Top investment executives told a webinar held Wednesday morning that investors should not mix Politics and Investing. Even so, while market observers at Franklin Templeton view the upcoming U.S. election as essentially a “toss-up” they seem to believe that a victory or sweep by the Republicans’ Donald Trump would be more positive for stocks than a Kamala Harris win.

Grant Bowers, portfolio manager and Senior Vice President for Franklin Equity Group, said “it’s a 50/50 tossup for the presidential winner. Both candidates are well known so it’s not surprising” there’s been little market volatility in the runup to the November 5th election. Generally, he’s bullish no matter the outcome. The economy did well in Trump’s first term while a Harris victory would be a continuation of Biden policies. The real differences are on tariffs, fiscal policy and regulation. “The most likely outcome is a split government” but there would be more volatility if there is a sweep by either party.

Of course, it’s quite possible that investors won’t know the official outcome for several weeks. If the process of counting votes drags on and there are legal challenges like there were in 2020, investors can expect more protracted volatility.

Sonai Desai, Chief Investment Officer for Franklin Templeton Fixed Income said the U.S. economy is set to do “quite well. I agree there’s a reduced probability of Recession: that’s not our baseline for a while.” If there’s a Republican sweep and broader tariffs measures introduced by Trump, “that might limit the Fed’s appetite for massive rate cuts.” Her baseline is that even with a Republican sweep, there won’t be a literal imposition of tariffs: that didn’t happen in 2016, so “I don’t think we will get the full range of cross-the-board tariffs.” Either way, the mighty U.S. consumer will “continue to consume and I don’t see that changing with the Election.”

In the very long run, of course, any short-term market volatility from elections is likely to be a blip, which is why Franklin Templeton tells clients not to mix investing and politics.

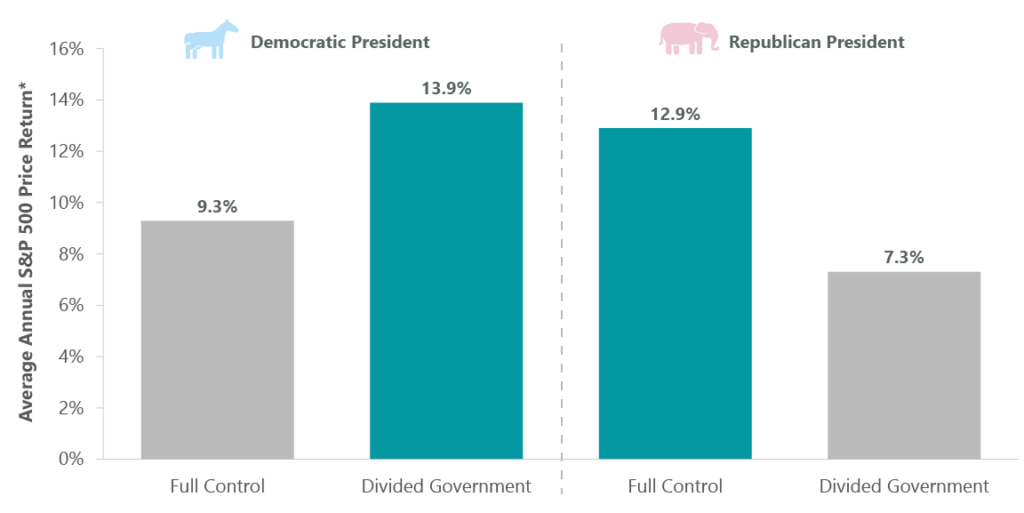

In an analysis released early in October, Clearbridge Investments Head of Economic and Market Strategy Jeffrey Schulze, CFA, showed the following annual returns for the S&P500, all positive for equities no matter which party wins and whether or not they get full control or are in a divided government. Based on that, the best outcomes for investors would be a Democratic president with a Divided Government or Full Control by a Republican president.

“We view a Trump win, likely coming in a sweep scenario, as net positive for equities as it preserves favorable corporate tax treatment and builds on tax elements that expired,” Schulze wrote in the October 1st update, “A Harris win, likely coming with a divided Congress, would be mildly negative due to fewer provisions of expiring tax legislation getting extended due to political gridlock.”

