By Alizay Fatema, Associate Portfolio Manager, BMO ETFs

(Sponsor Content)

While inflation was sidelined by several central banks and deemed as “transitory” for the most part during 2021, the tone shifted promptly this year as back-to-back red-hot inflation prints forced most central banks to go on an interest-rate hiking spree. This aggressive action is being taken to tame inflation otherwise known as the rate of change in prices over time, [1], as it’s persistently high and is eroding the purchasing power of households, reducing consumer spending, and the overall economic well-being.

What are the causes of inflation?

Before we discuss whether inflation will slow down or not, let’s take a step back and analyze what’s causing prices to rise globally in the first place. Most economists attribute this uptick in inflation to several different causes such as:

- Cost-push inflation driven by supply chain crisis

The COVID-19 outbreak led to a series of lockdowns and restrictions across the globe, which caused supply chain disruptions and labour shortages and ultimately induced cost-push inflation [2], resulting in a surge of prices due to an increase in costs of producing and supplying products and services. World economies are still recovering from this effect, and some of these constraints are fading away as global transportation costs plunge and Chinese production ramps up again. However, the Russian invasion of Ukraine is clearly hampering this progress and further stoking inflation. [3]

- Demand-pull inflation fueled by savings, fiscal stimulus, and monetary policy

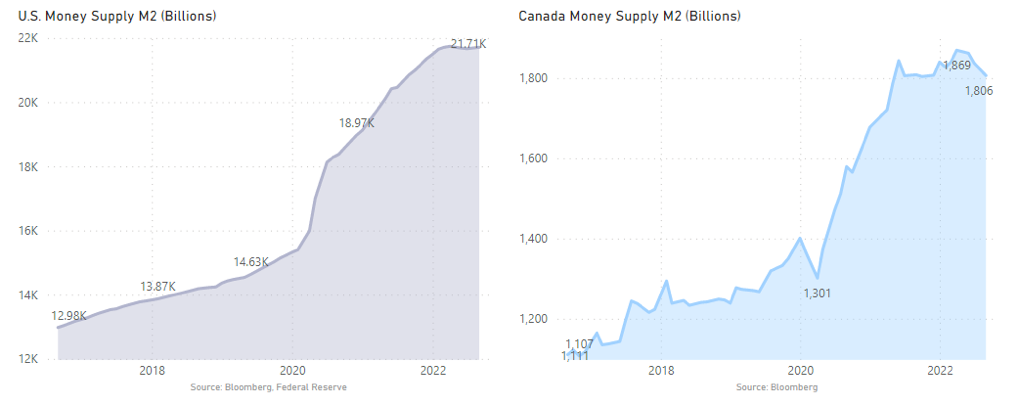

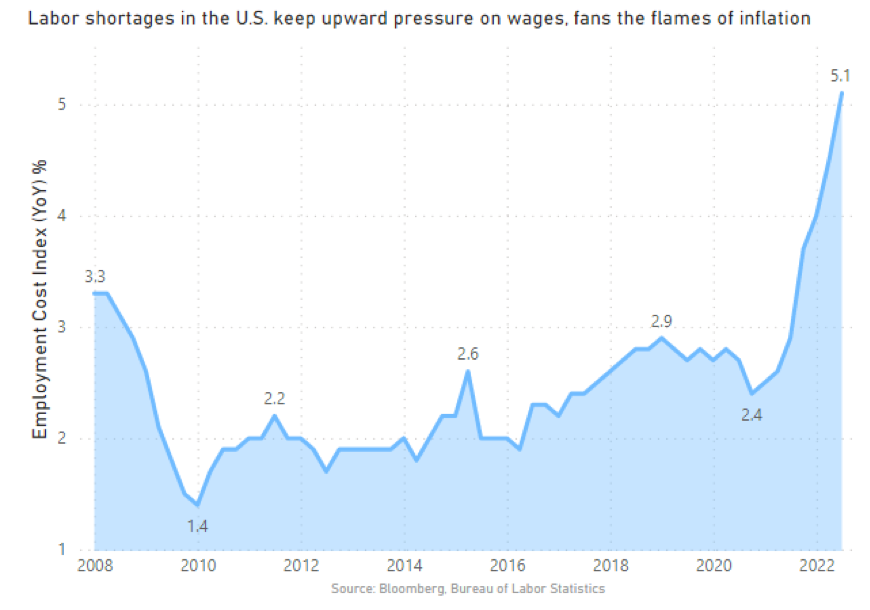

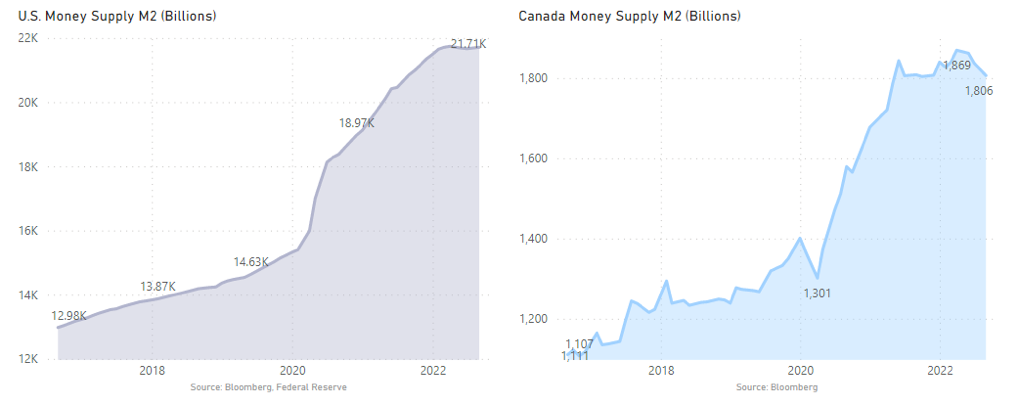

The pandemic had caused an unconventional recession, and to keep economies afloat, several central banks slashed their interest rates, increased their money supply M2 (a measure of the money supply that includes cash, checking deposits, and easily- convertible near money)., gave out government aid, relief, & stimulus payments as part of the fiscal response during 2020 & 2021. As businesses reopen this year after remaining shuttered and reducing their production and services, they could not meet the pent-up demand driven by savings accumulated during the pandemic along with the monetary & fiscal stimulus. Thus, strong consumer demand, fueled by robust growth in employment, has outstripped supply temporarily for several products & services such as air travel, hotels, cars, etc., resulting in demand-pull inflation [4].

