By Benjamin Felix, PWL Capital,

with Vijay Jog, Carleton University

Special to the Financial Independence Hub.

Making smarter investment choices is one of the key elements in building up adequate retirement savings. [1] People are constantly inundated with sales pitches for investment opportunities from banks, insurance companies, and their friends and relatives. For those with limited investment knowledge, this can be intimidating. The natural inclination is to seek advice from a professional investment advisor; however, many investment advisors may be motivated to recommend the investment vehicles that pay them the highest commission. In this environment, it’s wise for individual investors to have a basic knowledge of investments. This paper aims to provide seven fundamental principles that should lead to smarter investment decisions.

1. Ignore ‘hot’ investment tips

Investments are inherently risky; some have lower risk, others have higher risk. It is socially common for co-workers, friends, or relatives to announce that they have the inside scoop on an investment opportunity that is going to have a high return, if it is acted on immediately. To compound this, people tend to discuss their winning stock picks publicly, but do not readily disclose their losers. The media often provides flashy investment advice that may not be right for a vast majority of investors, while sensationalizing world events in the context of stock markets. There are constant psychological triggers to buy and sell securities without adequate knowledge built into everyday life, and acting on these triggers can be the single biggest threat to the long-term financial health of an investor.

Conclusion: Acting immediately on information from friends, family, and the media may lead to a bad investment experience.

2. Have a basic knowledge of investment vehicles

There are many ways for individuals to invest their savings in financial markets. The most common ways to invest include stocks and bonds, mutual funds, and exchange traded funds (ETFs).

Individual stocks and bonds are inherently risky investments requiring in-depth knowledge of the underlying company being considered. It is highly unlikely that individual investors will have the time, background, or resources to conduct the necessary analysis on enough companies to build a portfolio that is positioned to outperform a passive investment in a benchmark index – even professional money managers have trouble achieving this consistently[2]. An alternative is to invest in a basket of stocks and bonds in such a way that diversifies away the risk associated with any individual company. The exact number of securities that it takes to build an optimally well-diversified portfolio is up for debate, but it is safe to say that buying a handful of stocks and hoping for the best is not ideal.

Mutual funds are vehicles that allow investors to obtain a well-diversified portfolio through a pre-packaged product. For this service, investors pay a fee to the mutual fund company, referred to as management expense ratio (MER). The MER pays for the fund’s manager and other expenses. Many mutual fund companies claim that their managers have special predictive insights and the ability to find stocks that are poised to increase in price more than their peers. These actively managed funds have significantly higher fees than a mutual fund that simply buys all of the stocks in an index, called an index mutual fund, or index fund. The high fees paid to actively managed mutual funds could be warranted if they produced superior performance, but an overwhelming amount of evidence shows that superior long-term performance is not likely[3]. Currently, 98.5% of the assets invested in Canadian domiciled mutual funds are invested in actively managed mutual funds[4].

ETFs, like index mutual funds, invest passively in an index. ETFs tend to have much lower fees than mutual funds due to their underlying structure, while still allowing investors to invest in a well-diversified basket of securities.

Conclusion: It is not practical for the average investor to build a well-diversified portfolio using individual stocks and bonds. There is sufficient empirical evidence to show that actively managed mutual funds, on average, do not show any superior performance over index mutual funds. Investors are likely better off investing in index ETFs or low cost index mutual funds.

3. Understand the risk-return trade-off

Most investors build their portfolio using some mix of stocks and bonds; this is known as their asset mix. Stocks tend to be riskier than bonds, as measured by the standard deviation of their returns. Riskier investments must have higher expected returns to attract investors, and it follows that stocks must have higher expected returns than bonds.

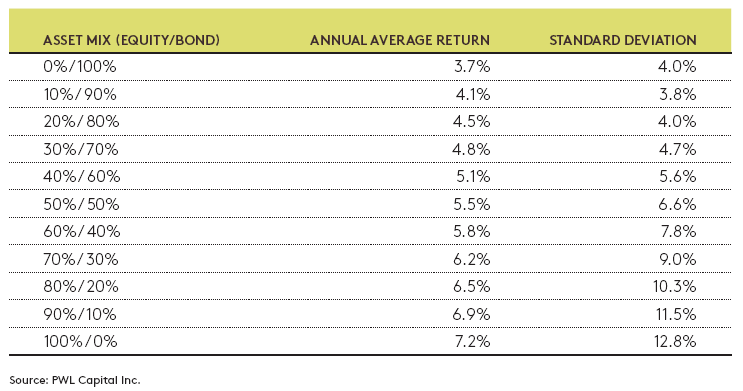

In a recent white paper, PWL’s Raymond Kerzerho and Dan Bortolotti used historical data and current market expectations to demonstrate the expected returns for portfolios with various mixes of stocks and bonds. The results demonstrate the relationship between risk and return – portfolios with higher expected returns also have a higher expected standard deviation. Statistically, it can be expected that in 65% of trials, the returns of a portfolio will fall within one standard deviation of the average return; in 95% of trials, the portfolio returns will fall within two standard deviations of the average return.

