By Noah Solomon

Special to Financial Independence Hub

Today’s Special: An Inverted Yield Curve with a Side Order of (Possible) Recession

In our discussions with clients over the past several months, the two frequent topics of conversation have been:

- The inversion of the U.S. Treasury curve, and

- The possibility of a recession occurring within the next few quarters.

In the following missive, I use a data-based, historical approach to explore the possible investment implications of these concerns.

How Smart is the Yield Curve?

The U.S. Treasury market has an impressive track record in terms of forecasting recessions. Going back to the late 1980s, every time the yield on 10-year U.S. Treasury bonds has remained below that of its two-year counterpart for at least six months, a recession has followed. Such was the case with the recession of the early 1990s, of the early 2000s, and of the global financial crisis.

When it comes to investing (as with many things), timing is critical. Given that yield curves do occasionally invert and that recessions do happen from time to time, it follows that every recession has been preceded by an inverted curve, and vice-versa. What makes the historical prescience of inverted yield curves so impressive is that the recessions which followed them did so within a relatively short period.

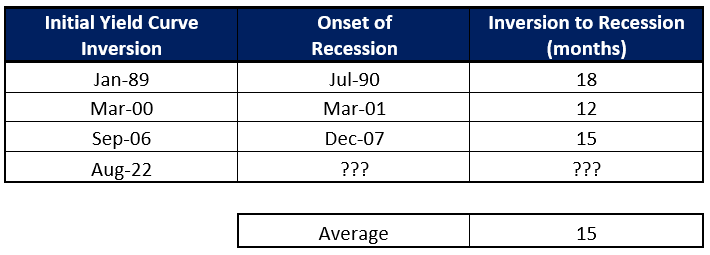

United States – Months from Yield Curve Inversion to Onset of Recession: 1989-Present

The table above covers the past three U.S. recessions, excluding the Covid-induced contraction of 2020, which I have omitted since it had nothing to do with macroeconomic factors, monetary policy, etc. As the table demonstrates, the time lag between yield curve inversions and economic contractions has ranged between 12 and 18 months, with an average of 15 months.

However, the yield curve’s impeccable record of predicting recessions has not been matched by its market timing abilities. As summarized in the following table, the S&P 500 Index has produced mixed results following past inversions in the Treasury curve.

S&P 500 Performance Following Yield Curve Inversions: 1989-Present

When the Treasury curve inverted at the beginning of 1989, stocks proceeded to perform well, returning 24.1% over the following two years. Conversely, when the curve became inverted in March 2000, the S&P 500 fared poorly, losing 21.5% over the same timeframe. The index suffered a similarly undesirable fate following the Treasury curve inversion in September 2006, when stocks suffered a two-year decline of 9.1%.

How Smart is the Stock Market?

In the past, the economy and equity markets have not been correlated. Stock prices are forward looking. Historically, equities have started to decline prior to peaks in economic growth and have tended to rebound in advance of economic recoveries.

The trillion-dollar question is not whether the market is smart, but whether it is smart enough. Do prices bake in a sufficient amount of bad news ahead of time so that they avoid further losses following the onset of recessions? Or do they lack sufficient pessimism to avoid this fate? Frustratingly, the answer depends on the recession!

S&P 500 Performance Following Start of Recessions: 1990-Present

Stocks managed to skate through the recession of the early 1990s unscathed. Following the peak of the economy in mid-1990, the S&P 500 Index went on to produce a total return of 27.2% over the next two years. Unfortunately, investors were not so lucky during the recession of the early 2000s, with stocks losing 24.6% in the two years after the recession began. Similarly, the recession of 2008 was no walk in the park for markets, with the S&P 500 falling 20.3% after the economy began contracting at the end of 2007. Continue Reading…