By David Miller, CFP, RFP

By David Miller, CFP, RFP

Special to the Financial Independence Hub

Real estate can be a differentiator in a diversified investment portfolio. But when you watch the pundits in the media and certain TV network shows, as seen on HGTV, buying, flipping or renting a property seems like a sure way to increase your income or get rich quick. As glamourous as it seems when you take a sledgehammer to a useless wall to ‘open up the space’, the reality of making it a marketable investment is often much more daunting. What really is daunting is the sheer number of options you have when it comes to investing in real estate, and the obvious question is:

Does it make financial sense to add real estate to your portfolio?

The Positives

Real Estate does make sense in most investment portfolios but let us back up a little bit here and provide some context:

What are the primary reasons people choose real estate as an investment?

There is something reassuring about investing in real estate, as in the case of owning a rental property. You own a tangible asset and you may feel like you can see the value and the risks just by walking through the property. You may own your home, and assuming you are mortgage free, brings an incredible feeling of security and freedom.

Real estate investing can offer a stable, reoccurring income; after all, ‘who doesn’t pay their mortgage or rent?’ It also carries a fairly high certainty of a higher value over the long term; after all, “they are not making more land” (unless you’re in the South China Sea or Dubai). These are two common positive arguments.

If you look specifically at Canada, there can be times when your rate of return can be incredibly high. We experienced this with Calgary’s real estate boom from 2005-2007. The Greater Toronto Area and Greater Vancouver area from 2015-2018 have seen incredibly high growth and price increases that have been covered extensively through the media.

Real estate investing provides an interesting option that is not directly tied to overall stock market risk, which can provide you with increased diversification. Whether the stock market goes up or down, your real estate price may move independently.

The wealthy endowment funds, private pensions, institutional money and the Canada Pension Plan invest heavily in real estate, private equity and infrastructure projects that average Canadian investors either don’t know about, can’t invest or don’t invest into.

To summarize, the benefits of a real estate investment are that it is a tangible, generally stable income producing, ‘always goes up’ investment and offers other benefits not seen in the stock market. Ready to jump in with both feet? Not so fast. There are some serious pitfalls to understand and multiple options to choose from.

How can I invest into real estate?

- Buy a rental property (putting at least 20% down)

- Buy a commercial building

- Real Estate Investment Trusts (REITs)

- Exchange Traded Funds (ETFs) of REITs

- Mutual funds specializing in real estate

- Private equity or debt (Mortgage pools/investment corps)

Primary Issues

Price Risk

Can real estate values fluctuate? The real answer is yes. Nationally, Canadian housing prices reduced by 4.9% on average in 2018, the worst performance since the 2008 financial crisis. Toronto and Vancouver skew the average price to high side, but even they are starting to fall off their 2017/18 highs and there are obvious concerns of a bubble bursting.

Prices for real estate are difficult to gauge as every property is different and value is in the eye of the beholder. To sell your property, you likely need to employ a realtor to get a starting price and you need to find someone else who agrees on the price to buy. Real estate negotiations can go awry quickly, which causes further delays regarding the liquidity. For this service, there is a sales cost paid to the realtor, usually 7% of the first 100,000 and 3% after, although this can be sometimes negotiated.

In an example of how poor the Calgary commercial real estate market is; this*is an article that explains how the city of Calgary is losing over $300 million in tax revenue every year as downtown core commercial property values have decreased by a collective $12 billion. This is an example of how real estate values can fluctuate to the downside and how unstable a source of income a real estate investment could be.

