It was a few years ago now that my mom came to me and told me about this book I just absolutely had to read.

It was a few years ago now that my mom came to me and told me about this book I just absolutely had to read.

As with most things my mother tells me, I nodded, then continued on as if nothing was said. She gave me a copy of the book but I just put it on my shelf, along with many other parental recommendations that I never quite had the time to pick up and get to.

This past January, though, I was sitting around with my friends and they were all panicking about this book they were reading, and how their lives weren’t where they should be for our age, and how their entire perspective had shifted after reading it. Naturally, I was intrigued. What is this book and why is it so powerful as to elicit such a panic from my friends?

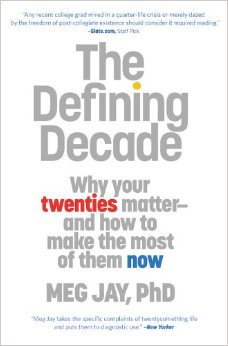

As luck would have it, the book they were discussing was the same book my mother had tried to get me to read years before, and I knew exactly where it was sitting on my shelf. I picked up The Defining Decade as soon as I got home that evening, and didn’t put it down ’til it was done.

‘The Defining Decade’ by Meg Jay, PhD is, as cliché as it may sound, a call to action. Continue Reading…