To ensure a desirable risk-return expectation, investors must decide how much volatility they are willing to bear, while understanding that less volatility means lower long-term expected returns. Selecting the right asset mix is one of the keys to sticking with an investment plan.

Conclusion: Higher returns are associated with higher risk, as measured by standard deviation. Investors need to understand, and be comfortable with, the risk and return expectations of their portfolio.

4. Know your time horizon

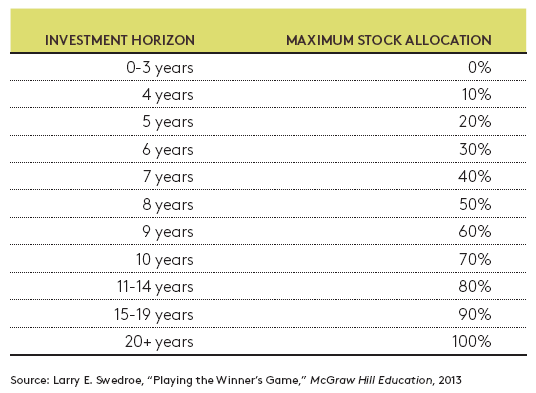

In a given year, the return on a portfolio has a 95% chance of being within two standard deviations of the expected average return. As an example, the one year return on a 60% equity, 40% fixed income portfolio could be expected to fall between -9.8% and 21.4%. If an investor has a one year time horizon, this wide range of returns is not likely to be suitable. As the investor’s time horizon gets longer, it becomes more likely that the realized average return on the portfolio will be close to the expected average return. Investors can have different time horizons for various investment goals, but the funds associated with each goal must be invested appropriately to achieve a successful investment experience. In his book, Playing the Winner’s Game, Larry Swedroe outlines some suggested asset mixes based on investment time horizon.

Conclusion: A long time horizon gives investors the ability to withstand the short-term volatility that accompanies the higher expected returns of stocks. A short time horizon means that less risky investments must be chosen to avoid realizing losses.

5. Focus on time in the market, not timing the market

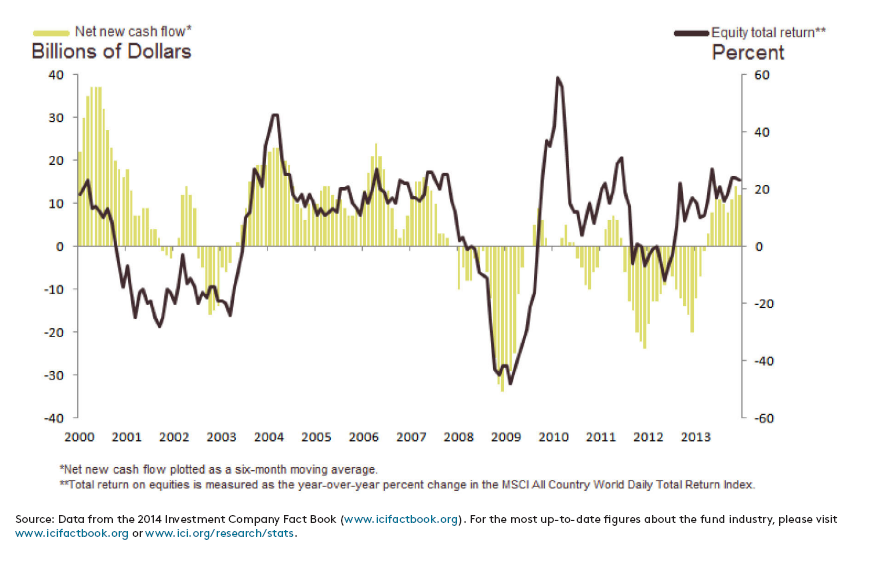

Timing the market is the action of timing buy and sell decisions in an attempt to gain additional profits by buying low and selling high. Data for US mutual fund cash flows and global equity returns from the Investment Company Institute shows how investors tend to fare at market timing; when markets were doing well, investors were pouring money into equity mutual funds, and when markets were doing poorly they were selling. This buying high and selling low behaviour is driven by the fear and greed that underlie investor psychology. These actions have extremely negative effects on the performance of a portfolio.

Source: Data from the 2014 Investment Company Fact Book (www.icifactbook.org). For the most up-to-date figures about the fund industry, please visit www.icifactbook.org or www.ici.org/research/stats.

A simple solution to avoid market timing impulses is dollar-cost averaging, systematically investing the same amount each month. This method of entering the market alleviates the stress associated with market timing, and suits investors with a fixed amount available to invest each month.

