By Dale Roberts, cutthecrapinvesting

Special to the Financial Independence Hub

It’s possible that the game has been changed for the better, for Canadian retirees. Purpose Investments has launched a retirement funding mutual fund that is designed to deliver an annual payout at 6.15% annual. That is, the fund would pay out a minimum of 6.15% of your initial total fund value. For every $100,000 that you have invested, you would receive an annual payment $6,150. Introducing the Purpose Longevity® Pension Fund.

The Purpose Longevity Pension Fund offers the pension model, now available to the typical investor. Advisors will also be able to use the fund and will collect a modest trailing commission. For many Canadian retirees it will certainly be a game changer.

Income for life.

One of the greatest fears for retirees is running out of money. And most retirees don’t want to manage their own investments. They want to enjoy life, without financial worry. The Purpose Longevity Pension Fund will allow Canadians to top up their Canada Pension Plan and Old Age Security payments. Retirees may have other private pensions and other assets within the mix. The fund will allow a retiree to pensionize a large percentage of their liquid assets. They approach would remove much of the stock and bond market (volatility) risk.

And more importantly perhaps, it would remove the risk of investors messing up their retirement portfolio (and retirement funding) by way of bad behaviour.

Related post: Pensionize your nest egg with annuities: your super bonds.

The Purpose fund sits between the Vanguard VRIF ETF retirement funding solution and the traditional annuities. The Vanguard ETF is designed to pay out at a 4% rate of the portfolio value, adjusted each year.

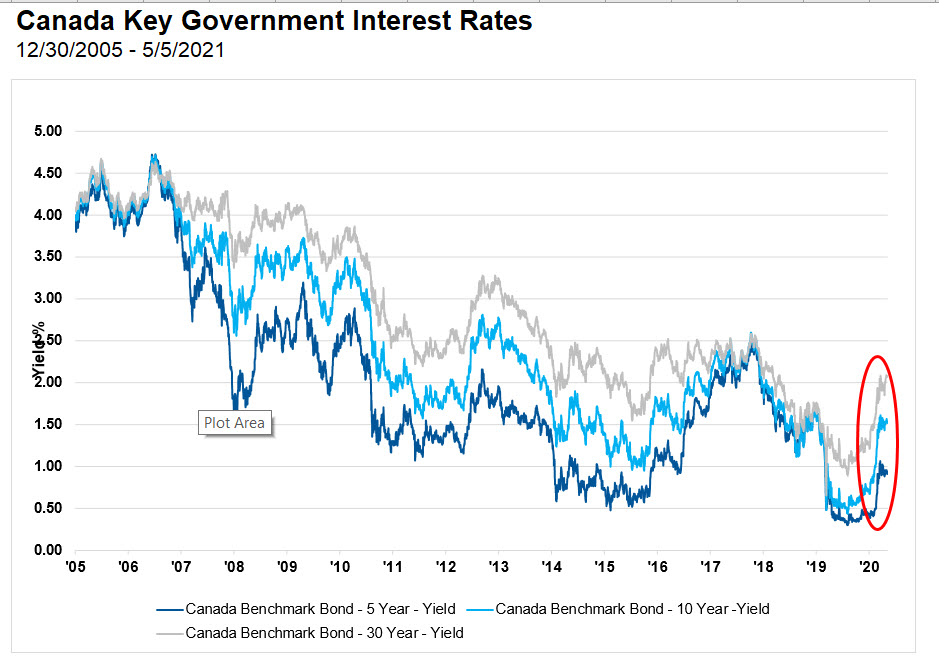

An annual 6.15% payment (at age 65) is a big step up the retirement funding ladder.

When a retiree manages their own investment portfolio they will often use the 4% rule as a benchmark for the level that the portfolio can safely deliver retirement income, including an annual inflation adjustment. On Boomer and Echo I had offered …

The 4% rule. Is there a new normal for Canadian Retirees?

Everything changes in the decumulation stage.

Life changes and priorities change when we switch to the retirement or decumulation stage. Retirees just want to get paid.

Canadian retirees are not necessarily well served by the financial institutions in the retirement stage.

The pension model for the masses.

