Special to the Financial Independence Hub

Real estate can be a differentiator in a diversified investment portfolio. But when you watch the pundits in the media and certain TV network shows, as seen on HGTV, buying, flipping or renting a property seems like a sure way to increase your income or get rich quick. As glamourous as it seems when you take a sledgehammer to a useless wall to ‘open up the space’, the reality of making it a marketable investment is often much more daunting. What really is daunting is the sheer number of options you have when it comes to investing in real estate, and the obvious question is:

Does it make financial sense to add real estate to your portfolio?

The Positives

Real Estate does make sense in most investment portfolios but let us back up a little bit here and provide some context:

What are the primary reasons people choose real estate as an investment?

There is something reassuring about investing in real estate, as in the case of owning a rental property. You own a tangible asset and you may feel like you can see the value and the risks just by walking through the property. You may own your home, and assuming you are mortgage free, brings an incredible feeling of security and freedom.

Real estate investing can offer a stable, reoccurring income; after all, ‘who doesn’t pay their mortgage or rent?’ It also carries a fairly high certainty of a higher value over the long term; after all, “they are not making more land” (unless you’re in the South China Sea or Dubai). These are two common positive arguments.

If you look specifically at Canada, there can be times when your rate of return can be incredibly high. We experienced this with Calgary’s real estate boom from 2005-2007. The Greater Toronto Area and Greater Vancouver area from 2015-2018 have seen incredibly high growth and price increases that have been covered extensively through the media.

Real estate investing provides an interesting option that is not directly tied to overall stock market risk, which can provide you with increased diversification. Whether the stock market goes up or down, your real estate price may move independently.

The wealthy endowment funds, private pensions, institutional money and the Canada Pension Plan invest heavily in real estate, private equity and infrastructure projects that average Canadian investors either don’t know about, can’t invest or don’t invest into.

To summarize, the benefits of a real estate investment are that it is a tangible, generally stable income producing, ‘always goes up’ investment and offers other benefits not seen in the stock market. Ready to jump in with both feet? Not so fast. There are some serious pitfalls to understand and multiple options to choose from.

How can I invest into real estate?

- Buy a rental property (putting at least 20% down)

- Buy a commercial building

- Real Estate Investment Trusts (REITs)

- Exchange Traded Funds (ETFs) of REITs

- Mutual funds specializing in real estate

- Private equity or debt (Mortgage pools/investment corps)

Primary Issues

Price Risk

Can real estate values fluctuate? The real answer is yes. Nationally, Canadian housing prices reduced by 4.9% on average in 2018, the worst performance since the 2008 financial crisis. Toronto and Vancouver skew the average price to high side, but even they are starting to fall off their 2017/18 highs and there are obvious concerns of a bubble bursting.

Prices for real estate are difficult to gauge as every property is different and value is in the eye of the beholder. To sell your property, you likely need to employ a realtor to get a starting price and you need to find someone else who agrees on the price to buy. Real estate negotiations can go awry quickly, which causes further delays regarding the liquidity. For this service, there is a sales cost paid to the realtor, usually 7% of the first 100,000 and 3% after, although this can be sometimes negotiated.

In an example of how poor the Calgary commercial real estate market is; this*is an article that explains how the city of Calgary is losing over $300 million in tax revenue every year as downtown core commercial property values have decreased by a collective $12 billion. This is an example of how real estate values can fluctuate to the downside and how unstable a source of income a real estate investment could be.

