Harvest ETFs CIO explains that as markets take a breather, the healthcare sector continues to show defensive characteristics with exposure to growth prospects

By Paul MacDonald, CIO, Harvest ETFs

(Sponsor Content)

US large-cap healthcare has been a bastion for investors in an otherwise rough market. While not fully insulated from the broad sell-off we’ve seen in recent months, the sector has outperformed due to stable demand, high margins and relatively low commodity price exposure. The Harvest Healthcare Leaders Income ETF (HHL:TSX) combines a portfolio of diversified large-cap healthcare companies with an active covered call strategy to generate consistent monthly cash distributions. The portfolio’s defensive positions, plus its income payments, has resulted in significant outperformance of broader markets.

In the wake of July earnings data, however, we saw some relief come to the broader markets as companies across sectors reported largely in line with expectations, providing much-needed visibility. As markets breathed a sigh of relief, growth-oriented sectors like tech started to pare back losses from earlier in the year. While the healthcare sector has shown its reputation for defensiveness in recent months, we are also seeing that the sector’s growth tailwinds are making a greater impact.

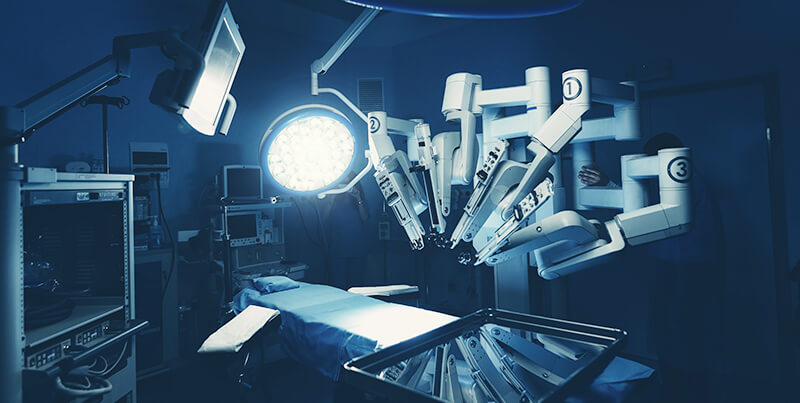

This whole space is innovative: whether that’s a company leading the way on robotic-assisted surgery, or a huge established player like Eli Lily making strides in obesity medication. Healthcare companies have significant growth tailwinds and, in our most recent rebalance of HHL we’ve taken some steps to capture more of those growth prospects.

Positioning HHL for growth prospects

We would stress that the recent rebalance in HHL maintained the ETF’s commitment to subsector and style diversification within the healthcare sector. However, some of the new additions to HHL have positioned the portfolio for greater growth opportunity.

The first move was replacing Agilent Technologies with Danaher in the portfolio holdings. Both companies focus on life sciences, tools & diagnostics, but Danaher has a more diverse line of businesses and a larger market share, which in our experience better positions Danaher for any potential market recovery.

The second move in the rebalance was to remove HCA Healthcare Inc, a value position which had shown worsening earnings visibility and rising costs due to labour issues and add Intuitive Surgical. Intuitive Surgical is the market leader in robotic-assisted surgery, with technology almost a decade ahead of its closest competitor. The robotic-assisted surgery market is currently underpenetrated, and a number of companies are making strides in the space: including Stryker, another HHL portfolio holding. The addition of Intuitive Surgical positions HHL to better participate in that subsector’s growth prospects.

While moves like these are designed to position HHL for improved growth prospects, we should emphasize that the whole portfolio is designed for diversified exposure to the growth opportunities and defensive characteristics inherent in the healthcare sector.

Maintaining defense while capturing growth opportunity

It’s ironic. We can easily think of specific investment sectors as a value-growth binary, trading off one for the other. But the healthcare sector isn’t so simple. Some of the largest companies in this sector have incredible growth prospects due to innovations in treatments, pharmaceuticals, and patient service. At the same time, given the large-cap focus we take in HHL, even our more growth-oriented names have market shares and barriers to entry that can be seen as highly defensive.

Those characteristics have shown themselves throughout 2022, as low commodity price exposures and high margins kept the sector in a state of outperformance. HHL is also one of the 6 Harvest ETFs held in the Harvest Diversified Monthly Income ETF (HDIF:TSX), where it contributes to the overall defensive position of that core portfolio.

There are also two aspects of HHL that beef up its defensive traits: diversification and covered calls. Continue Reading…