How does a fund pay out at a 6.15% rate (and potentially to increase) while studies show that a balanced or conservative investment mix can only ‘safely’ pay out at a 4%-4.5% level? Once again it follows the model used by pension funds (public and private) around the world.

I asked Som Seif, CEO of Purpose Investments to deliver an explanation.

It is based on what they call Longevity Risk Pooling. The difference between the required return on the fund (net 3.5%) and the income paid to investors (6.15%+) is because when people buy, they get their income, but as some people redeem/pass away earlier, they leave behind in the pool their returns on their invested capital (ie they get their unpaid capital out upon death or redemption). These returns left behind reduce the total return required to provide the income stream for all investors.

Som Seif

It is the pooling of funds by the collective group of investors that will hold the fund, that delivers the secret sauce. There is retirement funding strength in numbers.

This is called Longevity Risk Pooling (or Sharing).

And as per the above quote, the underlying fund holdings only have to deliver at an annual 3.5% rate of return for the Purpose Longevity Pension Fund to deliver on the 6.15% funding level. Here’s ‘the how’ …

If you put in $500,000. After a number of years you receive distributions of $200,000, but then you pass away. Your estate would receive the unpaid capital of $300,000 ($500k-$200k). The return on the invested capital would stay in the pool for the benefit of all of the investors remaining. This return would reduce the overall required return for everyone.

Som Seif

The approach as been back tested.

Morneau Shepell conducted extreme stress testing on the model, which included the use of their economic scenario generator (ESG) that produced over 2,000 different simulations of future paths of economies and financial markets.

Probability of success (i.e. not having to decrease the income payout):

- Over a 25 year period: 91%

- Over a 35 year period: 86%

Purpose Investments can reduce income levels to ensure that the assets are never depleted and that income payments can continue to unitholders for their lifetime.

Net, net, the payments could move higher or lower. The risk will be managed, while any benefits offered by the markets will be passed along to investors.

The fund series.

There will also be a D-series available for self-directed investors.

The game changers combo offering.

On MoneySense and when we put together the Best ETFs in Canada, we often refer to the one ticket asset allocation ETFs as game changers. For use in the accumulation stage (wealth building) Canadian investors can hold comprehensive all-in-one portfolio ETFs with fees in the range of 0.20%.

And now enter the Purpose Longevity Pension Fund that might turn out to be the next piece in the game changing investment landscape.

- Accumulation: one ticket

- Decumulation: personal pension mutual fund

I’ll continue to do more research and I’ll add to this post. And I would invite reader questions. What do you want to know about this new offering?

I’ll get you the answers and I’ll add the responses to this post.

Thanks for reading. We’ll see you in the comment section.

Support your portfolio and Cut The Crap Investing.

While I do not accept monies for feature blog posts please click here on the mission and ‘how I might get paid’ disclosures. Affiliate partnerships help me pay the bills for this site. That will allow me to keep this site free of ads and easy to read.

You will also earn a break on fees by way of many of those partnership links.

I also have partnerships with several of the leading Canadian Robo Advisors such as Justwealth, BMO Smartfolio ,Wealthsimple, Nest Wealth and Questwealth from Questrade.

Consider Justwealth for RESP accounts. That is THE option in Canada.

At Questrade, Canadians can buy ETFs for free.

I use and I’m a big fan of the no fee Tangerine Cash Back Credit Card. We make about $55 per month in cash back on everyday spending.

Make your cash work a lot harder at EQ Bank. RRSP and TFSA account savings rates are at 1.3%.

Kindly use the buttons below to share this post.

Dale

Dale Roberts is the Chief Disruptor at cutthecrapinvesting.com. A former ad guy and investment advisor, Dale now helps Canadians say goodbye to paying some of the highest investment fees in the world. This blog originally appeared on Dale’s site June 1, 2021 and is republished on the Hub with his permission.

Dale Roberts is the Chief Disruptor at cutthecrapinvesting.com. A former ad guy and investment advisor, Dale now helps Canadians say goodbye to paying some of the highest investment fees in the world. This blog originally appeared on Dale’s site June 1, 2021 and is republished on the Hub with his permission.