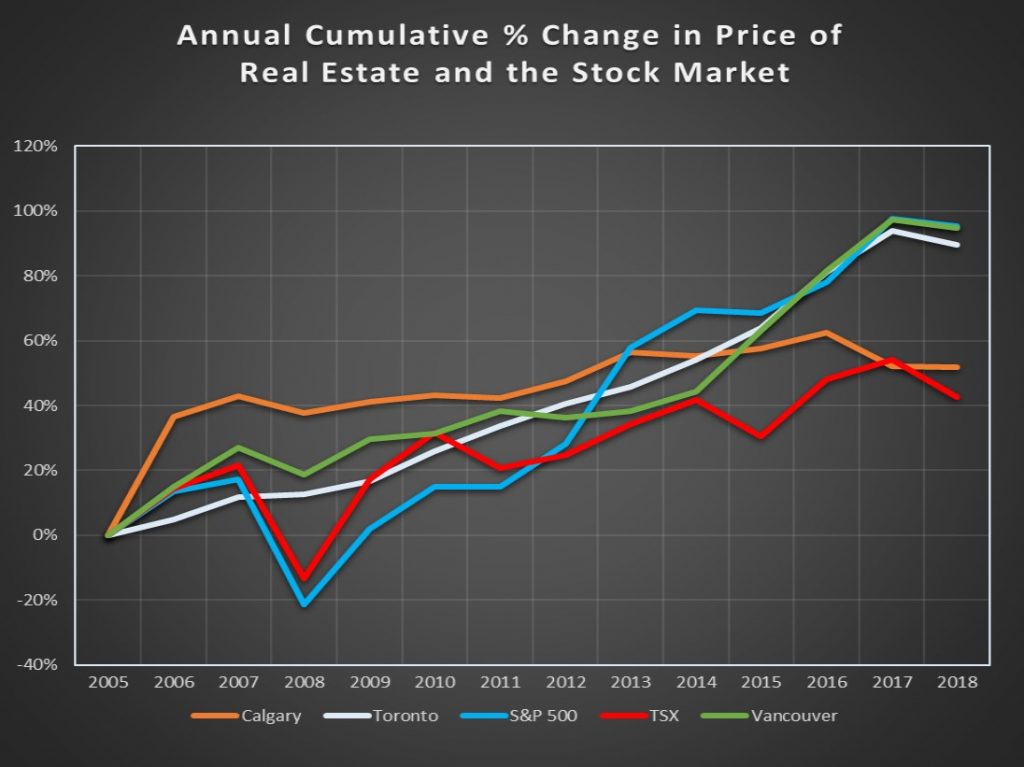

See the chart below for the relative volatility of the selected Calgary, Toronto and Vancouver markets when compared with the US Equity and Canadian Equity markets. While the annual volatility in the S&P 500 and TSX has been much higher relatively, this chart shows that you could lose out if you sell your real estate holding at the wrong time or pick the wrong city or neighbourhood to invest in.

Calgary data via CREB Monthly Average Sale Price “Attached, Detached, Apartment”, Jan 2005 to Dec 2018. Vancouver Data via CREA.ca HPI Tool Greater Vancouver Composite historical price data Jan 2005 to Dec 2018. Toronto Data via CREA.ca HPI Tool Greater Toronto Composite historical price data Jan 2005 to Dec 2018. TSX data via tmxmoney.com price history. S&P 500 data via http://www.multpl.com/s-p-500-historical-prices/table/by-year. The chart above only looks at price change and does not factor the effects of leveraging or reinvestment of interest or dividends.

Liquidity Risk

Liquidity refers to how quickly you can get your money out if you change your mind about your investment. Are you prepared to invest money into a residence only to find out it’s a money pit? What happens when you struggle to sell it when the market turns, and you could really use the extra money for something else? What if there is an emergency and you need those funds and there is no liquidity? If you are buying a stock or ETF on a major open market, the level of liquidity can be measured in volume of shares bought or sold and shares usually change hands instantaneously. While investing in stocks should be a long-term investment, at least you have the option to get out at any time almost instantly. The same is generally true in real estate; however, the liquidity premium is significantly higher.

Other real estate deals, such as private offerings or commercial properties also have serious liquidity issues. With some private offerings, you can only redeem your funds once a month or may be locked in for years.

With REITs and ETFs, liquidity is generally not an issue as they are bought and sold on the open stock market with high volume.

