What’s the point of investing, anyway? We invest our money for future consumption, with the idea that we’ll earn a higher rate of return from investing in a portfolio of stocks and bonds than we will from holding cash.

What’s the point of investing, anyway? We invest our money for future consumption, with the idea that we’ll earn a higher rate of return from investing in a portfolio of stocks and bonds than we will from holding cash.

But where does this equity premium come from? And how do we capture it without taking on more risk than is needed? Moreover, how do we control our natural instincts of fear, greed, and regret so that we can stay invested long enough to achieve our expected rate of return?

For decades, regular investors have put their trust in the expertise of stockbrokers and advisors to build a portfolio of stocks and bonds. In the 1990s, mutual funds became the investment vehicle of choice to build a portfolio. Both of these approaches were expensive and relied on active management to select investments and time the market.

At the same time, a growing body of evidence suggested that stock markets were largely efficient, with all of the known information for stocks already reflected in their prices. Since markets collect the knowledge of all investors around the world, it’s difficult for any one investor to have an advantage over the rest.

The evidence also showed how risk and return are intertwined. In most cases, the greater the risk, the higher the reward (over the long-term). This is the essence of the equity-risk premium – the excess return earned from investing in stocks over a “risk-free” rate (treasury bills).

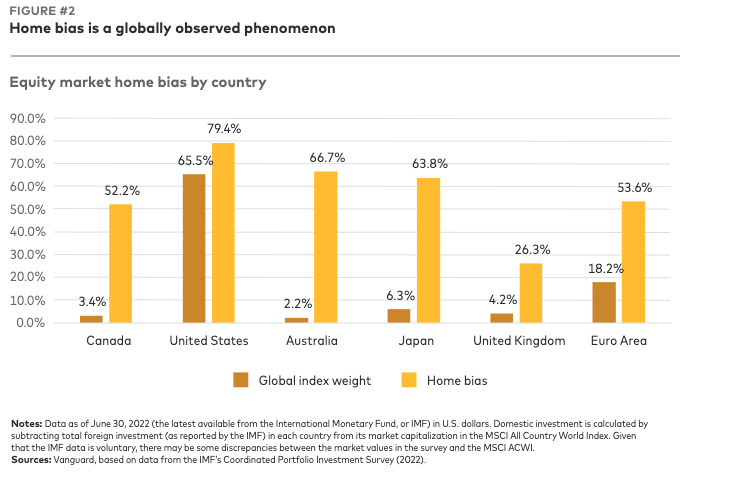

Evidence-based investing also highlights the benefit of diversification. Since it’s nearly impossible to predict which asset class will outperform in the short-term, investors should diversify across all asset classes and regions to reduce risk and increase long-term returns.

As low-cost investing alternatives emerged, such as exchange-traded funds (ETFs) that passively track the market, the evidence shows that fees play a significant role in determining future outcomes. Further evidence shows that fees are the best predictor of future returns, with the lowest fees leading to the highest returns over the long term.

Finally, it’s impossible to correctly and consistently predict the short-term ups and downs of the market. Stock markets can be volatile in the short term but have a long history of increasing in value over time. The evidence shows staying invested, even during market downturns, leads to the best long-term investment outcomes.

Evidence-based Guide to Investing

So, what factors impact successful investing outcomes? This evidence based investing guide will reinforce the concepts discussed above, while addressing the real-life burning questions that investors face throughout their investing journey.

