A report by LendEDU finds Bitcoin is making a lot of headway with investors over Gold. 56% said Bitcoin is a better investment to maximize profits, versus just 33% for gold. However, they still see gold as a better store of value against inflation, with 50% answering gold (including 67% over the age of 54), and 39% saying bitcoin.

A report by LendEDU finds Bitcoin is making a lot of headway with investors over Gold. 56% said Bitcoin is a better investment to maximize profits, versus just 33% for gold. However, they still see gold as a better store of value against inflation, with 50% answering gold (including 67% over the age of 54), and 39% saying bitcoin.

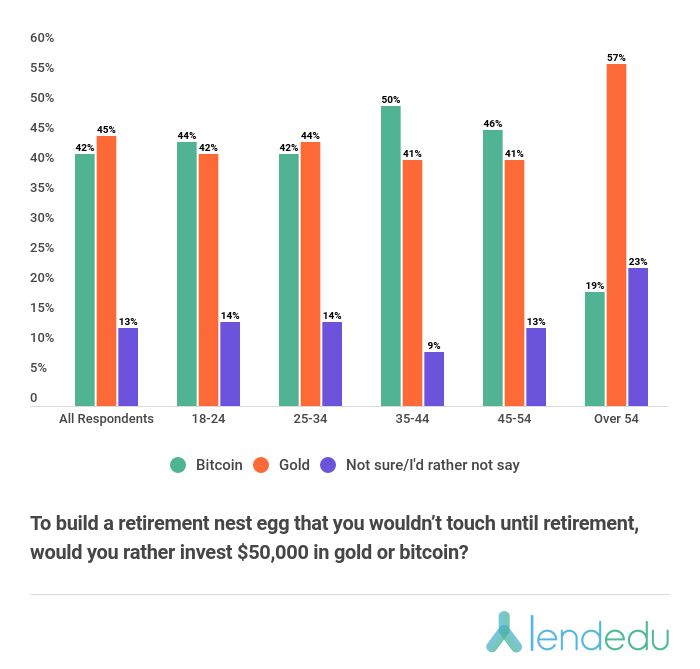

On behalf of New Jersey-based LendEDU, research firm Pollfish surveyed 1,000 Americans on April 21st to see how they would deploy an initial US$50,000 to build a retirement nest egg, and found gold only had a slight edge: 45% versus 42% for bitcoin. However, if the goal of the $50,000 investment is strictly to maximize profits, 49% specified bitcoin, versus just 37% for gold.

LendEDU Director of Communications Mike Brown says Bitcoin is up roughly 68,189,500% since its start in 2009, while gold is up 105% over the same period.

“Gold is proven as a reliable investment and safe haven against market volatility and inflation, which is especially relevant in 2021. Bitcoin is becoming a competitor for just the same thing, although its wild price fluctuations are not for the faint-hearted and attract a younger, more aggressive investor … We found gold is still trusted for more cautious investing, especially amongst older Americans, but bitcoin is closing that gap and is preferred for speculative investing, especially with the younger crowd.”

Brown says the survey results were “none too surprising; bitcoin has periods of monumental gain that make it a salivating buy for aggressive investors trying to make a profit. But it also has periods of monumental loss and faces constant regulatory and institutional scrutiny that make it a questionable buy if your first investment priority is protecting the money you already have.”

Gold, on the other hand, doesn’t have eye-popping surges like bitcoin but is safe and has historically delivered steady profits to the patient investor looking for a financial safe haven.

The survey reveals a younger bias towards bitcoin and an older population favoring gold. Thus, 56% of those between the ages of 18 and 24 thought bitcoin was the better speculative asset, while 29% thought gold was. The percentages were 29% and 55%, respectively, for poll participants over 54.

Similarly, 42% of the 18 – 24 cohort thought bitcoin was a better store of value to protect against inflation, while 44% said gold. For the over 54 cohort, those percentages were 16% and 67%, respectively.

Brown found the 35-44 age group surprising as they were quite bullish on bitcoin in all four questions and broke with the normal trend that had older respondents favoring gold and younger ones opting for bitcoin. “This could be due to this demographic getting in on bitcoin in the extremely early stages, around 2010 when they were in their mid-twenties or early-thirties.”

When asked if they have invested in bitcoin or gold recently amid concerns about inflation, 15% had invested in gold, 31% in bitcoin, 15% in both, and 36% in neither.

For retirement investing, gold still holds a dwindling edge

In another part of the survey, poll participants were given four increasing monetary values and asked if they would rather invest each value in either bitcoin or gold to build a retirement nest egg that they couldn’t touch until retirement. In nearly every scenario, gold was the preferred retirement investment choice over bitcoin. Only when $1,000 was the starting amount did more respondents (47%) want to invest in bitcoin over gold (43%).

But as the starting amount went up, so too did the risk, which is likely why respondents switched over to the less-risky, less-volatile gold to start building their retirement nest eggs as the questions progressed. As Brown notes, “Retirement accounts should be stable, and you’ll lose a lot less sleep investing $50,000 in gold instead of $50,000 in bitcoin.”

Even so, no matter the initial investment amount, most age groups preferred building their retirement nest egg through bitcoin rather than gold. For example, 46% of the 45-54 cohort wanted to invest $50,000 in bitcoin compared to 41% who said gold.

Brown says this bodes well for bitcoin bulls because “if enough Americans already trust bitcoin over gold as a retirement investment then it could mean soaring bitcoin prices as younger Americans amass more wealth, more purchasing power, and more of a stake in the virtual currency.”

