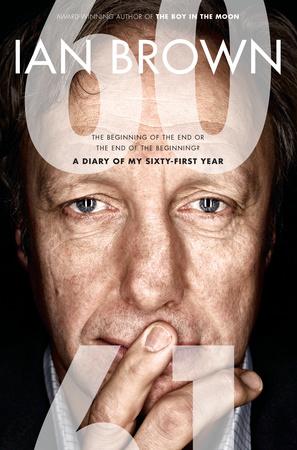

Perhaps it’s because we are contemporaries who went to the same college and are slightly acquainted, but my wife and I thoroughly enjoyed reading Ian Brown’s recently published memoir/diary: Sixty (Random House Canada, 2015).

Perhaps it’s because we are contemporaries who went to the same college and are slightly acquainted, but my wife and I thoroughly enjoyed reading Ian Brown’s recently published memoir/diary: Sixty (Random House Canada, 2015).

While attempting to read some other book, I was constantly interrupted by the laughter Brown induced in my wife. I was soon hooked, in part because some of the names Brown drops were familiar to us.

Sixty started as a Facebook post and a declaration that Brown — a feature writer for the Globe & Mail — would be conducting a diary of his 61st year. It reads more like a personal memoir than a mere day-by-day chronicle of events, although Brown deftly does both.

Not surprising, since Brown is a skilled proponent of what is variously known as creative non-fiction or literary journalism. He has over the years been a literary journalism instructor at the Banff Centre, where we once enjoyed a pleasant dinner with him.

The angst of Boomer envy