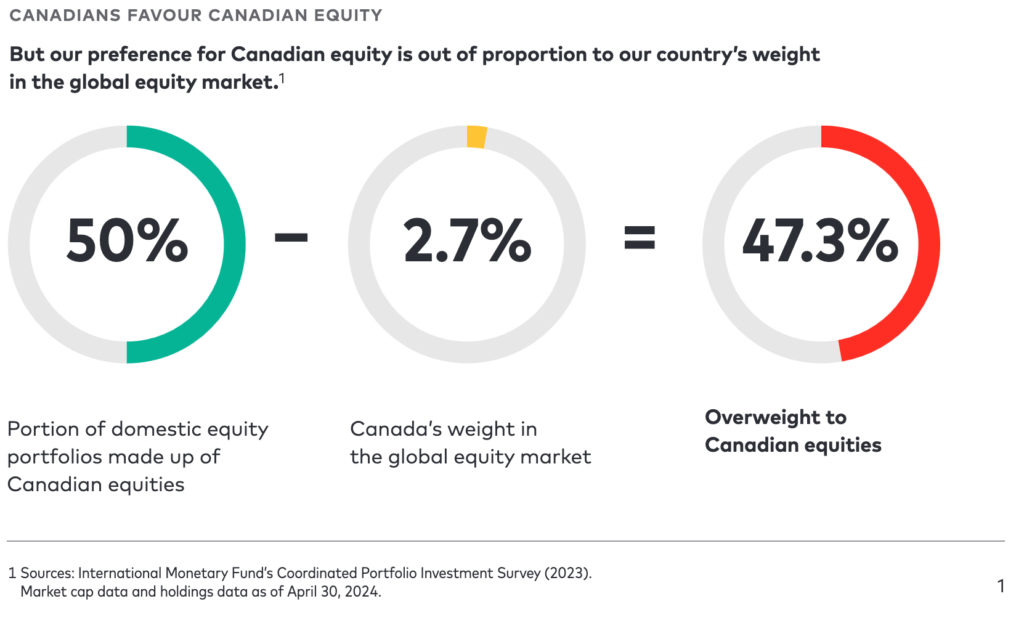

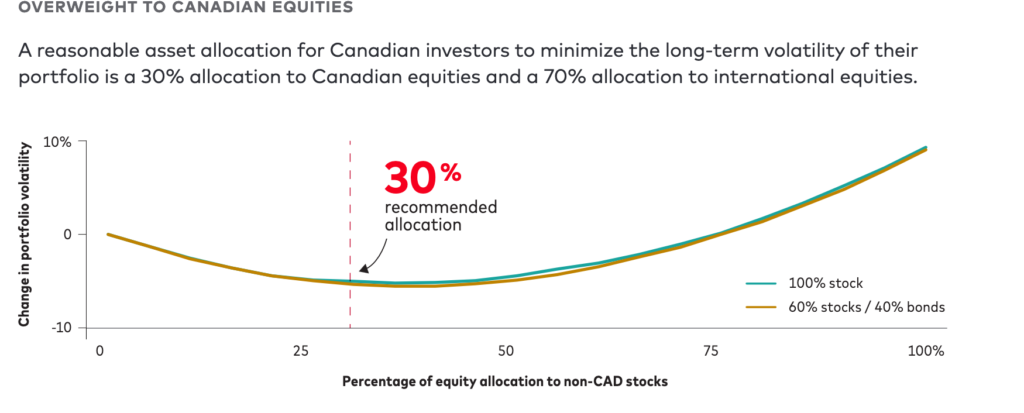

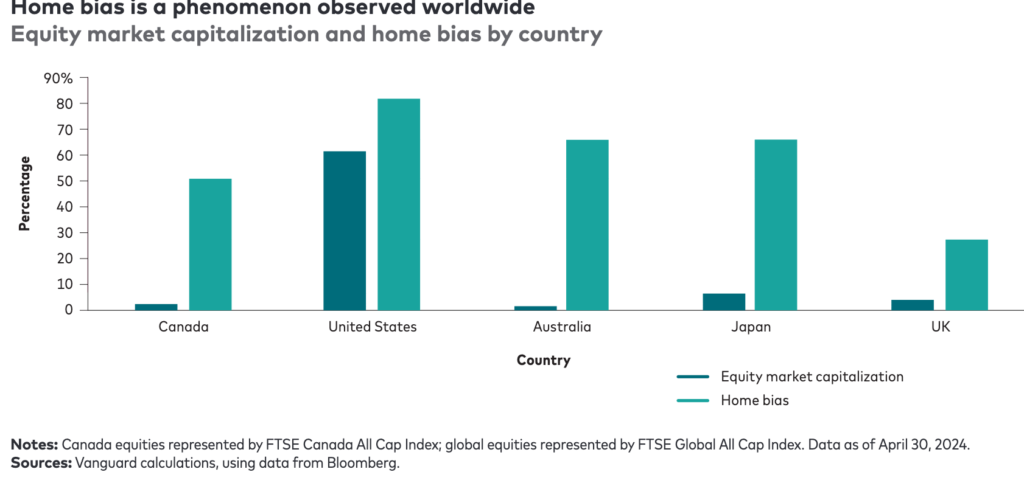

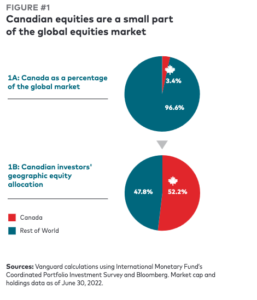

Questions like, should you passively accept market returns or take a more active role with your investments, should you invest a lump sum immediately or dollar cost average over time, should you invest when markets are at all-time highs, should you use leverage to invest, and how much home country bias is enough?

To answer these questions, I looked at the latest research on investing and what variables or factors can impact successful outcomes. Here’s what I found:

Passive vs. Active Investing

The thought of investing often evokes images of the world’s greatest investors, such as Warren Buffett, Benjamin Graham, Peter Lynch, and Ray Dalio: skilled money managers who used their expertise to beat the stock market and make themselves and their clients extraordinarily wealthy.

But one man who arguably did more for regular investors than anyone else is the late Jack Bogle, who founded the Vanguard Group. He pioneered the first index fund, and championed low-cost passive investing decades before it became mainstream.

Jack Bogle’s investing philosophy was to capture market returns by investing in low-cost, broadly diversified, passively-managed index funds.

“Passive investing” is based on the efficient market hypothesis: that share prices reflect all known information. Stocks always trade at their fair market value, making it difficult for any one investor to gain an edge over the collective market.

Passive investors accept this theory and attempt to capture the returns of all stocks by owning them “passively” through an index-tracking mutual fund or ETF. This approach avoids trying to pick winning stocks, and instead owns the market as a whole in order to collect the equity risk premium.

