Special to the Financial Independence Hub

Canadians often consider tax-saving strategies on an individual basis but don’t consider how their families can also contribute to lowering the tax bill. While often overlooked, family tax-saving strategies are effective and legitimate ways for households to save big on tax dollars each year.

The Canadian government recently announced the reduction of its prescribed interest rate from 2% to 1% starting on July 1, 2020 – the first time the prescribed interest rate has been this low since April 2018. For Canadian families, this represents a significant opportunity to make a loan directly to family members or where minors are involved, to a family trust, and use this income-splitting strategy to their advantage.

How does it work?

If you loan your spouse money for the purpose of income-splitting, the prescribed rate (the rate of interest you charge your spouse) remains fixed for the term of the loan. Through this tax-saving strategy, that many may not be aware of, transferring income from a high-income earner to a family member in a lower tax bracket allows Canadian families to pay less taxes overall, potentially saving hundreds or even thousands of dollars per year.

Although the Canada Revenue Agency (CRA) restricts most forms of income-splitting, there are legitimate ways to split taxable income with a spouse or minor child such as this strategy. Provided the loan is properly structured, the loan proceeds can be invested by the spouse receiving the loan, with the income taxed at their lower marginal rate.

Of course, one of the keys to a successful income-splitting strategy is to ensure that investment returns are higher than the interest rate charged on the loan: so keep that in mind when choosing your investment.

A real-life example

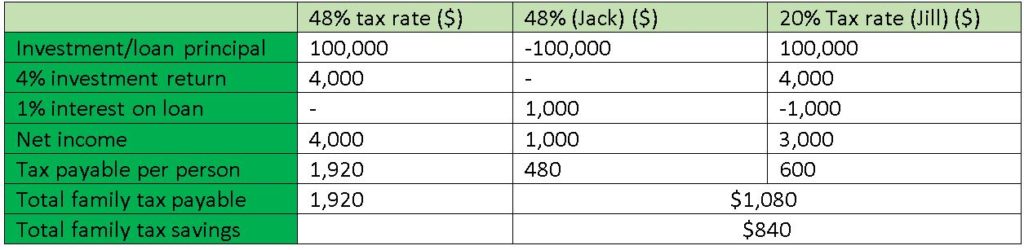

Let’s suppose spouses Jack and Jill are looking for ways to lower their family tax bill. They are in different tax brackets, Jack at 48% and Jill at 20%. Jack loans Jill $100,000 at a prescribed rate of 1%. Jill invests the money and earns 4% – or a total of $4,000. She then pays Jack the $1,000 loan interest and deducts the same amount as “loan interest expense.” Jill pays $600 in tax on the remaining $3,000, and Jack pays $480 on his interest income.

Here’s how it stacks up: Jack would have had to pay $1,920 in taxes had he invested the $100,000 himself. By loaning the money to Jill for the purpose of income splitting, the family tax bill is reduced by approximately 44% to $1,080, representing a savings of $840.

How to ensure a successful strategy

To ensure the income attribution rules don’t apply to investment income earned by the proceeds from the loan, two loan conditions must be met:

- The loan must carry interest at a rate that is at least equal to the prescribed rate (updated quarterly) as set by the CRA at the time the loan is made. If the commercial loan rate is lower than the prescribed rate at the time the loan is made, this lower commercial rate can be used

- The annual interest owing on the loan must be paid to the lender no later than 30 days after the end of each particular year.

This income-splitting strategy through loans is best suited for those with a pool of non-registered capital they are willing to invest and for those who have a spouse or minor children in a lower marginal tax bracket.

We recommend formalizing the spouse-to-spouse loan through a promissory note.

Taxes can be tricky and seem daunting for many people – especially when large sums of money are involved – so, when it doubt, consider the help of an advisor to walk you through the process to ensure you don’t make any mistakes along the way.

John Natale is the Head of Tax, Retirement & Estate Planning Services, Wealth, at Manulife Investment Management. He joined Manulife in 2001, having previously worked for a national account firm and a private law firm. He has experience with estate planning and wealth management strategies and a wide variety of general tax matters including trusts and annuities. John is a frequent speaker at industry conferences and seminars, has published articles on estate planning and income strategies, and has appeared as a guest speaker on BNN.

John Natale is the Head of Tax, Retirement & Estate Planning Services, Wealth, at Manulife Investment Management. He joined Manulife in 2001, having previously worked for a national account firm and a private law firm. He has experience with estate planning and wealth management strategies and a wide variety of general tax matters including trusts and annuities. John is a frequent speaker at industry conferences and seminars, has published articles on estate planning and income strategies, and has appeared as a guest speaker on BNN.

I have a question for John Natale. Is it possible to make the loan to an adult child who is not living at home and who has a low income? The article only mentions a spouse or a minor child (through a trust).

On behalf of John Natale: Yes, you can make a loan to anyone. However, the attribution rules which prevent income splitting generally only apply to spouses (including common-law partners) and minor children. Once children reach the age of 18 the rules change. You can gift the money to your adult child to invest and not be subject to the attribution rules with the result that the income from the investment is taxed in their hands. If however, you are uncomfortable gifting your adult child money and would prefer to lend them money and the loan was made principally to reduce or avoid taxes, then you would need a prescribed rate loan and the same principles and rules would apply, i.e. interest has to be paid by January 30th of the following year, the adult child would get an interest deduction for any interest on the loan that they pay to you and the parent would report any of the interest income received. This is because there is a different rule that says if you lend money at a rate below the prescribed rate to an adult child or other adult relative, income (but not capital gains) will be attributed to you if the purpose of the loan was to reduce or avoid taxes. Please note that these are only general comments and we would suggest readers speak to their tax advisor about their specific situation.