Interest rate risks

As of the date of this article, the Canadian government has paused on its goal to raise interest rates, at least in the short term, back to ‘normal’ historical levels. Starting in the middle of 2017, we have seen the Bank of Canada make five separate decisions to increase rates by 0.25% (25 basis points). I.e. Variable rate mortgages and loans are now 1.25% higher than they were a couple of years ago. Fixed rate mortgages are also higher. All of this creates a unique risk for people that have mortgages coming up for renewal.

Some people will see their mortgage payment renew at a cost higher than they can afford. Some landlords will be forced to increase rent to deal with the increased interest payments. Some tenants won’t be able to afford the rent payments and look for cheaper accommodations. Some first-time homebuyers will be priced out of the market as they can’t afford the mortgage payments and may buy something a bit smaller than they originally wanted, or they might just wait. On top of the higher interest rates, the Canadian government’s stricter mortgage rules have also put a damper on the real estate market.

As interest rates rise, home values fundamentally decrease**. In practice this is what usually happens with some exceptions.

Tenancy risks

Let’s assume you’ve bought yourself a nice-looking rental property. You spend an extra long time looking through the tenancy act to understand your rights as an owner, then you try to weed out the bad tenants from the good. Finally, you pick one, and for whatever reason, after 2 months, they leave, putting you in the exact same position of finding a good tenant again. In the meantime, your mortgage and utility bills must be paid, and you may have to clean or renovate the property to entice the same or potentially lower value of rent for next time. All of this adds up to an increased amount of time, energy and expense that you must understand and accept. What happens if the tenants damage the home, there is a flood, or the furnace goes? These are all significant costs borne by the investor.

To prepare for this risk, a separate slush fund for the rental property should be set up to cover the costs of missed payments, emergencies and renovations.

Tax implications

One of the main issues that I see regarding owning a rental property is the tax implications that are often overlooked. Every year that you own a rental property and generate a positive net income, you pay tax at your personal marginal rate. When you decide to sell, the property is subject to capital gains taxes. You cannot shelter this inside your RRSP or TFSA. You cannot declare your rental your primary residence and avoid the capital gains tax. Depending on how long you hold the property for, you could be looking at a very high tax payable on the sale.

Your mortgage interest is deductible, but not your principle payments. This, along with other such expenses, often lead to personal taxes payable at the end of the year even if your rental cash flow is negative.

Diversification

Regarding individual rental properties or individual REITs, you are subject to a very specific geographic risk. Not all cities grow at the same pace. Not all neighbourhoods are created equal. To make a correct choice to where you buy your rental will take a lot of time and luck. Therefore, you could equate buying a rental property in only one market as speculating on a specific stock market, sector, company, commodity, or anything.

Leveraging risk

When buying into the stock market, you have the option to borrow money to invest. This option is not common place because of the level of volatility the stock market has, as well as the issues you could face with margin calls. The same risks are not as apparent when it comes to borrowing to buy a rental property. With as little as 20% of the purchase price down, the bank, within your borrowing limits, will lend you the rest at the prevailing mortgage rates. The mortgage interest is deductible against your gross rental income. This is still considered a leveraged investment. What ever you borrow you must pay back. If the real estate market crashes, like it has happened in certain markets over history, and you are forced for one reason or another to sell, you could end up in a far worse position than when you started.

With any leveraging or borrowing of money, this will affect other areas of your life when it comes to how much you are able to borrow on top of the rental mortgage.

Ok, I’m ready to make my choice. I’m ready to invest into real estate. What should I invest into and how much risk do I decide to take?

What’s the best solution?

Once you understand some of the risks, there are investments out there that can remove several of the issues we can identify, namely liquidity and tax issues. To us investment professionals, a Real Estate Investment Trust and more specifically an ETF of REITs makes the most sense. In some cases, a real estate specific mutual fund or private equity fund may also make sense.

