A couple of recent surveys from J.P. Morgan Asset Management and RBC shed a fair bit of light into recent Retirement trends in North America in the wake of the ongoing Covid-19 pandemic. Summarized in the October 2021 issue of Gordon Wiebe’s The Capital Partner newsletter, here are the highlights:

A couple of recent surveys from J.P. Morgan Asset Management and RBC shed a fair bit of light into recent Retirement trends in North America in the wake of the ongoing Covid-19 pandemic. Summarized in the October 2021 issue of Gordon Wiebe’s The Capital Partner newsletter, here are the highlights:

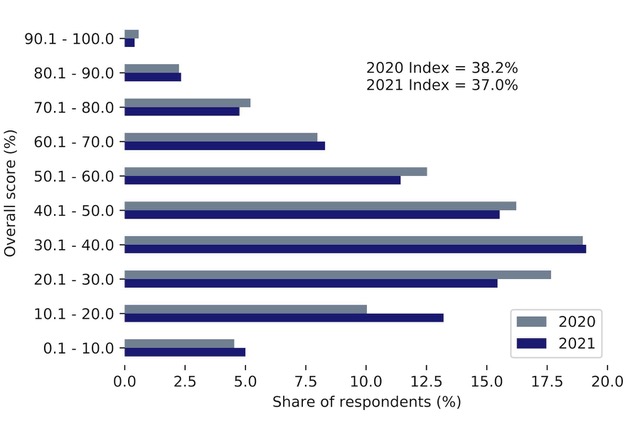

First up was J.P. Morgan on August 19 in a study focused on de-risking for investors approaching retirement and about to draw down on Retirement accounts.

The study was quite comprehensive, drawing on a data base of 23 million 401(k) and IRA accounts and 31,000 Americans. 401(k)s and IRAs are similar to Canada’s RRSPs and RRIFs.

De-risking is quite common, with 75% of retirees reducing equity exposure after “rolling over” their assets from a 401(k) to an IRA. These retirees also relied in the mandatory minimum withdrawal amounts.

Of those studied, 30% received either pension or annuity income, and the median value of Retirement accounts was US$110,000. The median investable assets were roughly US$300,000 to US$350,000, with the difference coming from holdings in non-registered accounts.

Not surprisingly, the most common retirement age was between 65 and 70 and the most common age for commencing the receipt of Social Security benefits was 66. (Coincidentally, the same age Yours Truly started receiving CPP in Canada.)

The report warns that retirees who wait until the rollover date to “de-risk” or rebalance portfolios needlessly expose themselves to market volatility and potential losses: they should consider rebalancing well before the obligatory withdrawal at age 71.

The newsletter observes that 61-year-olds represent the peak year of baby boomers in Canada and cautions that if they all retire and de-risk en masse, “Canadian equity markets will likely undergo increased downward pressure and volatility. Retirees should consider re-balancing or ‘annualizing’ while markets are fully valued and prior to an increase in capital gains or interest rates.”