A series of interest rate hikes to curb sky-high inflation

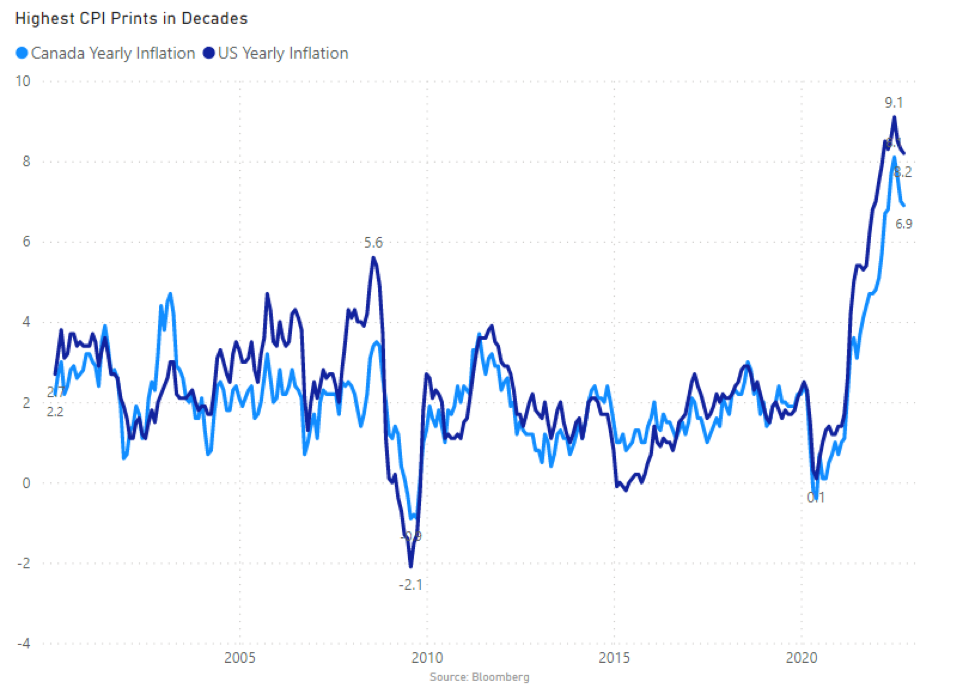

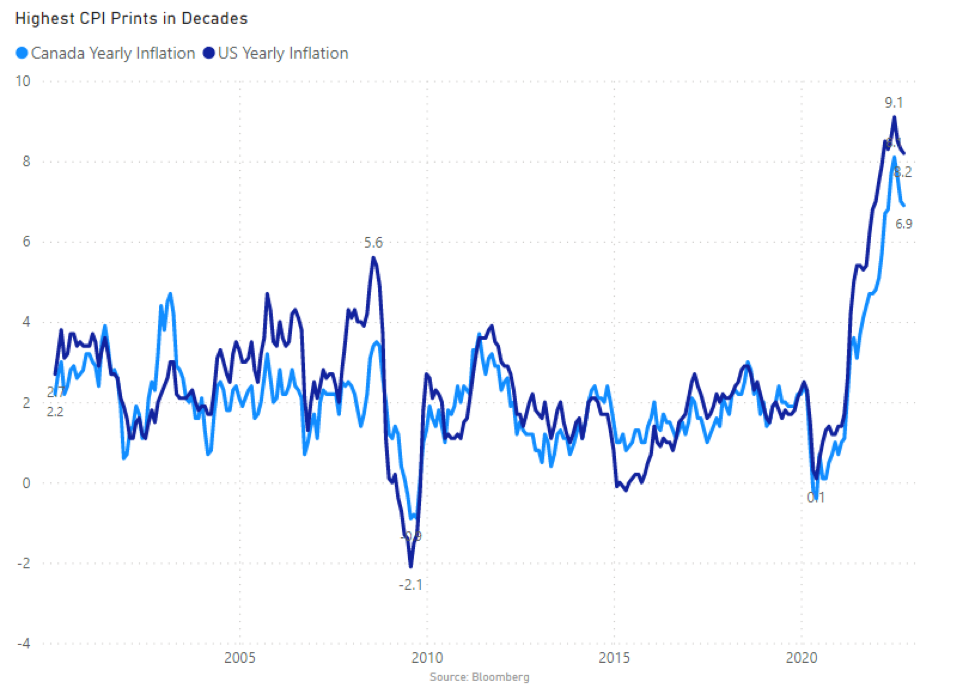

The price increases for gasoline, food, and housing caused Canada’s inflation to rise to a 39-year high of 8.1% in June 2022. The markets got some respite in August as headline inflation came down to 7% and further weakened in September to 6.9% from a year ago, as gasoline prices fell. However, the recent data was disappointing as the dramatic increase in food prices was unexpected.

On a similar note, south of the border, the U.S. inflation spiked to 9.1% in June 2022, the highest level since 1981. Although headline U.S. inflation reported for September was up by 8.2% from a year earlier (down from the peak of June 2022), the core U.S. consumer price index (ex. food & energy) rose to a 40-year high, increasing to 6.6% from a year ago, which is a cause of concern as its squeezing households by outpacing the growth in wages.

