A new report published by the National Institute on Ageing (NIA) and the Global Risk Institute (GRI) being published today aims to help overcome the $1.5-trillion Decumulation Disconnect in the Canadian Retirement Income System.

Titled Affordable Lifetime Pension Income for a Better Tomorrow, the report makes the case for how Dynamic Pension (DP) pools can strengthen retirement income security for millions of Canadian seniors. Here is the link to the full report.

The urgency is apparent when you consider that 10 million Canadian baby boomers are now entering retirement: with longer life expectancies and a greater dependency on private savings to sustain them. As the report’s authors write, “it’s more important than ever to find solutions that will help retiring Canadians turn their accumulated savings into low-cost lifetime pension income.”

Lead author Dr. Bonnie-Jeanne MacDonald, Director of Financial Security Research at the NIA, says fears that retiring Canadians’ savings won’t sustain them in retirement are “legitimate … Financial markets, inflation and health expenses are just some of the big unknowns that retirees will need to face over 10, 20, 30 or even 40 years.”

According to the report, Dynamic Pension [DP henceforth] pools have the potential to transform the Canadian retirement landscape. Their goal is simple: to help people optimize their expected lifetime retirement income while ensuring they never run out of money. In other words, gurantee that they won’t run out of money before they run out of life.

Pooling Longevity Risk

While protecting individuals from outliving their savings (i.e., longevity risk) can be prohibitively expensive, the same protection becomes affordable when spread across a large group. Pooling longevity risk allows retirees to spend their savings more confidently while they are alive, says the report.

In a DP pool, pension amounts are not guaranteed but may fluctuate from year to year. This means retirees can stay invested in capital markets and benefit from the higher expected returns.

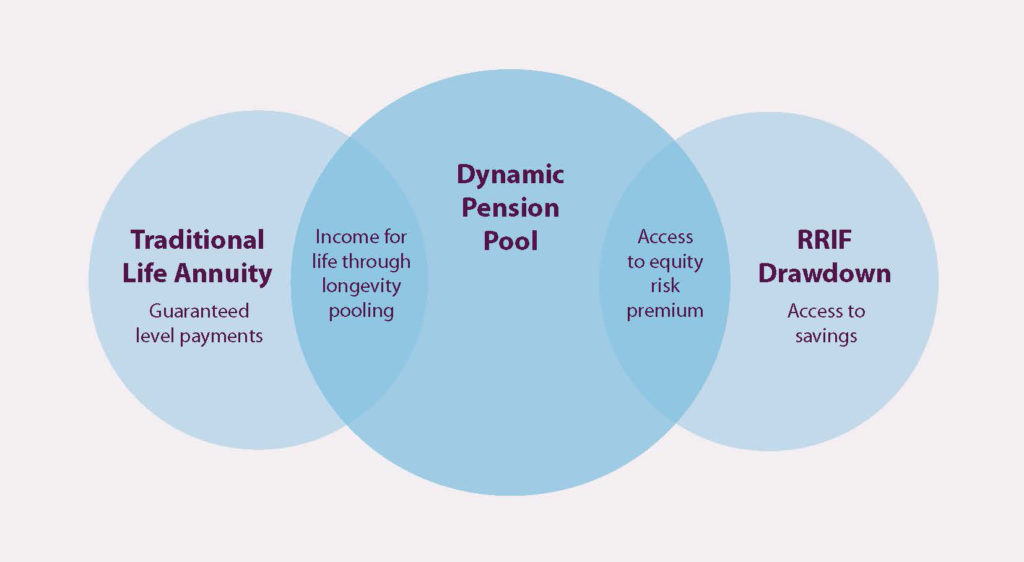

DP pools have a risk-reward profile that is fundamentally different from current options and products available for older Canadians: such as guaranteed annuities purchased through insurance companies or individually managing and drawing down savings from personal retirement savings accounts, says another of the report’s authors, Barbara Sanders, Associate Professor at Simon Fraser University, “Retirees who are comfortable with some investment risk can stay invested in equity markets and reap the associated rewards, which is important in today’s low-interest and high-inflation environment.”

While DP pools are recognized as a powerful decumulation solution in many other ageing countries around the world they aren’t yet broadly available in Canada.

“Turning lifetime savings into lifetime income is more than just a challenge: it’s an impossible task that threatens the financial and emotional security of a growing portion of the Canadian population,” says MacDonald. “DP pools are a proven and viable solution with the potential to improve retirement financial security for millions of retiring Canadians.”

One item in a list of Takeaways says that not only can DP pools protect the financial security of individuals, but they can also “protect the public purse by reducing reliance on income-tested federal and provincial senior social programs.”

The report urges policymakers to adopt a universal DP pool framework for all Canadians regardless of employment history, and that will accept all types of individual registered retirement savings accounts and encourage a broad range of providers.

Backgrounder

• In Canada, there is $1.5 trillion in individual registered retirement saving accounts (RRSP/RRIF, LIRA and DC pension plans) without a satisfactory option for conversion into lifetime retirement income. Only 10% of these assets are in workplace DC pension plan accounts.

• With defined benefit pension coverage continuing to decline in the private sector, Canadians are entering retirement with greater reliance on individual registered savings to finance their golden years. In 2019, two thirds of households nearing retirement held registered savings in individual accounts (RRSP/RRIF, LIRA and DC pension plans), with a median balance of $100,000: a third higher than the median balance two decades ago (in constant dollars).

• The retirement industry and public policy have historically focused on accumulation of retirement savings without adequately addressing the decumulation stage.

The report points out that for most would-be retirees the choice is between purchasing a life annuity from an insurance company — “where the guarantee requires conservative and costly pricing assumptions and, therefore, produces unattractively low levels of pension income” — or moving money into RRIFs.

With RRIFs, significant capital must be put aside to prepare for a longer-than-average lifespan. “Minimum RRIF withdrawals are designed to lead to precipitously declining payouts after age 95; however, there is a one-in-five probability that a 65-year-old Canadian will live beyond that age.”

• Access to efficient lifetime pension income is critical to protect Canadian seniors and their families, the economy and our existing social security systems. A lifetime income stream provides financial independence and peace of mind, removing the burden of managing financial assets when declines in cognitive abilities may impair seniors’ ability to make good financial decisions. Having large levels of savings at advanced ages can also expose them to bad advice or even fraud.

The National Institute on Ageing is a Ryerson University think tank focused on the realities of Canada’s ageing population. The Global Risk Institute (GRI) idefines thought leadership in risk management for the financial industry. GRI brings together leaders from industry, academia, and government to draw actionable insights on risks globally. For more information, visit globalriskinstitute.org.