By Dylan Callahan, Stocktrades.ca

By Dylan Callahan, Stocktrades.ca

Special to the Financial Independence Hub

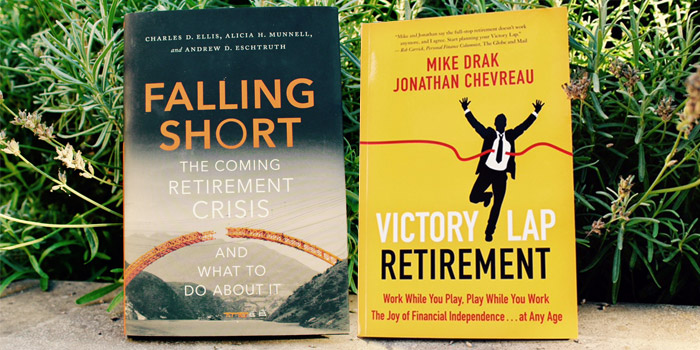

We’re constantly reaching out to financial authorities we feel would benefit our audience the most. From Mark Seed, to Xiaolei Liu, to Rob Carrick, we are always looking to compile information and pick the brains of experts in the industry. This is why we were ecstatic to hear that Jon Chevreau was willing to do a little interview with us about his most recent book. (Highlighted link is to original post at Stocktrades.ca)

A little bit about Jon before we start

Jon has long had our attention here at Stocktrades from his writing at Moneysense and the Financial Post. He is the owner of FinancialIndependenceHub, the author of Findependence Day and the co-author of Victory Lap Retirement, which is what this interview will be about. He was a columnist for the National Post from 1993 to 2012 and was Editor-in-Chief for Moneysense Magazine from 2012 to 2014. If we had to choose some financial authorities on the internet today that we’d follow, Jon would be near the top of the list.

Jon has long had our attention here at Stocktrades from his writing at Moneysense and the Financial Post. He is the owner of FinancialIndependenceHub, the author of Findependence Day and the co-author of Victory Lap Retirement, which is what this interview will be about. He was a columnist for the National Post from 1993 to 2012 and was Editor-in-Chief for Moneysense Magazine from 2012 to 2014. If we had to choose some financial authorities on the internet today that we’d follow, Jon would be near the top of the list.

We hope you enjoy this interview, and if you’re interested in purchasing Jon’s book, head on over Victorylapretirement.com to see what it’s all about or purchase it from Amazon here.

WHAT INSPIRED YOU TO WRITE THIS BOOK?

Jon: Co-author Mike Drak approached me with the idea of a book about Retirement/Victory Laps after he encountered my website, the Financial Independence Hub, and my financial novel, Findependence Day. We thought we could marry the two concepts since Findependence gets you to the point you can launch a proper Victory Lap.

COULD YOU BRIEFLY DESCRIBE THESE FOLLOWING TERMS IN YOUR OWN OPINION, OR AS THEY RELATE TO THE BOOK?

What is Findependence?

Jon: Findependence is simply a contraction of the phrase Financial Independence. And so Findependence Day is the day you achieve financial independence, which we define as the moment when all sources of passive income (pensions, investments, royalties etc.) exceed your monthly expenses nut (rent/mortgage, food, clothing, utilities etc.)

Jon: Findependence is simply a contraction of the phrase Financial Independence. And so Findependence Day is the day you achieve financial independence, which we define as the moment when all sources of passive income (pensions, investments, royalties etc.) exceed your monthly expenses nut (rent/mortgage, food, clothing, utilities etc.)

Explain a Victory Lap Retirement?

Jon: Victory Lap Retirement can be described variously as semi-retirement, self-employment, an encore career or launching a creative career (writer, artist, musician) that lets you monetize what was previously a hobby. Normally, the Victory Lap is made possible by first achieving Financial Independence. It differs from traditional full-stop retirement in that you may still be working, albeit not for a single employer.

Rather you have multiple streams of income, some of which may be passive (pensions, investments) and some of which may be active (part-time work, contracts, an online business). This allows you to pursue the inner creative dreams you may have harbored when you were young, and which you may have put aside during the decades you worked in a traditional “Job” and raised a family. In your Victory Lap, you work because you want to, not because you have to (financially speaking).

Lastly what is an Encore Career?

Jon: An Encore Career or Legacy Career is a late-life reinvention of your career, as described by the website encore.org and the book Encore by Marc Freedman. Its subtitle says it all: Finding Work that Matters in the Second Half of Life.

IN YOUR OPINION, HOW IS A VICTORY LAP RETIREMENT MORE BENEFICIAL THAN THE TRADITIONAL RETIREMENT?

IN YOUR OPINION, HOW IS A VICTORY LAP RETIREMENT MORE BENEFICIAL THAN THE TRADITIONAL RETIREMENT?

Jon: We think it’s crazy to go from the 100% work mode of traditional salaried employment to 100% non-stop leisure, which is the traditional “full-stop” retirement that often occurs at age 65. By the way, I turn 65 next April and don’t expect to slow down much if at all. I’m in the fourth year of my own Victory Lap and am as productive as ever, and probably in much better physical and mental health.

Continue Reading…

By Reviews Bee

By Reviews Bee