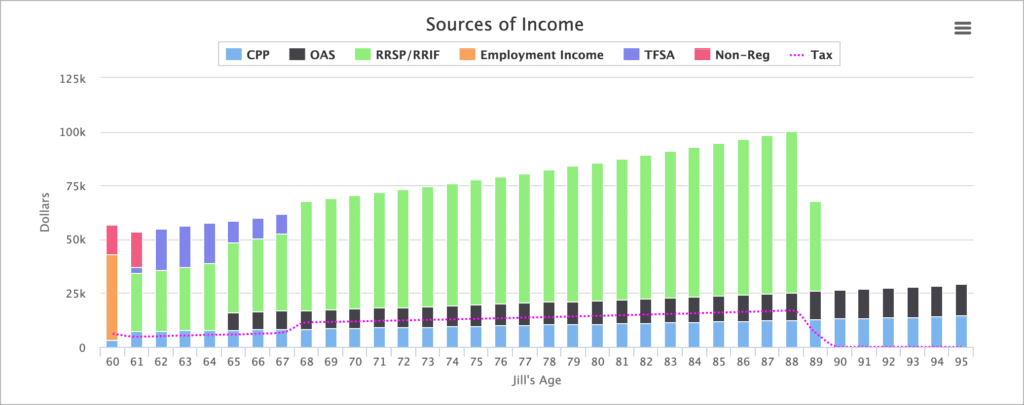

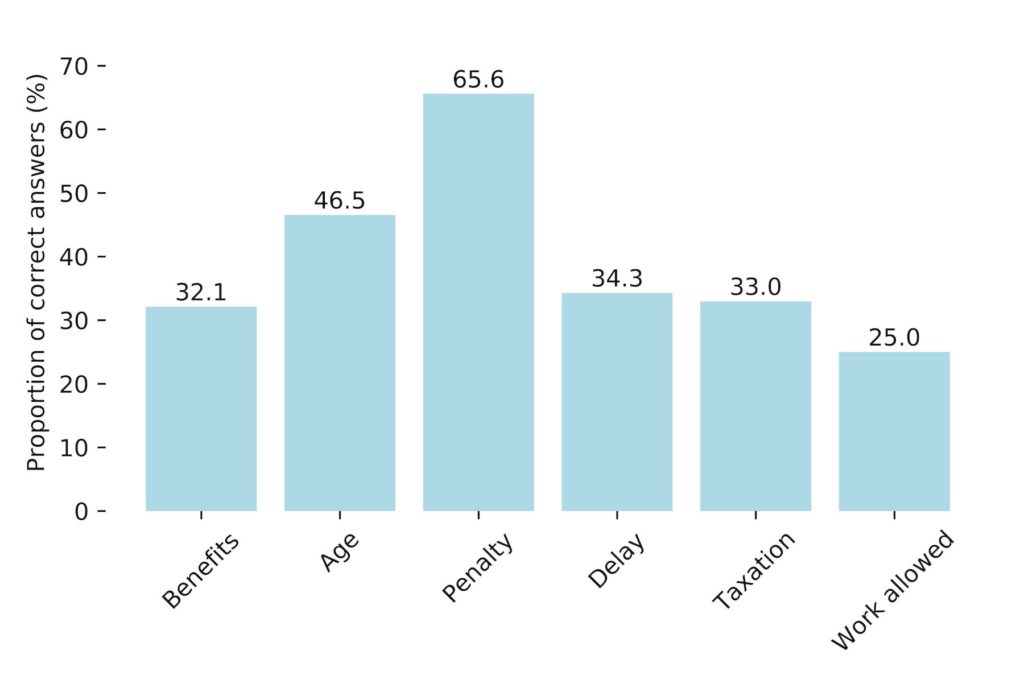

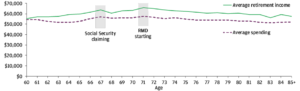

The report includes several interesting graphs, which you can find by clicking to the link above. The graph below is one example, which shows average spending (dotted pink line) versus average retirement income (solid green line.) RMD stands for Required Minimum Distributions for IRAs, which is the equivalent of Canada’s minimum annual RRIF withdrawals after age 71.

RBC poll on pandemic impacts on Retirement and timing

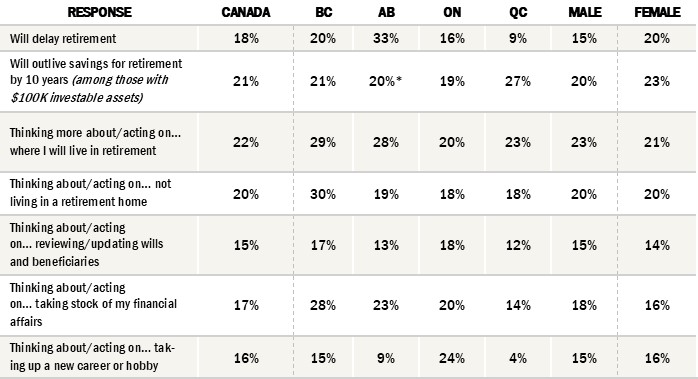

Meanwhile in late August, RBC released a poll titled Retirement: Myths & Realities. The survey sampled Canadians 50 or over and found that the Covid-19 pandemic has caused some Canadians to “hit the pause button on their retirement date.” 18% say they expect to retire later than expected, especially Albertans, where 33% expect to delay it.

They are also more worried about outliving their money, with 21% of those with at least C$100,000 in investible assets expecting to outlive their savings by 10 years. That’s the most in a decade: the percentage was just 16% in 2010.

Sadly, 50% do not yet have a financial plan and only 20% have created a final plan with an advisor or financial planner.

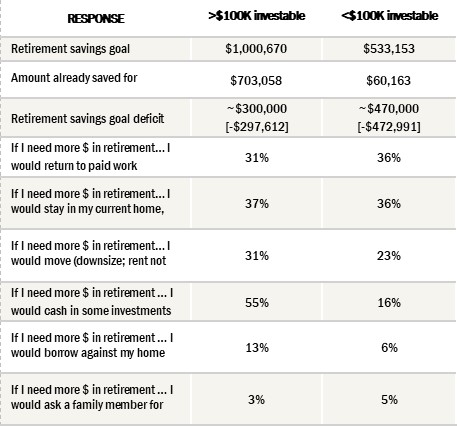

Those near retirement are also resetting their retirement goals. Those with at least $100,000 in investable assets now estimate they will need to save $1 million on average, or $50,000 more than in 2019. 75% are falling short of their goal by almost $300,000 on average.

Those with less than $100,000 have lowered their retirement savings goal to $533,153 from $574,354 in 2019, and the savings gap is a hefty $472,994.

To bridge the shortfall, 37% of those with more than $100K plan stay in their current home and live more frugally, compared to 36% of those with under $100K. 31% and 36% respectively plan to return to paid work, 31% and 23% plan to downsize or move, and 3 and 5% respectively intend to ask a family member for financial assistance.