Some investors may have a large lump sum to invest from a settlement, prize, or inheritance. Research from the Vanguard Group has shown that approximately two-thirds of the time, lump sum investing has resulted in superior risk-adjusted performance as compared to dollar-cost averaging[5]. Based on this research, if an investor is comfortable with their asset mix and its risk and return characteristics, it is statistically prudent to invest the full lump sum immediately. If the investor is more concerned about protecting against short-term losses and feelings of regret, then dollar-cost averaging is appropriate.

Conclusion: The simplest solution for investors to avoid market timing is to invest the same amount every week, month, or quarter without worrying about the short term movement of the market. When lump sum investing is deemed appropriate, the investor must be comfortable with the risk/return characteristics of their portfolio.

6. Costs impact wealth accumulation

If an investor decides to invest in an actively managed mutual fund, they are subject to management fees, which are especially high in Canada[6]. The fees, typically in the range of 1.5 to 2.5% of the account value on an annual basis, have a significant impact on wealth accumulation[7]. This can be best illustrated with an example. Assume that both an active mutual fund (2% annual fee) and a passive ETF (0.5% annual fee) generate the same long-term investment return, less their fees. If the market produces an assumed rate of return of 5% over 25 years, and an investor invests $10,000 each year in an RRSP, the value of the savings invested in the active mutual fund would be $364,593, whereas the value of the passive ETF investment would be $445,652. This is a difference of $81,059, or 18%, in favor of the low cost passive investment.

Conclusion: Costs can have a dramatic effect on wealth accumulation. Ask for all possible fees to be disclosed when working with a professional, and look for investments with low upfront and ongoing costs.

7. Utilize tax advantaged accounts

In Canada, we have a handful of tax advantaged accounts that can be used to hold qualified investments. The various accounts have different purposes, but both large and small investors can benefit from using them. For a long-term investor planning for retirement, two of the most useful account types are the Registered Retirement Savings Plan (RRSP), and the Tax Free Savings Account (TFSA).

Contributions to the RRSP are deducted from taxable income in the year they are made, in most cases result ing in a tax refund. Investment growth and income build inside the RRSP tax free, and any withdrawals are taxed as income in the year they are withdrawn. The idea is that investors will contribute when they are in a high tax bracket, and withdraw when they are in a lower tax bracket. RRSP room builds based on 18% of the previous year’s earned income and can be carried forward indefinitely.

For the TFSA, there is no deduction from taxable income when money is added to it, and there is no tax payable on withdrawals. Like the RRSP, investment income and growth build tax free. Every Canadian resident starts building TFSA room when they turn 18, and currently all eligible people build $5,500 of new room each year.

Until both these accounts have been maximized, there are very few logical reasons to start investing in taxable accounts.

Conclusion: Before investing in taxable accounts, maximize the user of registered, tax-advantaged savings plans.

Becoming a smart investor

Acting on these principles is likely to be beneficial, but they all need to be tied together with a clear investment strategy. One method for sticking to an investment strategy is the creation of an Investment Policy Statement (IPS), which becomes a guideline for future investment decisions.

The IPS is created based on risk-return requirements, time horizon, and investment preferences; it sets rules for how much of each type of security should be held. An example of an IPS could be 20% Canadian stocks, 20% US stocks, 20% International stocks, and 40% bonds. When designed thoughtfully, an IPS allows the investor to separate their emotions from buy and sell decisions, instead basing decisions on the predetermined rules. When the portfolio strays from its targets due to market movement, it must be rebalanced to match the allocations set out in the IPS.

With a strategy in place, a smart investor will revisit their personal situation periodically (annually at least) to see if they should be modifying their IPS or their holdings. It is possible that new investment vehicles with lower costs or increased tax efficiency have been introduced, or that the investor’s time horizon or risk tolerance has changed due to a life event. Managing the optimal use of tax advantaged accounts must also be revisited periodically.

Tying these seven principles together and sticking to a consistent and methodical strategy can result in a pleasant, stress free investment experience, and long term wealth creation.

This post was adapted with the permission and cooperation of the authors from this original PWL Capital white paper.

Footnotes

[1] Vijay Jog, “Investment Performance and Costs of Pension and other retirement Savings Funds in Canada: Implications on Wealth Accumulation and Retirement,” Department of Finance Canada, 2009

[2] Mark Carhart, “On Persistence in Mutual-fund Performance,” Journal of Finance, March 1997

[3]Aye M. Soe, “The Persistence Scorecard,” S&P Dow Jones Indices, June 2014

[4] Investor Economics, August 2014

[5] Anatoly Shtekhman, Christos Tasopoulos, Brian Wimmer, “Dollar-cost averaging just means taking risk later,” Vanguard, July 2012

[6] Benjamin N. Alpert, John Rekenthaler, “Global Fund Investor Experience 2011,” Morningstar, March 2011

[7] Kenneth French, “The Cost of Active Investing,” Dartmouth College – Tuck School of Business; National Bureau of Economic Research, April 2008