It’s been two years since former Vanguard Canada CEO Atul Tiwari launched Cult Wines Americas. Late in April, Tiwari celebrated the milestone with a small media gathering at Fine Wine Reserve, a premium wine storage facility in Toronto.

For a refresher, see this Hub blog written by Tiwari late in 2021: A New Asset Class for Affluent Investors. It explains that the Cult Wine Investment story began in London, England in 2007, and in 2021 expanded into North America with offices in Toronto and New York. See also these articles written by two Globe & Mail writers who were at this month’s event along with myself: How profitable is investing in fine wine? and Former Vanguard Canada CEO to head wine investing venture in the U.S.

The idea behind Cult Wine Investment is to let you invest in leading global wines (mostly French) for ultimate profit, and to safely store it off-site while still having title to and access to the actual product, should you wish to consume a portion. As Tiwari told the G&M’s John Daly last year, “Cult Wines is not securities regulated, because you actually own the wine.” Below are some pointers on building a collection. Cult currently allows Canadian investors with as little as $12,500 (or US$10,000 for U.S. investors) to access a customized wine portfolio, with management fees ranging from 2.25%t to 2.95%, depending on portfolio size.

In addition to sampling the mostly-French wines, we had a quick tour of the Toronto storage facility, courtesy of Marc Russell, Founder and CEO of The Fine Wine Reserve Inc. (shown on the right).

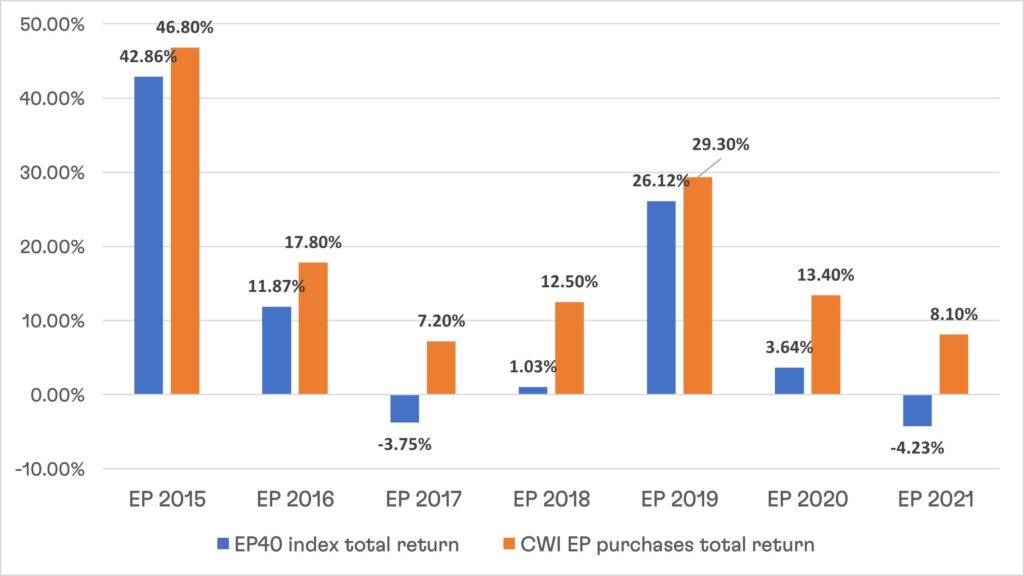

The chart above shows a portfolio of Cult Fine Wines [CWI is the orange bars] has performed against its benchmark, the EP40 index (Green bars) as of March 31, 2023. EP40 is a fixed basket of 40 Bordeaux En Primeur wines.

“Fine wine as an asset class has performed as it should over the last two years,” Tiwari told me, “In a volatile market setting, Cult Wines has returned on average 16% in 2021 and 12.77% in 2022, in addition to providing the portfolio diversification benefits of low correlations to equities, low volatility and acting as an inflation hedge.”

As we learned at the briefing, investing in fine wines for profit primarily means investing in French wines, mostly from the French districts of Bordeaux, Burgundy and Champagne. Those three districts account for roughly 80% of Cult Wine portfolios. At the briefing, the tasting focus was on the first two: after all, Tiwari is a member of the Confrérie des Chevaliers du Tastevin, a global society of Burgundy aficionados.

A handout says Bordeaux wines are “the bedrock of fine wine” portfolios, adding that after a period of recent underperformance, “Bordeaux wines now offer more attractive relative values when compared to other French regions.” In addition, “the end of zero-COVID policies in China fuelled a surge in fine wine trading in early 2023.”

How to store fine wines

While most folk merely buy wines from the LCBO or nearby Vineyard and consume it within days, it turns out that storing multiple cases of wines for profit is considerably more complex. This was evident at the four of the Fine Wine Reserve, where temperature control, humidity and other variables are all far more complex than you might imagine. And yes, if you do hire them to store your wines, you are able to visit and even withdraw a few bottles or cases for actual use, should you desire to enjoy your investment as well as profit from it down the road.

Here are a few interesting talking points provided at the tour:

• Everyone overestimates the importance of cool temperatures when storing and aging fine wines, and underestimates the importance of temperature stability and high humidity.

• This explains why wines age best in the cool damp natural cellars located far below ground, as in Europe.

(Here I dare to add a personal note, since I once visited a white wine vineyard in France’s Loire Valley that bears the illustrious name Chevreau.)

• Wines are like kids. If you neglect them when young, they grow up unbalanced. Don’t put off proper storage. Stored improperly, wines will be irreversibly damaged within a year. And 1 hour in a hot car! Continue Reading…