Hub Blogs

Despite recession fears & inflation, DB pension health improving: Mercer

Things appear to be looking up for members of Defined Benefit [DB] pension plans in Canada, despite inflation and rising fears of a looming recession.

In the third quarter, Canadian defined benefit (DB) pension plans continued to improve, according to the Mercer Pension Health Pulse (MPHP), released on Monday.

The MPHP, which tracks the median solvency ratio of DB pension plans in Mercer’s pension database, finished the third quarter at 125%, up from 119% last quarter. At the beginning of the year, the MPHP was at 113%, as shown in the chart above left.

This strengthening appears somewhat counterintuitive, as pension fund asset returns were mostly negative in the quarter, Mercer said in a news release. Over the quarter, bond yields increased, which decreases DB liabilities. This decrease, along with a fall in the estimated cost of buying annuities, “more than offset the effect of negative asset returns, leading to stronger overall funded positions.”

Plans that use leverage in the fixed-income component of their assets will not have seen this type of improvement, it added.

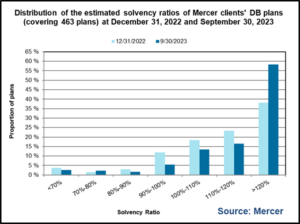

Of plans in its database, at the end of the third quarter 88% were estimated by Mercer to be in surplus positions on a solvency basis (vs. 85% at the end of Q2). About 5% are estimated to have solvency ratios between 90% and 100%, 2% have solvency ratios between 80% and 90%, and 5% are estimated to have solvency ratios less than 80%.

“2023 so far has been good for DB pension plans’ financial positions,” said Ben Ukonga, Principal and leader of Mercer’s Wealth practice in Calgary [pictured on right],” “However, as we enter the fourth quarter, will the good news continue to the end of the year?”

The global economy is still on shaky grounds, Mercer says. “A recession is not completely off the table, despite continued low unemployment rates. Inflation remains high, potentially back on the rise, and outside central banks’ target ranges.”

Geopolitical tensions also remain high, reducing global trade and trust and fragmenting global supply chains – which further reduces global trade. And the war in Ukraine “shows no sign of ending – adding economic uncertainty atop a geo-political and humanitarian crisis.”

Mercer also questions whether recent labour disruptions at U.S. auto manufacturers will be resolved quickly, with Canadian workers expecting large wage increases, leading to further inflationary pressures.

Interest rates may stay at high levels

Mercer also worries that central banks globally may continue to keep benchmark interest rates at elevated levels.

“Given the delayed effect of the impact of interest rate changes on economies, care will be needed by central banks to ensure their adjustments (and quantitative tightening) do not tip the global economy into a deep recession, as the full effects of these actions will not be known immediately. As many market observers now believe, the amount of quantitative easing during the COVID-19 pandemic was more than was needed.”

Most Canadian DB pensions are in favourable financial positions, with many plans in surplus positions, the release says: “Sponsors who filed 2022 year-end valuations will have locked in their contribution requirements for the next few years, with many being in contribution holiday territory (for the first time in a long time).”

Most Canadian DB pensions are in favourable financial positions, with many plans in surplus positions, the release says: “Sponsors who filed 2022 year-end valuations will have locked in their contribution requirements for the next few years, with many being in contribution holiday territory (for the first time in a long time).”

That said, it added, DB plan sponsors should not be complacent: “Markets can be volatile, and given that plans are in surplus positions, now more than ever is the time for action, such as de-risking, pension risk transfers, etc. These actions can now be done at little or no cost to the sponsor.”

Mercer also said DB plan sponsors should “remain cognizant of the passing of Bill C-228, which grants pension plan deficits super priority over other secured creditors during bankruptcy and insolvency proceedings.” Continue Reading…

Managing your Finances after Immigrating to the United States

By Devin Partida

Special to Financial Independence Hub

Every day, the United States welcomes people worldwide who epitomize the American dream. After settling into their new country, many buy homes, launch businesses, become outstanding citizens and live prosperous lives.

However, moving to another country often presents financial challenges. Those new to the U.S. should remember these tips when setting up and managing their assets after immigrating.

1. Open a Spending Account

A spending account will allow you to store your money and make everyday transactions safely, such as clothing or groceries. It may help to see if your bank in your native country has international branches. In that case, you could likely open an account in the U.S. without changing institutions.

TD Bank and RBC Bank are just some of the Canadian financial institutions with U.S. branch offices. If not, many banking institutions simplify opening a new spending account and may even offer some perks.

2. Ask Questions

There is much to know about financial management in a new country. The best way to learn is to reach out for support. Some experts — bankers, accountants and financial advisors — specialize in helping immigrants and will offer guidance on taxes, investing, and other benefits.

Likewise, seeking community organizations or local government agencies to bring yourself up to speed is a good idea. Community groups in particular are an excellent way to connect with other immigrants, and learn with and from one another.

3. Build Credit

Building credit will allow you ample opportunities in your new country: a daunting feat if you’ve established excellent credit in your native country and must start over. Fortunately, some apps allow you to import your previous credit.

Like any U.S. borrower, establishing legal residency and maintaining good credit is crucial for loan eligibility. Lenders require at least two to three years of credit history to qualify. With excellent credit, newcomers can take out a loan to purchase a home, refinance or take out a second mortgage. You can use a second mortgage to pay off credit cards or fund home projects.