For maximizing profits, bitcoin takes the cake

For the last four questions of the survey, respondents were once again given increasing monetary values but now had to think about if they wanted to invest in bitcoin or gold for maximizing profits, not building a retirement nest egg.

For the last four questions of the survey, respondents were once again given increasing monetary values but now had to think about if they wanted to invest in bitcoin or gold for maximizing profits, not building a retirement nest egg.

When it came to investing for profits and nothing else, bitcoin was the clear choice over gold for each monetary value. For example, 57% wanted to invest $1,000 in bitcoin over the 33% that opted for gold, and 49% wanted to invest $50,000 in bitcoin compared to 37% who answered gold. Brown says that even when the results were broken out by age, every age group except the over 54 cohort, which heavily favored gold throughout the survey, wanted to invest in bitcoin over gold for every single monetary value.

Click here to jump to the full survey results.

1. In your opinion, which is a better speculative asset?

- 51% of respondents answered, “Bitcoin”

- 39% of respondents answered, “Gold”

- 10% of respondents answered, “Not sure/I’d rather not say.”

2. In your opinion, which is a better investment to maximize returns/profits?

- 56% of respondents answered, “Bitcoin”

- 33% of respondents answered, “Gold”

- 11% of respondents answered, “Not sure/I’d rather not say.”

3. In your opinion, which is a better store of value to protect against inflation?

- 39% of respondents answered, “Bitcoin”

- 50% of respondents answered, “Gold”

- 12% of respondents answered, “Not sure/I’d rather not say.”

4. In your opinion, which is a better store of value to protect against market volatility?

- 38% of respondents answered, “Bitcoin”

- 52% of respondents answered, “Gold”

- 11% of respondents answered, “Not sure/I’d rather not say.”

5. Have recent concerns about inflation persuaded you to invest some of your money in bitcoin or gold?

- 15% of respondents answered, “Yes, I invested in gold.”

- 31% of respondents answered, “Yes, I invested in bitcoin.”

- 15% of respondents answered, “Yes, I invested in both.”

- 36% of respondents answered, “No, I invested in neither.”

- 4% of respondents answered, “I’d rather not say.”

6. Have recent concerns about market volatility persuaded you to invest some of your money in bitcoin or gold?

- 16% of respondents answered, “Yes, I invested in gold.”

- 31% of respondents answered, “Yes, I invested in bitcoin.”

- 14% of respondents answered, “Yes, I invested in both.”

- 36% of respondents answered, “No, I invested in neither.”

- 4% of respondents answered, “I’d rather not say.”

7. In 2021, gold’s current market cap (share price multiplied by the number of shares outstanding) is $11 trillion, bitcoin’s is $1.1 trillion. By the year 2031, do you think gold or bitcoin will have a bigger market cap?

- 32% of respondents answered, “Gold”

- 43% of respondents answered, “Bitcoin”

- 13% of respondents answered, “Equal”

- 13% of respondents answered, “Not sure/I’d rather not say.”

8. By the year 2041, do you think gold or bitcoin will have a bigger market cap?

- 29% of respondents answered, “Gold”

- 47% of respondents answered, “Bitcoin”

- 11% of respondents answered, “Equal”

- 13% of respondents answered, “Not sure/I’d rather not say.”

9. To build a retirement nest egg that you wouldn’t touch until retirement, would you rather invest $1,000 in gold or bitcoin?

- 43% of respondents answered, “Gold”

- 47% of respondents answered, “Bitcoin”

- 10% of respondents answered, “Not sure/I’d rather not say.”

10. To build a retirement nest egg that you wouldn’t touch until retirement, would you rather invest $10,000 in gold or bitcoin?

- 45% of respondents answered, “Gold”

- 44% of respondents answered, “Bitcoin”

- 12% of respondents answered, “Not sure/I’d rather not say.”

11. To build a retirement nest egg that you wouldn’t touch until retirement, would you rather invest $25,000 in gold or bitcoin?

- 46% of respondents answered, “Gold”

- 42% of respondents answered, “Bitcoin”

- 11% of respondents answered, “Not sure/I’d rather not say.”

12. To build a retirement nest egg that you wouldn’t touch until retirement, would you rather invest $50,000 in gold or bitcoin?

- 45% of respondents answered, “Gold”

- 42% of respondents answered, “Bitcoin”

- 13% of respondents answered, “Not sure/I’d rather not say.”

13. As strictly a stock market play to maximize profits, would you rather invest $1,000 in gold or bitcoin?

- 33% of respondents answered, “Gold”

- 57% of respondents answered, “Bitcoin”

- 11% of respondents answered, “Not sure/I’d rather not say.”

14. As strictly a stock market play to maximize profits, would you rather invest $10,000 in gold or bitcoin?

- 35% of respondents answered, “Gold”

- 53% of respondents answered, “Bitcoin”

- 12% of respondents answered, “Not sure/I’d rather not say.”

15. As strictly a stock market play to maximize profits, would you rather invest $25,000 in gold or bitcoin?

- 38% of respondents answered, “Gold”

- 49% of respondents answered, “Bitcoin”

- 14% of respondents answered, “Not sure/I’d rather not say.”

16. As strictly a stock market play to maximize profits, would you rather invest $50,000 in gold or bitcoin?

- 37% of respondents answered, “Gold”

- 49% of respondents answered, “Bitcoin”

- 14% of respondents answered, “Not sure/I’d rather not say.”