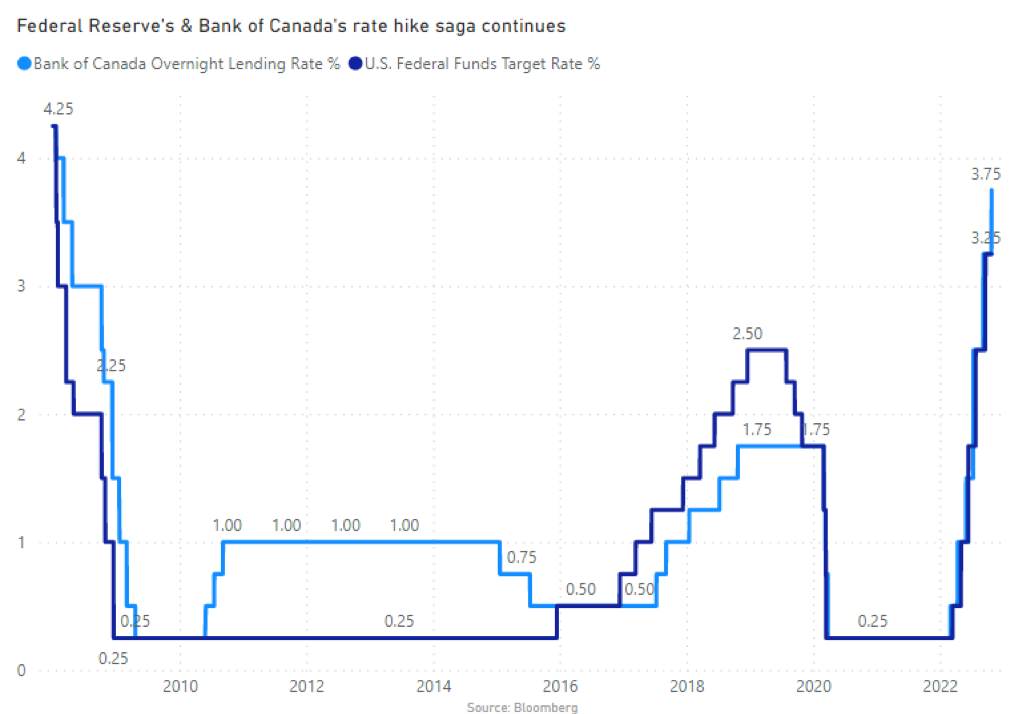

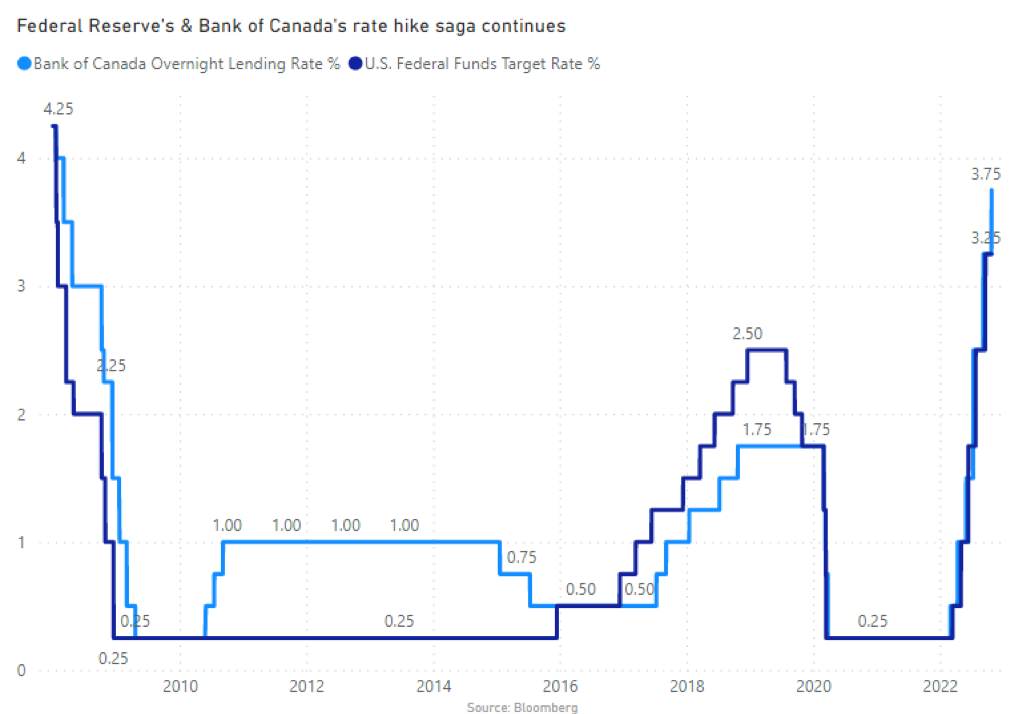

To dial down the surge in prices, the Federal Reserve engaged in a series of rate hikes not seen since the late 1980s, increasing the front-end interest rate to 3.25% in September. The Bank of Canada followed suit by raising rates through consecutive outsized hikes, bringing its target overnight rate to 3.75% in October. Given inflation is still sky-high in both countries and way above their 2% target, both Fed & Boc are expected to raise their short-term rates again. Both central banks are maintaining their hawkish tones, which means the rates will be further raised to fight against raging inflation. However, they may dial back the pace of their hikes amid recession fears.

When will we see a slowdown in inflation?