The equity risk premium explains how investors are rewarded for taking on higher risk. More specifically, it’s the difference between the expected returns earned by investors when they invest in the stock market over an investment with zero risk, like government bonds.

Bogle’s first index fund – the Vanguard 500 – was founded in 1976. At the time, Bogle was almost laughed out of business, but nearly 50 years later, Vanguard is one of the largest and most respected investment firms in the world. Who’s laughing now?

In contrast, opponents of the efficient market hypothesis believe it is possible to beat the market and that share prices are not always representative of their fair market value. Active investors believe they can exploit these price anomalies, which can be observed when trends or momentum send certain stocks well above or below their fundamental value. Think of the tech bubble in the late 1990s when obscure internet stocks soared in value, or the 2008 great financial crisis when bank stocks got obliterated.

Comparing passive vs. active investing

Spoiler alert: there is considerable academic and empirical evidence spanning 70 years to support the theory that passive investing outperforms active investing.

The origins of passive investing dates back to the 1950s when economist Harry Markowitz developed Modern Portfolio Theory. Markowitz argued that it’s possible for investors to design a portfolio that maximizes returns by taking an optimal amount of risk. By holding many securities and asset classes, investors could diversify away any risk associated with individual securities. Modern Portfolio Theory first introduced the concept of risk-adjusted returns.

In the 1960s, Eugene Fama developed the Efficient Market Hypothesis, which argued that investors cannot beat the market over the long run because stock prices reflect all available information, and no one has a competitive information advantage. Continue Reading…