4. Set a Budget

Immigrating to the United States can be expensive, with international relocation costs totalling anywhere between $2,000 USD and $10,000 USD. With these and the various expenses that follow, it’s important to create a budget for your relocation.

U.S. goods may cost less or more than your native country. Once you arrive, you’ll have a much better idea of what to expect from your monthly spending. Items you may not consider at first are car and health insurance, or the fees to obtain a driver’s license. Creating a budget by categorizing your spending — food, medical, housing and transportation — will help you determine how much you’ll need to set aside from your paycheck. Continue Reading…

An ETF Strategy with Exposure to High Credit Security and High Monthly Income

Harvest Premium Yield Treasury ETF (HPYT)

By Michael Kovacs, President & CEO of Harvest ETFs

(Sponsor Blog)

Canadian investors have been forced to adapt to aggressive interest rate hikes from the Bank of Canada. This was preceded by a prolonged period of low interest rates that continued since the 2007-2008 Financial Crisis.

Some experts and analysts are projecting that interest rates are at or near the peak of this tightening cycle. In this environment, an optimal investment strategy factors in high interest rates while preparing for the eventual downward move that many analysts expect in 2024 or later. When the period of high interest rates subsides, there may be great potential for capital appreciation and income generation with an investment strategy that captures those benefits/opportunities. That is where the brand new HPYT ETF comes into play!

What is it?

HPYT is an ETF that holds several long-duration US Treasury ETFs and actively manages a covered call write position on those ETFs to generate an attractive monthly income. It has an approximate yield of 15%, representing the highest fixed-income yield in Canada. The approximate yield is an annualized amount comprised of 12 unchanged monthly distributions (the announced distribution of 0.15 cents on Sept. 28 multiplied by 12) as a percentage of the opening market price of $12 on September 28, 2023. Continue Reading…

Retired Money: Time for a Newsletter Purge?

My latest MoneySense Retired Money column suggests that for retirees and semi-retirees like myself, it may be time for a newsletter purge. You can find the full column by clicking on the highlighted text here: Check your inbox: Investing newsletters can cost you more than a sub fee.

The column is a frank confession of some rather painful investment losses sustained the last three years, mostly from recent IPOs or SPACs.

When I asked myself where some of these investment “ideas” came from I realized that almost all of them came from investment newsletters published by various American stock pundits, self-proclaimed or otherwise, including two I mention below.

The worst of these is supposed EV play Lordstown [RIDE], down in my account an astounding 100%, following its recent bankruptcy. And no, I did not renew the newsletter responsible, which I have been persuaded I should not divulge here.

Credit another Letter for tipping me to such losers as Matterport (MTTR/Naqsdaq: down 83% after its recommendation), Zoom (ZM), down 80% and Coinbase (COIN), down a whopping 78%. I won’t name his newsletter as it doesn’t matter: the culprit responsible left some time in 2022, his patience exhausted long before the “Hold with strong hands” patience he recommended for his hapless readers.

When I further asked myself how it came about that I subscribed to these newsletters in the first place, I realized that well more than half were the result of email pitches and — typically — a US$49 per year offer. You know the drill: get 3 or 4 “special reports” that divulge the ticker symbols of these moonshots that are as apt to crash your portfolio as they are the hoped-for 10-baggers.

From a risk management perspective, I tend to invest far less in such speculations (for that’s what they are), compared to blue-chip individual stocks, broadly based ETFs or GICs, but those $1,000 or $1,500 per spec losses do add up. The MoneySense column goes into some detail on the hazards of holding such losers in registered accounts, versus tax-loss selling in taxable ones. [The tax tail often waves the investment dog in both directions.}

Stop biting on initial pitches, then stop renewing

So job one is to stop clicking on those email pitches. Second, do not renew them when they come up for it, typically after a year. Beware automatic renewals: you may have to contact the publishers directly to cancel.

A few exceptions

I don’t want to throw out the baby with the bathwater and it’s only fair to say there may be the odd exception, particularly here in conservative Canada. I have long been on the record for reading and sometimes acting on the recommendations of Patrick McKeough of The Successful Investor and his stable of newsletters like Wall Street Forecaster and Canadian Wealth Advisor. Most of Patrick’s stock picks are well-known blue chips. When he does go further afield with foreigner domestic juniors he identifies them as being riskier and suitable mostly for “aggressive” investors. Fair enough! Incidentally, Patrick kindly allows us to run an article here on the Hub roughly on a monthly basis: you can do worse than act on recommendations like this recent instalment: Use these successful investment strategies for your portfolio success.

I also respect the work of fellow Canadian Gordon Pape, who is a regular writer for the Globe & Mail. For the most part I find the Motley Fool to be decent, although I tend to focus on their free audio podcasts rather than their paid-for newsletters. At one point, in fact, I wrote for them.

Minimize media market noise

The MoneySense column also mentions some related topics, like monitoring cable TV all-news channels that also run stock quotes. We’ve looked before on the Hub about steps to take to avoid investment noise and the Fear of Missing Out (aka FOMO: currently, it’s all about AI). CFA and investment advisor Steve Lowrie, also a Hub contributor, and one who I initially met through the aforementioned Pat McKeough, captured this nicely in this blog: SPACs, NFTs and another Tech-inspired Silly Season. Continue Reading…