Apparently, the handover of power from the Conservatives to the Liberals was deemed as more newsworthy this week but we at the Hub did note via a Tweet that our first-year birthday came and went on Wednesday, Nov. 4th. Happy birthday to us!

Apparently, the handover of power from the Conservatives to the Liberals was deemed as more newsworthy this week but we at the Hub did note via a Tweet that our first-year birthday came and went on Wednesday, Nov. 4th. Happy birthday to us!

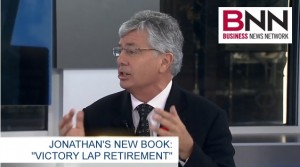

Starting with Mike Drak’s Halloween blog last Saturday, we have revealed that the title of the “Life After Findependence” book we’ve co-authored will be Victory Lap Retirement. The book is now with the editor and should be out in the new year.

There was a “sneak peek” of sorts on Monday on Larry Berman’s Berman’s Call segment on BNN, which you can find at Findependence.TV or clicking on Saving for Retirement in a low-return world. Gee, there’s that word retirement again!

Also, I’ll be providing a more in-depth peek at the book in three presentations entitled From Findependence to Victory Lap Retirement, the first of which is scheduled this Sunday in Vancouver. We go to Calgary on Nov. 22 and Toronto Nov. 29th, all Sunday engagements. You can find details and register for these, as well as other cities and dates, here.

We plan to send out pre-release PDFs of the book next, in order to improve accuracy and possibly generate a few testimonials. If you’re a “media influencer,” feel free to ask for one by emailing me at jonathan@findependencehub.com

By the way, this theme of the Boomers not being ready to stop working in Retirement is also being explored this weekend by the Globe & Mail. See I don’t believe in Retirement: 5 Boomers on why they’re not ready to quit.

New Finance Minister Bill Morneau wrote the book on Retirement