Trump win likely positive for Stocks

“In aggregate, we view a second Trump presidency under a sweep scenario as net positive for equities. The expectation is for a more favorable corporate tax regime and less of a regulatory burden, both of which should boost corporate profits. Conversely, there is the potential for increased tariffs and retaliation from U.S. trade partners … We view U.S. stocks as best placed under Trump, with banks and capital markets, as well as the oil and gas complex, well positioned due to lighter regulation. Aerospace and defense is also likely going to benefit as well as biopharmaceuticals. Areas that could see pressure are restaurants and leisure, due to the less availability of labor, as well as EVs, autos and clean energy producers.”

Harris win might be “mildly negative” for Stocks

A Kamala Harris win would be less positive for U.S. stocks, Schulze writes: “We see a Harris win as mildly negative to equities should she preside over a divided Congress. It will be more of a headwind to the markets should we see a Democratic sweep as she will then be able to implement higher taxes on corporations and high-income individuals, as well as push a more ambitious regulatory agenda. However, tax credits for low-income individuals would provide an offset, creating an economic boost to this segment of the economy.Tighter regulation could weigh on biopharmaceuticals, banks, capital markets, energy as well as mega cap technology. But again, we caution against basing investment or portfolio positioning solely on the regulatory environment. Areas to be bullish about under Harris would be consumer discretionary, specifically restaurants & leisure, home building and building products.”

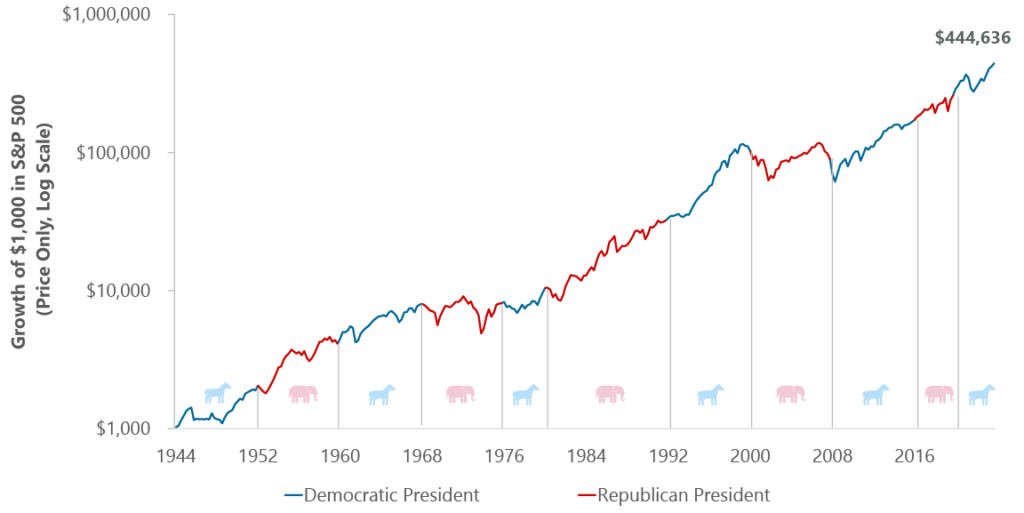

Generally, Franklin Templeton continues to advocate a “stay the course” stance for investors geared to the long term. The chart below shows that going back to 1944, the U.S. stock market has risen steadily over time regardless of which political party is in the White House.

Stephen Dover, chief market strategist and Head of Franklin Templeton Institute, acted as Moderator in Wednesday’s webinar, fielding audience questions. He also wrote a U.S. election update earlier this month, headlined “Uncertainty Reigns.”

He concluded back then that the election remains “too close to call. A divided government in Washington, DC, with no single party controlling the White House, Senate and House of Representatives is likely … Investors should gird themselves for uncertainty and potential bouts of volatility preceding and following election day. It is quite possible that the outcome for the presidency will not be settled until the December 17 certification deadline.”

He concluded back then that the election remains “too close to call. A divided government in Washington, DC, with no single party controlling the White House, Senate and House of Representatives is likely … Investors should gird themselves for uncertainty and potential bouts of volatility preceding and following election day. It is quite possible that the outcome for the presidency will not be settled until the December 17 certification deadline.”

Dover expects market uncertainty to continue well past November 5th, if not until January’s inauguration of the ultimate winner.”Legal challenges, some of which have already commenced, add to uncertainty. Re-counts, delays and disputes over certification of results, alongside courtroom litigation are virtually assured if state election outcomes are close. Various legal and procedural challenges are likely to endure until at least December 17, which is the deadline for state certification of the presidential election results and the official nomination of state electors to the Congressional certification on January 6, 2025.”

However, Dover says his basic investment conclusions remain unchanged. They are as follows: Continue Reading…