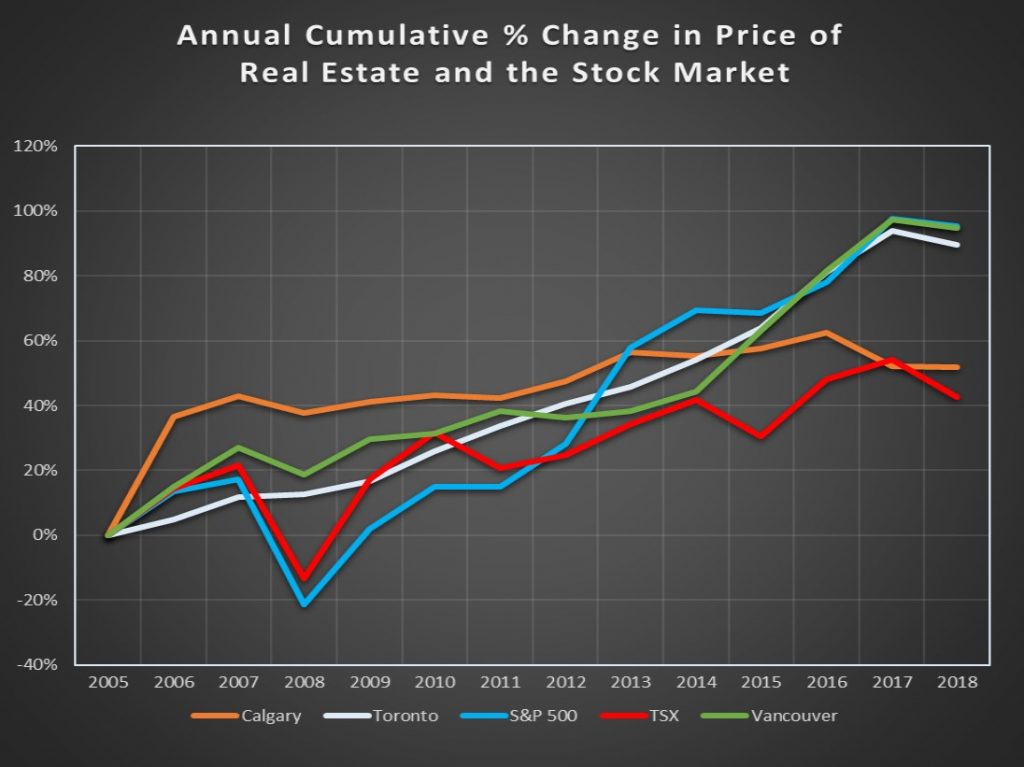

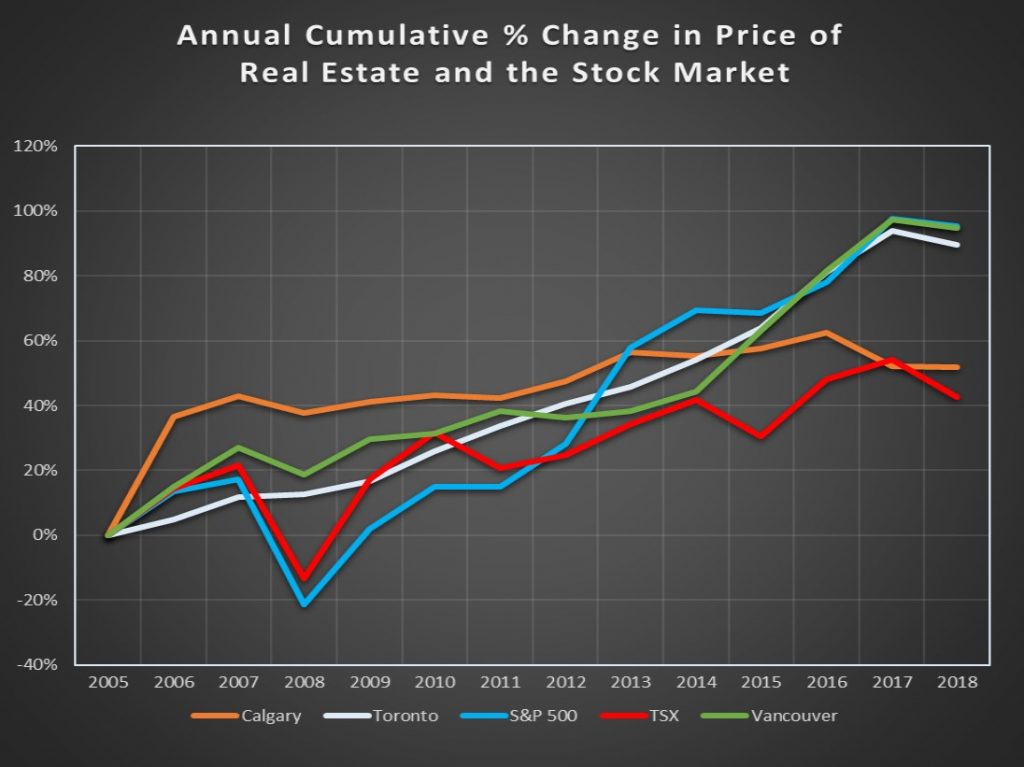

See the chart below for the relative volatility of the selected Calgary, Toronto and Vancouver markets when compared with the US Equity and Canadian Equity markets. While the annual volatility in the S&P 500 and TSX has been much higher relatively, this chart shows that you could lose out if you sell your real estate holding at the wrong time or pick the wrong city or neighbourhood to invest in.

Calgary data via CREB Monthly Average Sale Price “Attached, Detached, Apartment”, Jan 2005 to Dec 2018. Vancouver Data via CREA.ca HPI Tool Greater Vancouver Composite historical price data Jan 2005 to Dec 2018. Toronto Data via CREA.ca HPI Tool Greater Toronto Composite historical price data Jan 2005 to Dec 2018. TSX data via tmxmoney.com price history. S&P 500 data via http://www.multpl.com/s-p-500-historical-prices/table/by-year. The chart above only looks at price change and does not factor the effects of leveraging or reinvestment of interest or dividends.

Liquidity Risk

Liquidity refers to how quickly you can get your money out if you change your mind about your investment. Are you prepared to invest money into a residence only to find out it’s a money pit? What happens when you struggle to sell it when the market turns, and you could really use the extra money for something else? What if there is an emergency and you need those funds and there is no liquidity? If you are buying a stock or ETF on a major open market, the level of liquidity can be measured in volume of shares bought or sold and shares usually change hands instantaneously. While investing in stocks should be a long-term investment, at least you have the option to get out at any time almost instantly. The same is generally true in real estate; however, the liquidity premium is significantly higher. Continue Reading…

By Penelope Graham, Zoocasa

By Penelope Graham, Zoocasa