By Dale Roberts

By Dale Roberts

Special to the Financial Independence Hub

Investing is simple. We are all familiar with the KISS acronym. Simplicity is the key to successful investing. I have been reading and studying investing and investment strategies for decades and came to the conclusion that for the most part “nobody knows nothing.”

Great. All that research and tens of thousands of hours of study and I came back to the fact that I don’t need to know much at all. What a complete waste of time? No not at all. The thousands of hours of study showed me why I, we, don’t need to know much. We do not need to be experts when it comes to investing. As I like to write: It ain’t rocket surgery. Here’s how you find Easy Street.

What is an investment portfolio? In its basic form we can think of a portfolio as having two components: great companies for greater growth potential and bonds to manage the risk. Those bonds work like shock absorbers on the portfolio to reduce the risk or volatility. The more bonds in the portfolio, the lower the risk level of the portfolio.

A typical portfolio will hold great blue-chip companies (stocks) such as Apple, Google, Microsoft, Facebook, Johnson & Johnson, Berkshire Hathaway (Warren Buffett’s company), Coca-Cola and on and on. On the Canadian side we’ll hold Tim Hortons, the big Canadian banks, the telco companies such as Bell, Rogers and Telus, plus railroad companies such as CN and CP Rail and major energy players such as Suncor and Enbridge and on and on.

The rich are business owners

We know that the richest people on earth are usually business owners. We’re going to join them. We’re going to own a piece of those businesses. When enough of those companies do well, you do well. And certainly not every business is going to do well: that’s why you own a bunch of ’em. And that’s why you’ll own great companies in Canada, US and around the globe. And we don’t have to know how to analyze those companies, we can simply go and buy the ‘entire’ stock market. Here’s What is Index Investing and why it’s simply a superior form of investing. It’s so easy we call it Couch Potato Investing.

And back to risk or volatility. Certainly stock markets mostly go up over time, but they do correct or go down with regularity; it’s a normal and expected part of investing. For the potential of those 9-10% annual returns from stocks we need to accept some risk. Keep in mind that stocks can go down by 50% in major stock market corrections. That’s not everyone’s cup of tea to watch their investment portfolio get cut in half. That’s why many or most investors will need some bonds in the portfolio. Bonds are fixed-income investments and are typically less risky than stocks. A bond pays you a fixed payment on a regular basis and bonds can also go up in value when stocks go down – think teeter totter.

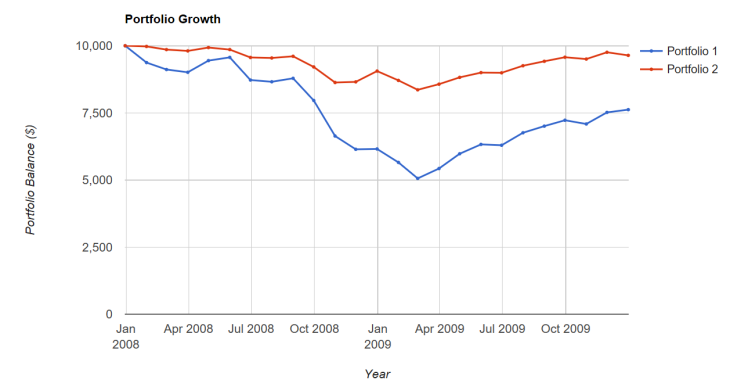

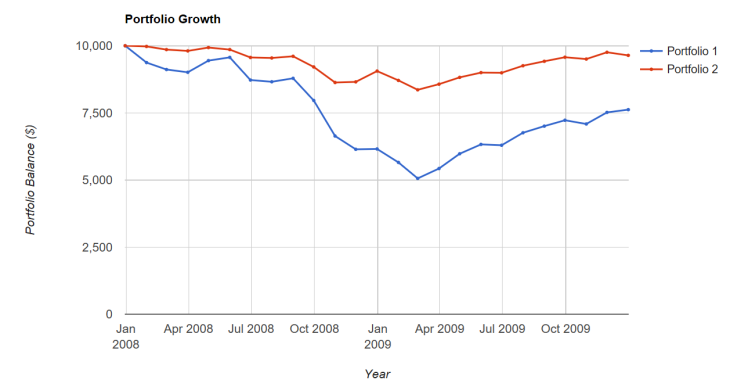

A portfolio with a very generous amount of bonds would have only decreased by about 10%-15% in the last major market correction. For the period of 2008 to end of 2009, here’s a comparison of the US stock market (S&P 500) as Portfolio 1, and a Balanced Portfolio as Portfolio 2.

We see that the all-stock portfolio declined by 50% while the Balanced Portfolio with a 70% bond component declined by just over 15%. By the end of 2009 that conservative Balanced Portfolio is almost back in positive territory while the all-stock portfolio still has more of that hill to climb.

Percentage in Bonds a critical decision

The most important decision that will be made, or the most important question answered will be “What percentage of bonds do you need?” What is your risk tolerance level? What roller coaster do you want to ride? You get to decide. Continue Reading…

I contribute to a defined benefit pension plan at work. How much will I get from the pension plan in retirement? That depends on when I retire or leave the plan. Hang on, we’re about to get math-y.

I contribute to a defined benefit pension plan at work. How much will I get from the pension plan in retirement? That depends on when I retire or leave the plan. Hang on, we’re about to get math-y.