By Veronica Baxter

Special to the Financial Independence Hub

If you are looking to get serious about real estate investing, then a multifamily commercial real estate investment offers you a great ROI, portfolio diversity, and strong growth potential. But, before we get too far ahead, what exactly is a multifamily property?

What is a Multifamily Property?

In the commercial real estate sector, a multifamily property is an apartment building that has five or more units. According to this definition, multifamily properties are very diverse. They can include everything from towering apartment complexes to city rowhomes converted by property developers.

Because there is a wide range of property types that can be designated as multifamily property, many smaller investors with less capital than large investment conglomerates can potentially reap some of the benefits.

Later on in the post, we will discuss three methods investors use to invest in real estate, but it helps to mention them here to show that even smaller investors can get in on the lucrative returns of real estate. Investors can directly purchase the property or pool their capital with other investors in a real estate investment trust or private equity firm.

Opportunities for both Passive and Active Investors

Another benefit of investing in multifamily commercial real estate is that it is profitable whether or not you are an active or passive investor. As the names imply, active and passive investors assume opposite engagement roles with their investments. Though there is plenty of nuance and overlap between the two, in general, passive investors are in it for the long haul. They plan to hold on to the property for as long as possible. In contrast, active investors see multifamily property as an opportunity to buy cheap, renovate and sell at a higher price.

For Passive Investors

Passive investors often leave the property management and financial management to other parties, which truly embodies the idea of passive income. Many of these investors receive only quarterly disbursements from the portfolio manager and have little else to do with the procedural technicalities. Passive investors, in this sense, only really front the initial investment and reap the rewards.

This passive strategy has been shown to be less risky over time and, as a result, more lucrative. In addition, passive investors see multifamily commercial real estate investments as tangible assets to grow their wealth in.

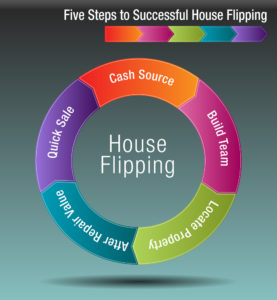

For Active Investors

Active investors search the markets for opportunistic buys. For example, they often look for cheaper, older property to renovate and refurbish into more expensive multifamily property. Then, after the flip, they either sell for a much higher price or hold if the asset is projected to appreciate rapidly. In general, active investors take more risks than passive investors, but when they strike gold, the profits come fast.

They are much more hands-on in their approach, working alongside developers, contractors, and designers to upgrade older properties. As a result, they must know the commercial real estate process and terminologies, such as NOI, commercial real estate cap rate, and other terms.

Benefits of Multifamily Commercial Real Estate Investing

Whether you seek to become an active or a passive investor, there are numerous benefits to multifamily real estate investing. Here are a few of the advantages:

Diversification

Having a diverse investment portfolio helps to mitigate the risks associated with economic downturns. Generally, commercial real estate is not highly correlated with the movement of the stock market, so it is an ideal asset class to hold opposite of stocks. Moreover, having wealth invested across various assets is the surest way to reduce risks if the stock market crashes or in lieu of a natural disaster that disrupts the global markets.

“Forced” Appreciation

Commercial property is valued on NOI, or net operating income, whereas residential real estate is usually valued on comparisons with other similar properties. NOI valuations allow property managers to directly increase the value of their property by raising rent and reducing operation costs. This alters the NOI equation, which, in turn, raises the value of their property. This is called forced appreciation.

Dispersion of Vacancy Risk

The more units in a property, the less any one vacancy will affect revenue. This is one significant benefit to investing in a multifamily property. If you rent out your residential property, you are solely dependent on your tenant for income. However, the more tenants you have, the less impactful a single vacancy will be. Multifamily property investments reduce the risks associated with numerous vacancies.

Lease Escalations

It is common practice for commercial leases to have escalation clauses built into them. These clauses stipulate rent increases over time. If operational costs generally remain stable, then the yearly ROI increases with the periodic rent increases.

What are different ways to Invest?

As mentioned above, there are three main ways investors can invest their capital in multifamily real estate. These different methods allow both large and small investors to get a stake in commercial property.

Direct Purchase

A direct purchase involves an investor or group of investors coming together to purchase commercial property directly. They usually form an LLC for liability purposes and have total control over the process. This freedom comes with a cost, however. The investors are responsible for finding a property, raising capital, and negotiating a deal. Once purchased, the investors are then entirely responsible for managing the property, drawing up leases, and outreaching to potential tenants.

This is a very involved route. For new investors looking to diversify their investment portfolio, this might not be the best place to start.

Real Estate Investment Trusts

Real estate investment trusts (REITs) are corporations that perform the above functions of a direct purchaser but as a corporate entity. Investors buy shares or stocks in the corporation, which can be publicly or privately traded. Continue Reading…