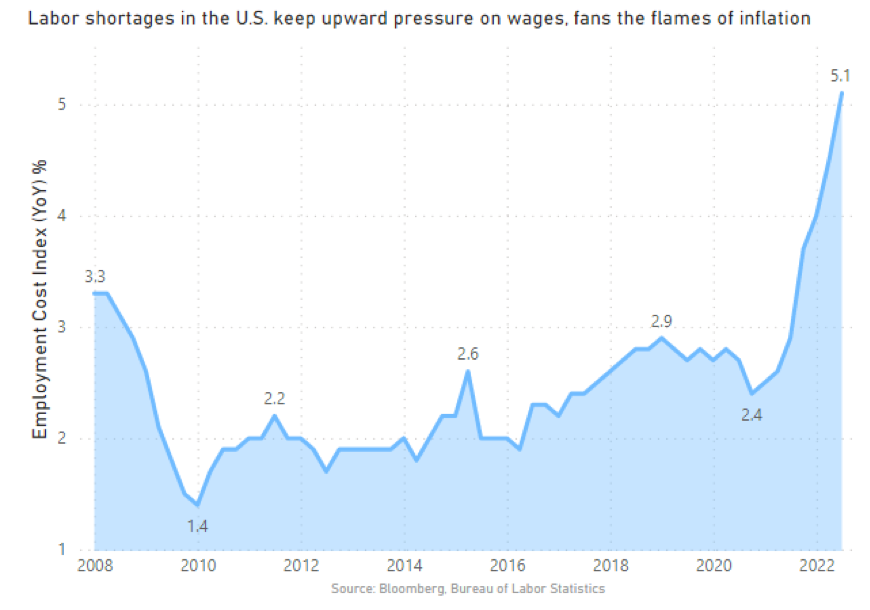

Looking at recent CPI prints, the question arises whether the U.S. and Canada have passed peak inflation. The truth is it’s hard to predict what lies ahead. Prices in some sectors, such as gas and used automobiles, have dropped, which is a good sign. However, prices for certain goods & services are “stickier” than others, such as rent, insurance, health care or dining out, meaning that they are likely to stay at their current levels or increase even further, so inflation may stick around for a while. Moreover, higher wages and inflation may continuously feed into each other, resulting in a wage-price spiral [5] which may result in further rate hikes, causing additional damage. Continue Reading…

By Myron Genyk, Evermore Capital

By Myron Genyk, Evermore Capital