By Alizay Fatema, CFA

(Sponsor Content)

Central banks across the globe are likely to continue with their attempts to tame inflation by hiking interest rates, crushing the hope that markets will return to normality any time soon.

With the unemployment rate at a historically low level, inflation remains a top concern for the Bank of Canada (BoC) and the Federal Reserve (Fed), who are also dealing with looming risk of a recession and uncertainty regarding the impacts of the recent bank turbulence. The BoC and the Fed appear to be ahead of global peers in their attempt to slowdown inflation – raising the question around whether we have seen the peak in rates in North America.

The rapid tightening cycles by policy makers are reinforcing the appeal of owning high-

quality ultra-short bond, and money market ETFs. A series of recent rate hikes by the Bank of Canada and the Federal Reserve gave a boost to yields for these products, making the saying “cash is king” true to a certain extent, as investors who are worried about higher inflation and slowing growth prefer investing in these cash alternatives to ride out the market volatility. In today’s market, you can earn an attractive yield while taking less risk – earning while you wait for volatility to subside.

Yield curve[1], are we in love with the shape of you?

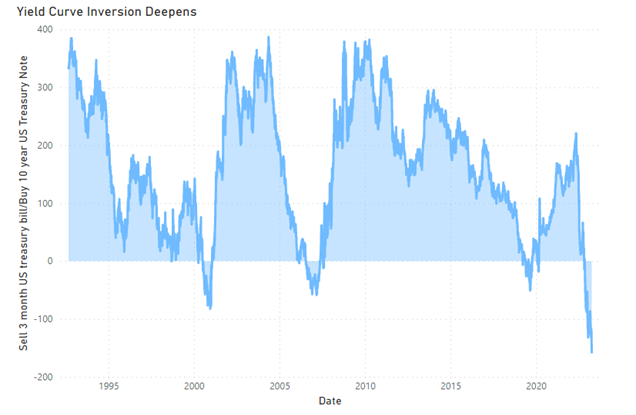

Normally, the yield curve is upward sloping, meaning longer-term bonds yield more than shorter-term bonds as investors often demand higher yields for locking their money up for a longer period. However, at present, the shape of the yield curve is inverted, which means shorter-term securities are yielding more than longer-term ones. This inversion is largely owing to the Central Bank’s quest to reduce inflation by hiking the interest rates.

Due to historically low interest rates in the last few years, investors were compelled to take more duration[2] risk by adding exposure to longer-term bonds and higher credit risk[3] by investing in lower credit quality segments such as high-yield or emerging markets bonds. However, due to the current yield curve inversion, the tables have turned now, offering a unique opportunity for fixed-income investors looking to earn higher yields.

Source: Bloomberg USYC3M10 Index (Sell 3 Month US T-bill & Buy 10 Year US Bond Yield Spread) Sep 1992 to April 2023

Why stash cash in money market & ultra-short-term bond ETFs?

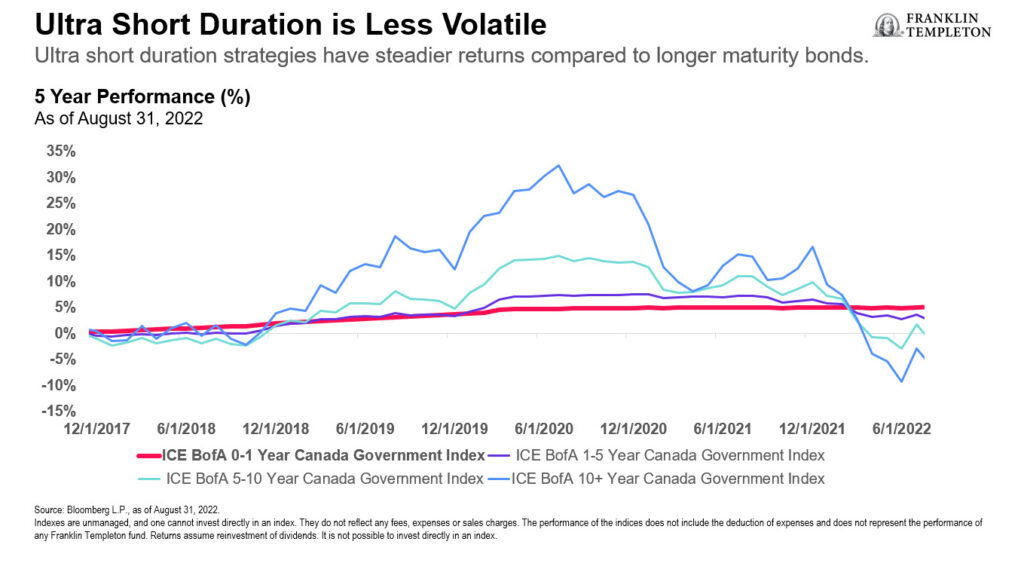

The front-end of the yield curve (0-1yr) offers an attractive asymmetry and opportunity to capture yield between 4-5% + with limited duration and credit risk. This allows investors to earn the highest yields we’ve seen in more than a decade on fixed income and build a more stable high-quality fixed-income portfolio by adding exposure to ultra-short investment grade bonds and money market securities. Based on the current interest-rate volatility, hugging the front-end of the curve seems a more prudent and consistent way to preserve capital in a fixed-income allocation. BMO ETFs offers solutions such as BMO Money Market Fund ETF Series (ZMMK), BMO Ultra Short-Term Bond ETF (ZST) and BMO Ultra Short-Term US Bond ETF (ZUS), which are a great way to get exposure to the front end of the curve.

These money market & ultra short-term bond ETFs invest in high credit-quality instruments that provide a great degree of safety and capital preservation. Firstly, by investing in securities that mature in less than one year, the duration risk is minimal, which results in lower interest rate sensitivity in your portfolio. Secondly, these ETFs offer high liquidity[4] due to the nature of their underlying securities, which means they can be bought and sold easily with minimal market impact. Continue Reading…