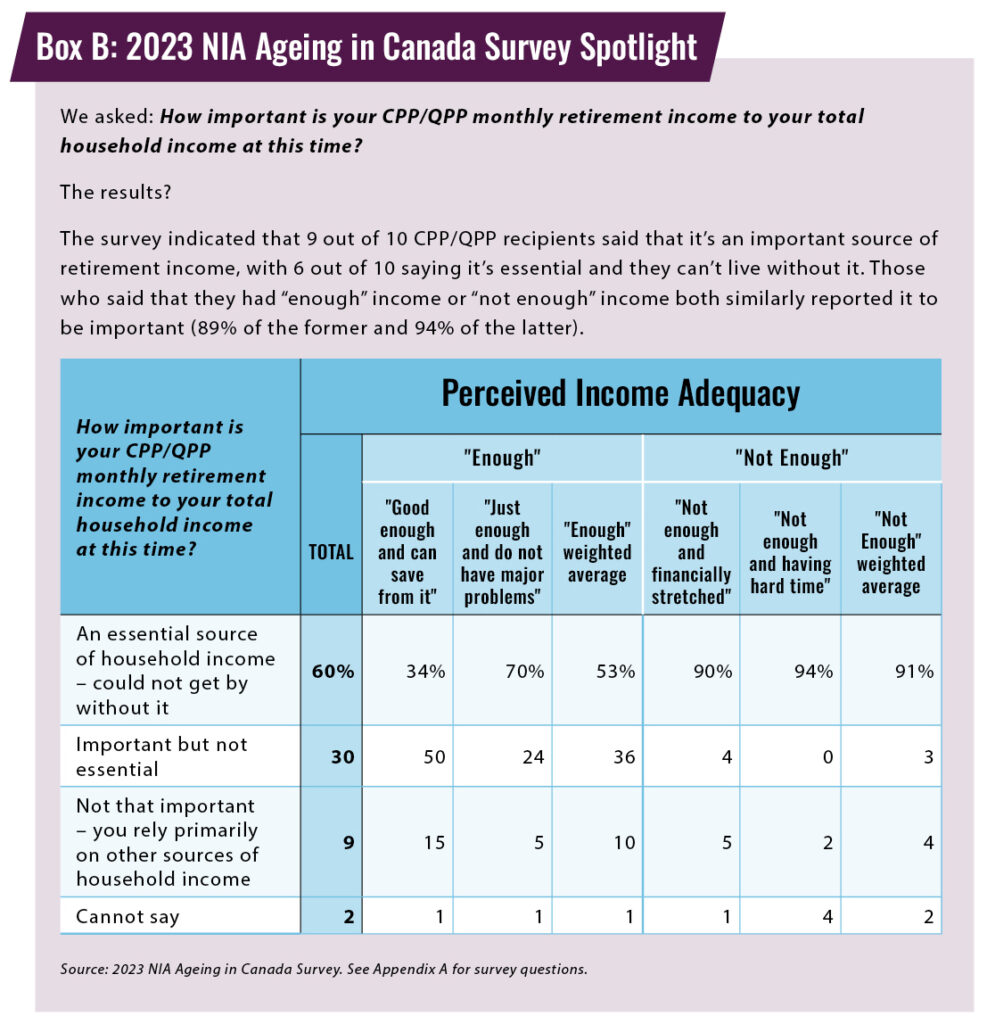

The other major chart from the NIA paper is reproduced above, showing just how important most retirees view the guaranteed inflation-indexed income that CPP and OAS provide. As the new column points out, for many retirees — especially those who worked most of their careers in the private sector and don’t enjoy a Defined Benefit employer pension — CPP and OAS are the closest thing they’ll have to a guaranteed-for-life inflation-indexed annuity.

The new MoneySense column focuses on how delayed CPP benefits not only generate higher absolute amounts of income but also carry with it the important related benefits of more longevity insurance and inflation protection.

You can find the full column by clicking on this highlighted headline: How to double your CPP income.

It features input from several well-known retirement experts, including noted finance professor and author Dr. Moshe Milvevsky, retired Mercer actuary Malcolm Hamilton, author and semi-retired actuary Fred Vettese, TriDelta Senior Financial Planner Matthew Ardrey and the lead author of the NIA report, Bonnie Jean MacDonald.

Delaying CPP is “the best annuity-buying strategy you can implement.”

Milevsky sums it up well, when he says “delaying CPP is the best ‘annuity-buying strategy’ you can implement. Everything else is just Plan B.” Audrey makes a similar point: CPP is “an annuity and an indexed annuity at that … This helps protect the purchasing power of this income stream through retirement. Many people wish they had an indexed DB [defined benefit] pension and in fact we all do. It is the CPP.”

You’ll probably see much more press on this topic as the NIA is releasing a paper each month between May and December. May 8th will be general education on the Canadian retirement income system while July 17th will explain the mechanics of delaying CPP (and QPP) benefits.