By Penelope Graham, Zoocasa

By Penelope Graham, Zoocasa

Special to the Financial Independence Hub

The Federal government’s budget reveal is tomorrow, and all eyes are on what kinds of goodies will be included for beleaguered first-time home buyers.

While Finance Minister Bill Morneau has strongly hinted that some sort of measure would be unveiled to alleviate the home affordability challenges facing Canadians, it remains to be seen what that will entail. In the meantime, the government has been on the receiving end of proposals from various members of the housing industry, including local and regional real estate boards as well as Mortgage Professionals Canada, as to what would best address the issue.

Industry wants Stress Test, Amortizations, reeled back

Much of the focus has been placed on two key areas: the federal mortgage stress test, which was implemented just over a year ago in January 2018, as well as the length of maximum amortizations for first-time buyers.

Relaxing the criteria around both would improve buyers’ chances of qualifying for a mortgage, experts argue, and therefore should be the priority of the feds when implementing change. The result of the stricter threshold has effectively cooled demand in even the largest Canadian markets, and has pushed a greater percentage of buyers to high-rise living across the nation, from Vancouver condos for sale, to Hamilton and Ottawa condos, rather than single-family detached options.

Survey results yield other priorities

However, home buyers aren’t necessarily in agreeance with that approach. According to a recent survey conducted by Zoocasa, while 82% of Canadians feel that housing affordability continues to be a major issue, they’re not so sure the government is in a position to improve the situation. A total of 55% of respondents do not believe that affordability can be fixed via government measures alone, while 21% don’t feel it’s possible for new policies to exact change within the next five years.

Respondents also had different opinions about what measures would be of biggest help to their pocket books. When asked specifically about the mortgage stress test, for instance, only 57% said they were aware of what it was – and of that group, just half felt reducing the test’s rate threshold (currently the Bank of Canada’s five-year rate of 5.34% or 2% on top of the borrower’s contract rate, whichever is higher) would be of help. Only 15% of all respondents felt such a measure would be effective.

They also weren’t sold that extending maximum amortizations for high-ratio borrowers (those paying less than 20% down) or first-time buyers would be of service either; doing so would reduce monthly mortgage payments, making home financing easier on household budgets, and also ease the stress test’s affordability criteria.

Just 10% agreed with this approach.

Canadians value cash in pocket

Rather, home buyers indicated that receiving more cash in hand would be the most helpful: a total of 28% said they’d most like to receive an increased payout as part of the First Time Home Buyer’s Tax Credit, which currently refunds $750 to those who claim their first home purchase on their taxes. To qualify buyers must not have owned a home within the last four consecutive years, nor can they have dwelled in a home owned by their spouse.

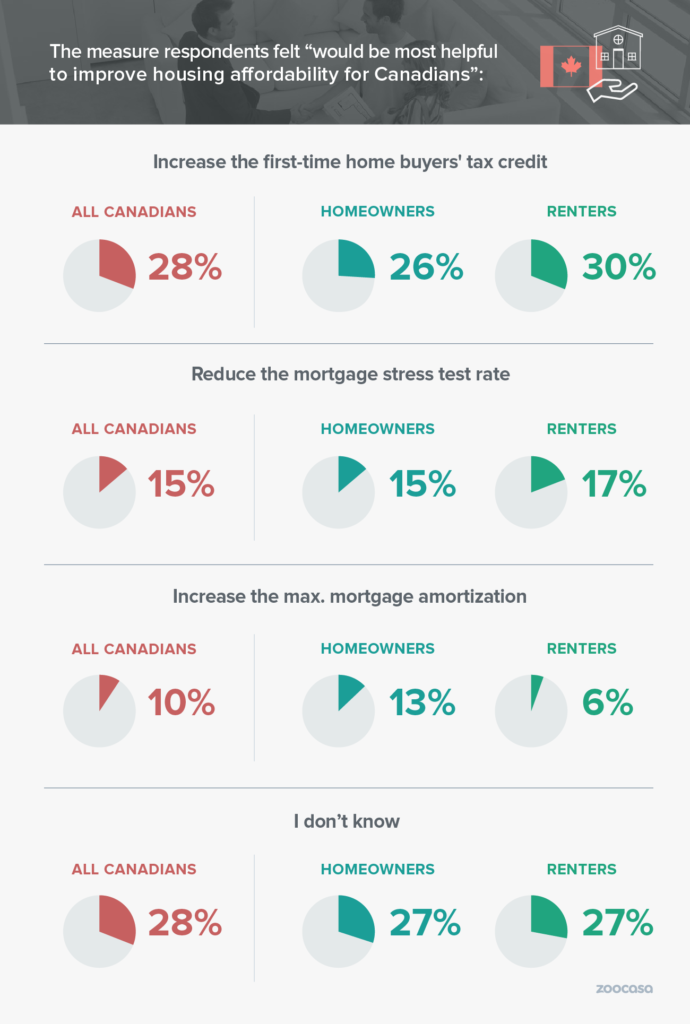

Check out the infographic above to see what Canadians feel would most aid home affordability in the upcoming federal budget.

Survey Highlights:

- 28%: Increasing the First-Time Home Buyers’ Tax Credit amount. 30% of renters and 26% of homeowners agree

- 15%: Reduce the mortgage stress test rate. 17% of renters and 15% of homeowners agree

- 10%: Increase the maximum mortgage amortization period to 30 years. 6% of renters and 13% of homeowners agree

- 8%: Expand the Home Buyers’ Plan. 8% of renters and 8% of homeowners agree

- 28%: I don’t know

- 11%: None of the above

Penelope Graham is the Managing Editor of Zoocasa.com, a leading real estate resource that uses full brokerage service and online tools to empower Canadians to buy or sell their home faster, easier, and more successfully.

Penelope Graham is the Managing Editor of Zoocasa.com, a leading real estate resource that uses full brokerage service and online tools to empower Canadians to buy or sell their home faster, easier, and more successfully.