Search the Internet for “Retirement Planning Toronto” and you’re likely to see a lot of fear out there, along with plenty of headline-grabbing stats on how ill-prepared many boomers are to retire. Before you let consumer-wide stats consume you, remember: Numbers don’t necessarily lie, but they can deceive.

As a personal financial advisor, I help families successfully prepare for retirement and other life transitions by emphasizing the planning part of retirement planning. Following are some of the most frequent topics of conversation I’ve found key to achieving your short- and long-term financial goals in retirement.

Family Retirement Planning: What Will It Really Cost?

If you’re like most folks getting serious about retirement planning, it may feel like a huge, angry gorilla is standing between you and your ideal lifestyle over the next 20–30+ years. One way to take on a hairy obstacle is to state the obvious about it, and consider your options from there:

Steve’s Retirement Planning Observations

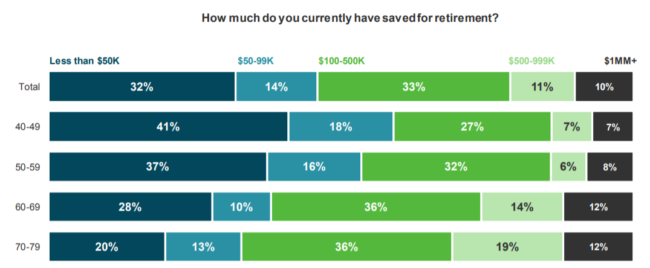

Before you retire: In a perfect world, you’ve been earning an amazing income, spending well within your means, and maxing out your registered investment accounts your entire life. But let’s get real. Most of us have earned some income, avoided most debt, and accumulated some assets along the way.

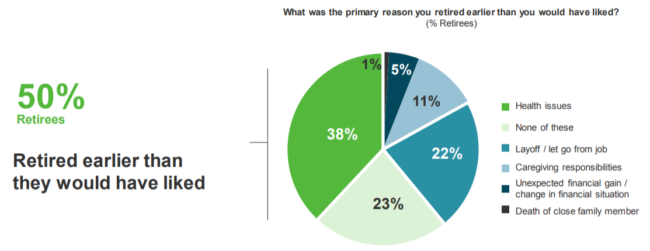

After you retire: You no longer have a salary to draw on. Even if you continue to tinker part-time, any earned income is likely to be greatly reduced (and should probably be positioned to avoid unpleasant OAS clawbacks).

Time travel: No matter what you’ve accomplished so far, there’s no going back to seize any past, passed-up opportunities.

Peace of Mind Planning

So, what can we do about your personal retirement realities? Robust retirement planning helps you quantify what you’re facing and qualify how we’re going to address it. In this sense, retirement planning may be better described as peace of mind planning. At least half the battle is getting your mind wrapped around the nature of the beast, so you can make informed decisions about how to tame it.

A financial needs analysis quantifies what your retirement might look like:

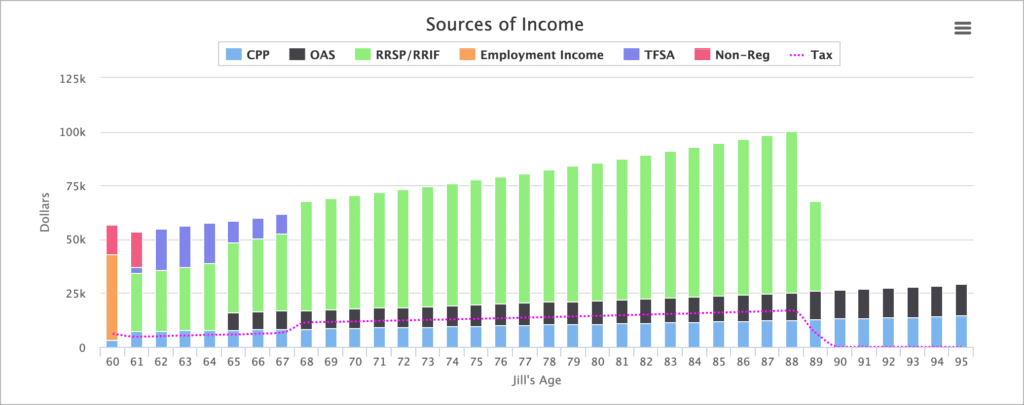

Income expectations: How much can you expect to receive from which outside sources? Possibilities include government or corporate pensions and benefits, proceeds from selling your business, a spouse’s continued salary, part-time employment, etc.