A REIT is a corporation that owns income producing real estate assets such as buildings, land and real estate securities. It trades on the stock market just like any other common stock. Because it trades like a stock, it removes the potential liquidity issues listed above. Because it can be held inside a tax advantaged account, the tax issues in those cases are muted or removed.

A REIT ETF holds multiple individual REITs which reduces the overall risk. It is less costly than a real estate specific mutual fund or private equity fund but without paying for management comes an added risk that your REIT portfolio may not hold a desirable REIT. One of the main risks of investing into a Canadian REIT, for example, is that there are only a handful of operating REIT companies in Canada and they all have different geographic and investment risks attached. Perfect diversification is nearly impossible in this space. Therefore, within your portfolio, it’s important to limit your overall REIT exposure to less than 10% and weigh the advantage a lower cost ETF has compared to a higher cost mutual fund or private equity fund.

What’s the real point of investing in Real Estate? Are you investing for income or growth?

To us, buying a rental property for income purposes doesn’t make as much investment sense as what some may say. We often find through client conversations that owners don’t charge enough rent to cover the costs of the property and run a small net deficit every month. We hear of horror stories with bad tenants and expensive renovations. We’ve heard of condo boards calling for massive special assessments. We believe that owing a rental property is like a part-time personal business, can be treated as such by the CRA, and has some of the same time commitments, tax implications, and risks.

Before entering a private real estate deal, extra care must be taken to ensure all the risks are understood and all the details are gone over with a lawyer. If you do decide on buying a rental property, remember that it is a long-term investment and generally will only generate a positive income after the rental mortgage is paid off.

Some keys to owning a rental property:

- Keep extra cash aside for emergencies, renovations, special assessments or vacancies;

- Treat it like a small personal business and keep all your applicable receipt;

- Hire an accountant, lawyer and realtor to help you keep up with all the changing rules.

The best way to incorporate real estate into your investment portfolio will depend on your personal situation and risk tolerance.

If you’d like to know more and understand how a custom-built portfolio that incorporates real estate combined with a comprehensive financial plan can benefit your personal situation, connect with RT Mosaic Wealth Management Ltd. today.

David Miller 403-457-3285 david.miller@rtmosaic.com

Sources:

*Danielle Kubes, Zoocasa.com, “Rising Interest Rates a Headwind for Canada’s Housing Market”. Source: https://www.canadianmortgagetrends.com/2018/09/rising-interest-rates-headwind-canadas-housing-market/

**Brian Labby, CBC News, “Finding Solutions to Calgary’s $300M downtown tax hole won’t be easy” Source: https://www.cbc.ca/news/canada/calgary/calgary-office-tower-values-taxes-small-business-1.4977506

David Miller, BFS, CFP®, R.F.P., CIM®, is RT Mosaic’s dedicated financial planner and research analyst, providing expert planning, advice, research and support. Along with an honors degree from Mount Royal University’s Bachelor of Financial Services Applied program in 2005, David is a Certified Financial Planner® Professional (2007), Chartered Investment Manager® (2014) and Registered Financial Planner (2017). David has been providing advice to high net worth and affluent individuals and families for over 10 years. He left a major bank in 2016 to help fulfill his drive to provide client centered advice. David prides himself on providing Canadians with the ability to make informed financial decisions with increased financial literacy and support.

David Miller, BFS, CFP®, R.F.P., CIM®, is RT Mosaic’s dedicated financial planner and research analyst, providing expert planning, advice, research and support. Along with an honors degree from Mount Royal University’s Bachelor of Financial Services Applied program in 2005, David is a Certified Financial Planner® Professional (2007), Chartered Investment Manager® (2014) and Registered Financial Planner (2017). David has been providing advice to high net worth and affluent individuals and families for over 10 years. He left a major bank in 2016 to help fulfill his drive to provide client centered advice. David prides himself on providing Canadians with the ability to make informed financial decisions with increased financial literacy and support.

Nice to read some level headed truths of real estate investment.

Good article