My latest MoneySense Retired Money column looks at the dilemma many retirees and would-be retirees face these days: that with sky-high stock prices and interest rates seemingly bottoming and headed up, there’s no such thing as a truly “safe” investment. Click on the highlighted headline for full column: Is the All-Weather portfolio the answer to the shortage of “safe” investments?

Even supposedly safe bonds, bond funds or ETFs largely suffered losses in 2021 as interest rates seemed poised to rise: now that various central banks are starting to hike rates, such pain seems destined to continue in 2022 and beyond.

Yes, short-term bank savings accounts and GICs seem relatively safe from both stock market meltdowns and precipitous rises in interest rates, but then there’s the scourge of inflation. Even if you can get 2% annually from a GIC, if inflation is running at 4%, you’re actually losing 2% a year in real terms.

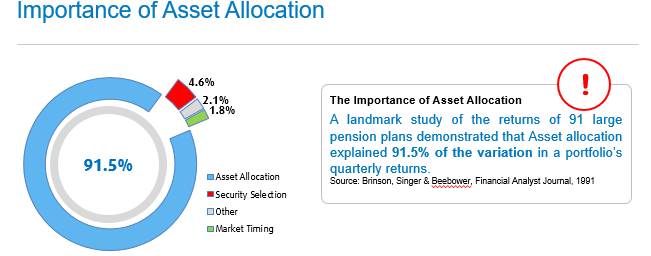

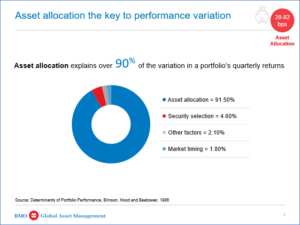

But what about those Asset Allocation ETFs that have become so popular in recent years. This site and many like it are constantly looking at products like Vanguard’s VBAL (60% stocks to 40% bonds) or similar ETFs from rivals: iShares’ XBAL or BMO’s ZBAL.

The nice feature of Asset Allocation ETFs is the automatic regular rebalancing. If stocks get too elevated, they will eventually plough back some of the gains into the bond allocation, which indeed may be cheaper as rates rise. Conversely, if stocks plummet and the bonds rise in value, the ETFs will snap up more stocks at cheaper prices.

But are these ETFs truly diversified?

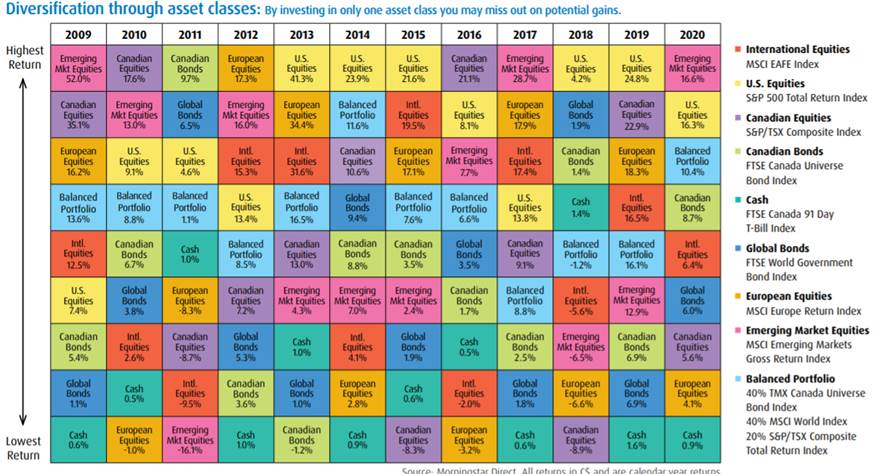

True, any one of the above products will own thousands of stocks and bonds from around the world. They are geographically diversified but I’d argue that from an asset class perspective, the focus on stocks and bonds means they are lacking many other possibly non-correlated asset classes: commodities, gold and precious metals, real estate, cryptocurrencies, and inflation-linked bonds to name the major ones.

The Permanent Portfolio and the All-Weather Portfolio

I’ve always kept in mind Harry Browne’s famous Permanent Portfolio, which advocated just four asset classes in four 25% amounts: stocks for prosperity, long-term bonds for deflation, gold for inflation and cash for recessions.

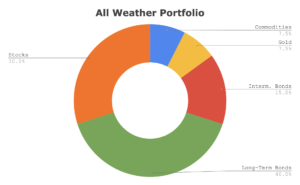

A bit more complicated is the more recent All-Weather portfolio, from American billionaire and author Ray Dalio, founder of Bridgewater Associates. You can find any number of variants of this by googling those words, or videos on YouTube.com. There’s a good book on this, Balanced Asset Allocation (by Alex Shahidi, Wiley), which makes the All-Weather portfolio its starting point. Continue Reading…