Spending goals: How much do you expect to spend in retirement? Estimate numbers for early retirement, when you may still be more active and independent, as well as for once you may be slowing down and requiring more care. Organize your expenses by needs and then wants.

The gap: Usually, you’ll discover a gap between your income and spending expectations. As long as it’s a manageable amount, you’ll bridge it by taking a “salary” from your taxable and registered investment accounts. After all, that’s what they’re there for. The goal is to draw a tax-efficient income stream from your total portfolio, while leaving the rest to grow as planned for funding future needs. (Hint: A personal financial advisor can add a lot of value here.)

Balancing Spending/Earning Trade-Offs

Has your initial financial needs analysis revealed ample accumulated wealth to bridge any savings/spending gap? Congratulations, you’re retirement-ready! You may even be able to add more “wants” to your spending plans.

But what if the financial needs analysis has demonstrated that your gap is too wide to leap? We can usually help families identify a combination of trade-offs they can mix and match to shore up their retirement funding. While belt-tightening is never fun — and, alas, there is no magic money wand to wave around — these no-nonsense steps can pack a lot more power than you might think:

Working more: You may be able to transition out of the workforce more gradually than planned, seek a higher-paying position, or consider a second source of income such as consulting or participating in the gig economy.

Spending less: Can you vacation closer to home, dine out less lavishly, or downsize to more modest quarters? Maybe you wouldn’t mind selling that cottage you rarely visit, ditching that second car, or canceling a languishing membership or two. If you’ve not yet got a household budget, create one; take a month or so to watch your spending: all of it. This will help you identify excess expenses you may not even miss once they’re gone.

Digging out of debt: If you’ve been spending beyond your means, you may have accumulated high-interest debt over the years, or you may be considering doing so to bridge that widening gap. Unfortunately, this form of “bad” debt only aggravates the issue. If you’re carrying heavy debt, work with a reputable personal financial advisor or debt counselor to lighten the load.

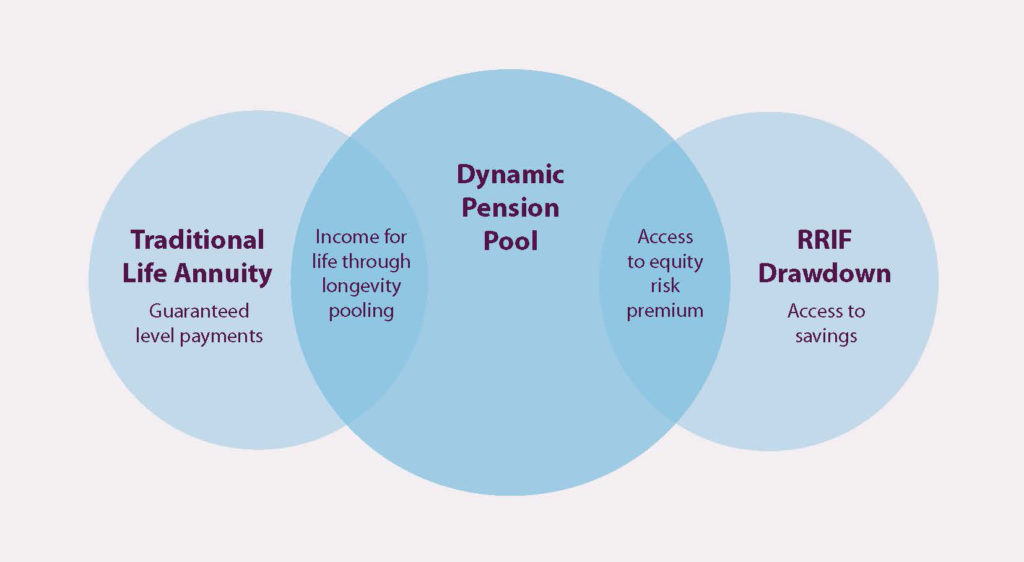

Saving/investing more: Even as you approach or enter retirement, the more money you can direct into your investment accounts, the more leverage you’ll have over time. Depending on your time horizon, you may also be able to restructure your investment portfolio to take on more market risk in pursuit of higher expected long-term returns. Or you might consider converting a portion of your wealth into the equivalent of a personalized pension plan to reliably fund your retirement lifestyle. (An important trade-off here is you’re likely leaving less legacy for your heirs. Perhaps you could offset this by considering long-term care coverage, to minimize the chance you’ll be a financial burden as you age.)

What About Real Estate?

With today’s red-hot real estate market (especially in Toronto and other major hubs in Canada), most retirement planning ends up including a conversation about housing. So, let’s talk about that before we wrap. Continue Reading…