By Dale Roberts

Special to Financial Independence Hub

Imagine retiring, and then you have to head back to work, or you cancel your planned trips and greatly curtail your lifestyle. That’s what happened to too many who retired at or near the recesssions created by the dot com crash and the financial crisis. Risk in retirement is perhaps the flipside of risk in the accumulation stage. In the accumulation stage, lower stock prices can be very good. Lower prices in retirement can impair retirement. The equity risk in retirement is called sequence of returns risk. Poor stock market returns early in retirement can create a situation where the portfolio value has decreased, and selling more shares at lower prices might be hazardous to your retirement health. That’s why retirees own bonds, cash and GICs.

I will start off with a few charts that demonstrate the path of a retiree’s portfolio who retired at the start of the dot com crash (late 90s) and the financial crisis (2007-2009).

Here’s the drawdown history in recessions using the U.S. market as an example.

Yes, two of the most recent major corrections were epic and extraordinary. In the dot com crash and the financial crisis, stock markets were down 50%. In the early 2000s U.S. stock markets were down 3 years in a row.

The “average” decline in a recession is close to 25%. But as we know, average rarely happens when it comes to investing and stock markets.

The dot com crash retirement scenario

In the following scenario the retiree has a C$1,000,000 portfolio and spends 4.2% of the portfolio value in year one. The $1,000,000 creates $42,000 of income. The spending rate then increases, adjusted for inflation. If inflation is 3%, the retiree gets a 3% raise.

The portfolio is 50% U.S. stocks and 50% global.

We can see that it was “over” quickly for the equity portfolio in this scenario. Even the strong market returns from 2003 to 2008 could not bring the portfolio back to health. In late 2007 the portfolio value was $870,000 but the spend rate would have been considerable. We have a portfolio value much lower than $1,000,000 and the amount taken out of the portfolio has increased at the rate of inflation. It is a dead portfolio walking, even in 2007. The financial crisis essentially finished it off, and was limping through the 2010s. 2024 would be its final year.

Unfortunate start date

The retiree was a victim of bad luck. They strolled into a very unfortunate start date – at the beginning of a recession and a severe stock market correction.

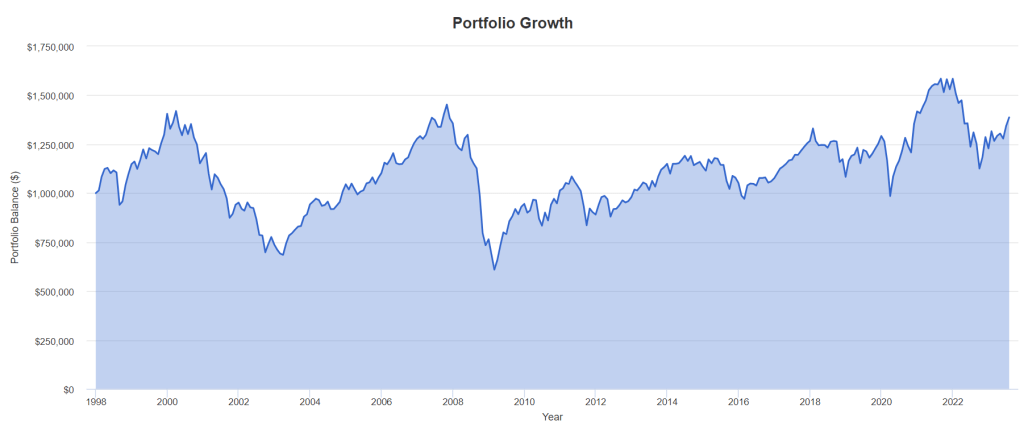

Let’s head back two years to see what happens to a retiree who retired in 1998.

What a difference two years makes. That said, I would suggest that the portfolio was impaired in 2003 and 2008. It was outrageous stock market gains that brought the portfolio back to the land of the living. There is no guarantee that after 40% and 50% portfolio declines that 30% and 20% annual stock market gains will ride to the rescue.

It’s also likely that a retiree who has watched 30% to 40% of their portfolio value disappear is not comfortable keeping up the spend rate. They have cancelled trips, dinners, gifting and more. They might have self-imposed retirement withdrawal.

Risk is different and feels different in retirement.

That self-imposed retirement withdrawal may have occurred during the financial crisis as well.

Who is going to keep the spend rate when the portfolio is down over 50%? I’d suggest no one. And I’d count that as a retirement failure, having to change your retirement plans.

Are you feeling lucky?

Now, let’s give the retiree a very fortunate start date. 1991.

The portfolio never sees new lows. And obvioulsy, the retiree could have treated themself to a much higher spend rate of 4.2% inflation-adjusted. That’s called a variable withdrawal strategy. You spend more when times are very good. And you spend less during recessions. More on that later. Continue Reading…